Back to nought: Cash is slowing eating away mobile wallets' party

Mobile user base growth slowed down to 9% in Q2 from a huge 23% growth in the Q1.

Key highlights:

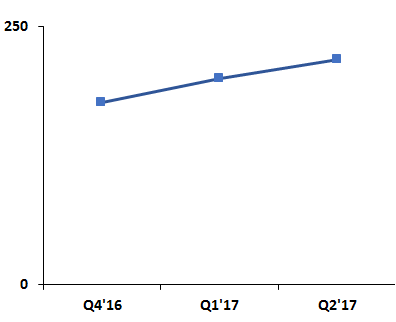

- User base of mobile wallets increased by only 9% in Q2 2017

- Cash re-entering the economy once again post demonetisation slowed mobile wallet user growth

- 23% growth in Q1 2017 from Q4 2016

Digital currency may have been the buzzword over the past nine months or so but Indians are slowly going back to their first love --cash.

User base of mobile wallets has been seeing a steady growth since the last two quarters. However, it is the pace of this growth that is worrying.

With cash re-entering the economy, the registered user base of mobile wallets rose by only 9% in Q2 2017.

"More number of people register on mobile wallets platforms, though at a slower pace now as cash re-entered. Overall registered users on mobile wallet platforms increased by 9% as compared to Q1’17 and 23% as compared to that in Q4 2016,” said the report.

Source: RedSeer Consulting

Registered user base growth for mobile wallets is nearing 250 million in Q2 2017, according to a RedSeer Consulting report.

Demonetisation, that was announced by Prime Minister Narendra Modi on November 9, 2016, presented a tremendous opportunity for mobile wallets like Paytm in India who grabbed the opportunity with both hands.

However, the size of mobile wallet market continues to remain minuscule as transaction volumes were at just 163 crore and Rs 53,200 crore of value transactions in FY17.

The mobile wallet market in India is forecast to grow to $6.6 billion by 2020, according to a TechSci Research.

ALSO READ:

02:13 PM IST

Adoptions rise but mobile wallets still less than 1% of all digital transactions

Adoptions rise but mobile wallets still less than 1% of all digital transactions BSNL unveils mobile wallet for subscribers

BSNL unveils mobile wallet for subscribers Mobile wallet firms FreeCharge, MobiKwik in talks regarding merger

Mobile wallet firms FreeCharge, MobiKwik in talks regarding merger Paytm withdraws 2% fee for adding money to mobile wallets using credit cards

Paytm withdraws 2% fee for adding money to mobile wallets using credit cards Not mobile wallets, cash will still be king in India

Not mobile wallets, cash will still be king in India