5 reasons why Morgan Stanley thinks Reliance Industries shares will reach Rs 1506-level

Mayank Maheshwari, Rakesh Sethia and Amruta Pabalkar, analysts at Morgan Stanley said, “RIL stock has underperformed peers by 60ppt in the past four years as its returns lagged peers'. This is set to change as earnings start from energy projects and telecom monetisation gathers pace. We raise our price target to factor in higher energy earnings and increased clarity on telecom investments."

Research firm Morgan Stanley has revised its target for Reliance Industries (RIL) and set a new price target of Rs 1506 per share.

In its report titled 'An Idiosyncratic Energy Play', Morgan Stanley (MS) said that RIL's energy earnings should exceed market expectations as investors begin to appreciate its leverage to an upcycle.

Mayank Maheshwari, Rakesh Sethia and Amruta Pabalkar, analysts at Morgan Stanley said, “RIL stock has underperformed peers by 60ppt in the past four years as its returns lagged peers'. This is set to change as earnings start from energy projects and telecom monetisation gathers pace. We raise our price target to factor in higher energy earnings and increased clarity on telecom investments."

RIL's share rose last week and crossed Rs 4 lakh crore market capitalisation as its CMD Mukesh Ambani announced plans to monetise Reliance Jio -- its telecom venture.

Here are five key reasons why Morgan Stanley went overweight on RIL:

Energy Business:

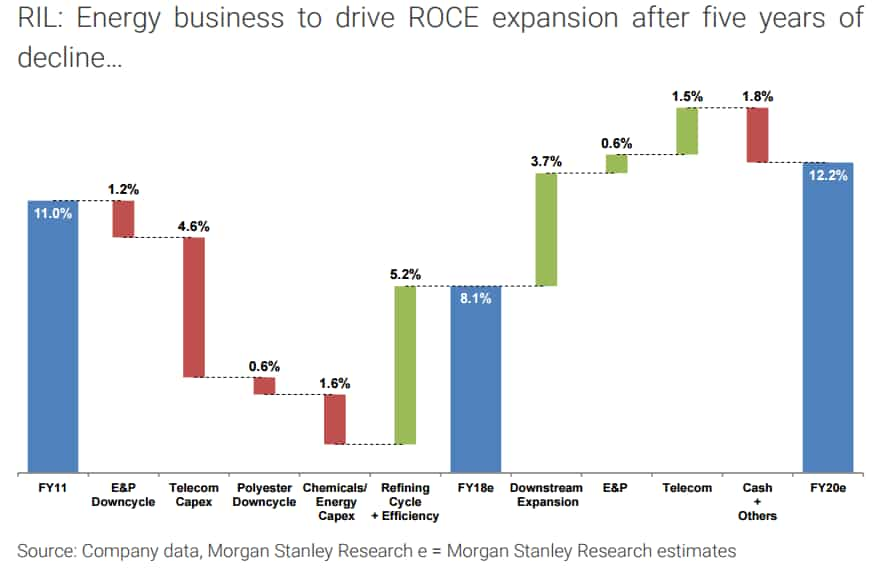

MS said, “After nearly doubling its energy business investments in the past four years, we believe RIL's energy earnings are poised to inflect over the next two years, benefiting from slowing oil oversupply, a rising global gas glut, and the start of a polyester upcycle.

They added, “ We think the ability to leverage these trends sets RIL apart from its global peers and drives our conviction that energy earnings can beat consensus by 12-23%.”

Free Cash Flows (FCF):

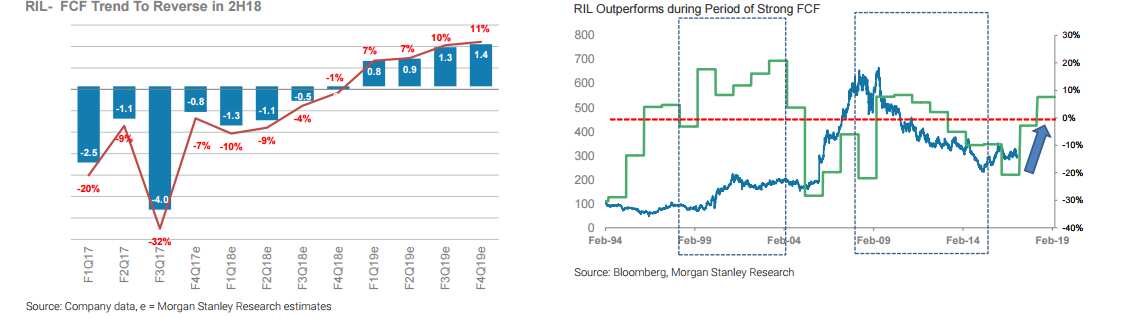

In spite of low dividend payout ratio, RIL has outperformed in times of FCF growth.

Trend in FCF is also expected to change in the second half of FY18.

RIL's energy business is set to rise by 500 basis points (bps) by FY2020E, to 15% in the top five in returns and FCF growth globally, it said.

Dividend Payout Ratio:

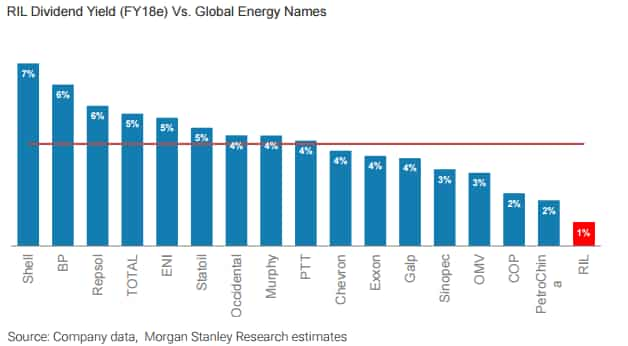

In the past 10 years, RIL's dividend payout ratio has been around 15% of net profits, which is lower compared to global peers'average of 47%. Despite including the shares buy back plan in the year 2012, the dividend payout ratio stood at 30%.

Morgan feels the scenario could change if RIL follows up on its AGM commentary.

Mukesh Ambani, RIL's chairman in September 2016 said, “I will work with your Board to share generously the returns of our investment cycle with you which I will report to you in the next AGM."

Thus, Morgan said, "If RIL were to raise its payout ratio towards the global average, it would imply 4.5% dividend yield with a 50% CAGR until F2020e, in the top quartile among global energy majors.

Refining and petrochemicals:

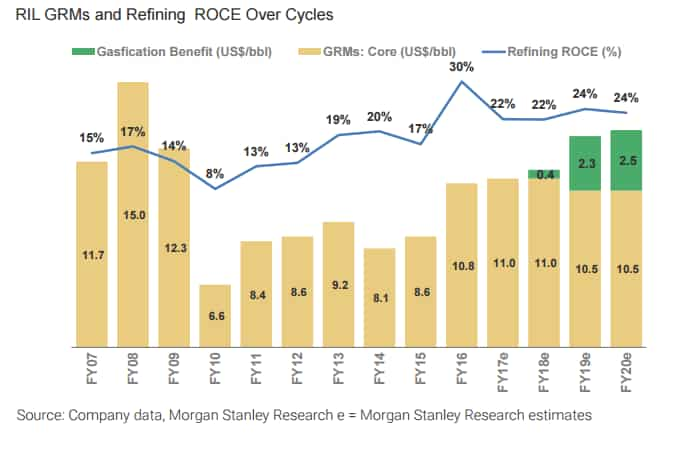

Led by consistent high utilisation rates, superior scale, product flexibility and downstream integration, RIL's refineries have earned 19% of ROCE through a 10-year refinery cycle.

The refinery has processed 50% more grades of crude in the past five years, and its utilization rates have also crept up 4.8ppts.

They said, "We believe there is upside to returns as the company increa ses the utilization rates of its downstream refining equipment and maximizes margins by improving its crude sourcing strategy. Overall we see a strong 2017 for Asian refiners as capacity additions slow down and demand growth remains healthy, supporting GRMs."

Reliance's petrochemical portfolio, while being focused on commodity chemicals, has still earned 20% ROCE over cycles.

The research firm expects ROCE to return to 20% levels with an EBITDA CAGR of 22% by FY2020. This, combined with downstream integration and improving feed stock supply, will lead to RIL having one of the most flexible (in terms of feedstock) chemical facility in Asia.

Investment in RJio:

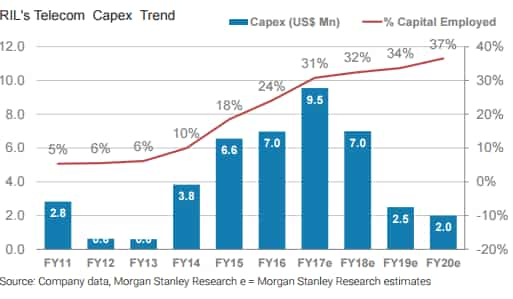

In a span of four years, RIL has invested about $25 billion in Reliance Jio.

Considering, the data tariff, pricing war under the telecom industry presently, MS believes the investment in RJio would reach at $34 billion by end of FY18.

MS said, "In our view this raises the probabilities of a slowdown in telecom capex starting 2018. In addition, we estimate the announced tariff plans could lead the telecom venture to achieve EBITDA breakeven by the end of first year of operations."

"Though we agree that telecom will be a drag on Reliance's returns over the next three years, we think the drag will gradually diminish as capex slows down and revenue generation gathers pace," added MS.

11:57 AM IST

HDFC Bank voted 'Best Managed', 'Best Governed' in India

HDFC Bank voted 'Best Managed', 'Best Governed' in India Bloodbath on stock markets! Sensex crashes 2,919 points, Nifty closes at 2-year low; SBI shares bleed

Bloodbath on stock markets! Sensex crashes 2,919 points, Nifty closes at 2-year low; SBI shares bleed Stock Market Today: Sensex, Nifty tank over 6.5% on Reliance Industries selloff; SBI shares crash over 9 pct

Stock Market Today: Sensex, Nifty tank over 6.5% on Reliance Industries selloff; SBI shares crash over 9 pct  Reliance Industries posts record profits on consumer strength

Reliance Industries posts record profits on consumer strength Sensex, Nifty dip on Reliance Industries selloff; Bharat Forge, Delta Corp, BPCL stocks bleed

Sensex, Nifty dip on Reliance Industries selloff; Bharat Forge, Delta Corp, BPCL stocks bleed