Five reasons why analysts are raising target price on Reliance Industries

After touching new high of Rs 872 per share on September 20, RIL's share price has given nearly 7% return in just one week. Analysts are optimistic over the stock due various reasons.

Key Highlights:

- RIL's share price gained by nearly 7% in two weeks

- Analysts have raised target price of RIL

- Analysts believe TRAI's cut in IUC will be most beneficial for RJio

The Telecom Regulatory Authority of India (TRAI), on September 19, decreased the interconnect usage charges (IUC) from 14 paisa per minutes to 6 paisa per minute with effect from October 1, 2017. This would be further reduced to zero from January 01, 2020.

Following this, the share price of RIL jumped to a new high of Rs 872-per piece on September 20, 2017. With this performance, RIL gave nearly 7% return since the time it started trading ex-bonus on September 07, 2017.

Talking on IUC cut, Reliance said, “Jio has always offered free voice services to its customers. There is no question of any advantage from the new IUC regulation to Jio as it has already passed on all the benefits to customers. We deny any benefits to Jio.”

RIL added, “ At a time when the world is moving towards IP-based technologies, cost of voice has come down to a fraction of a paisa and the customers should enjoy this advantage.”

Analysts recommend investors to stay invested in Reliance Industries and have increased their target price for the stock.

Naveen Kulkarni, analyst at Phillip Capital said, "Reliance Jio’s strategy hinges on providing free voice services; in current market conditions, it pays the highest IUC among smaller operators. Therefore, Jio will benefit the most. The incumbents’ loss will be Jio’s savings to a large extent.”

During seven months of its operations, the youngest member of the telecom industry paid as much as Rs 2589 crore as IUC, ICRA said.

Fitch Ratings said, “In contrast, the move should bring significant cost-savings and lead to faster-than-expected EBITDA break-even for recent entrant RJio. We expect the move will result in a transfer of $500 million-600 million per year from incumbents to Jio. ”

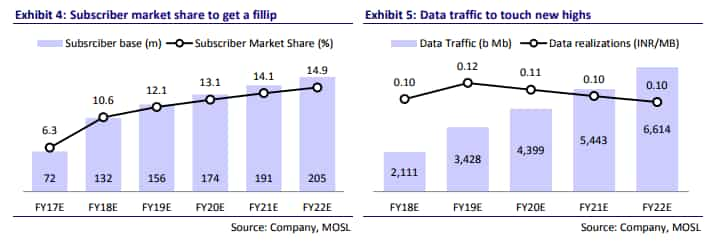

Swarnendu Bhushan and Abhinil Dahiwale, analysts at Motilal Oswal said, “We believe RJio will continue tapering freebies for smartphone subscribers, even as it may extend discounts to feature phone subscribers to accelerate market share growth.”

Rjio current active subscriber market share stands at 9.6%.

Based on 6 paisa IUC, the duo at Motilal has revised Rjio's access cost down by Rs 3000 crore (40%) to Rs 4400 crore for FY19 – 20. Subsequently the duo has revised EBITDA (operating profit) estimate of Rjio for FY19/20 by 43%/31% to Rs 9100 crore and Rs 130,000 crore respectively. Zero IUC by 2020 may not alter the scenario significantly.

Meantime ARPU estimates for FY19/20E remains intact at 132 million / 156 million and Rs 215 and Rs 229, respectively.

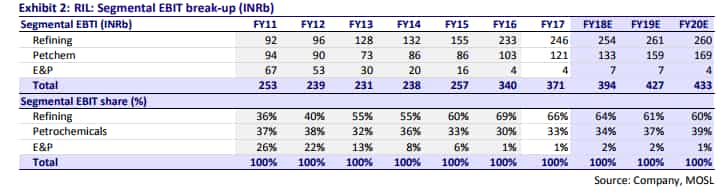

A Motilal Oswal report said, “We have increased the refining and marketing multiples from 6x to 7x, driven largely by the better performance exhibited by the company in its refining segment in an adverse environment, due to its better risk and yield/crude management.”

Mayank Maheshwari and Rakesh Sethia, analysts at Morgan Stanley said, "Refining margins are reaching cycle highs, chemical margins recovering to mid-cycle, clarity on telecom is improving. We expect windfall profits in the upcoming earnings season. More importantly, these trends should sustain in 2018 implying earnings surprises again driven by energy."

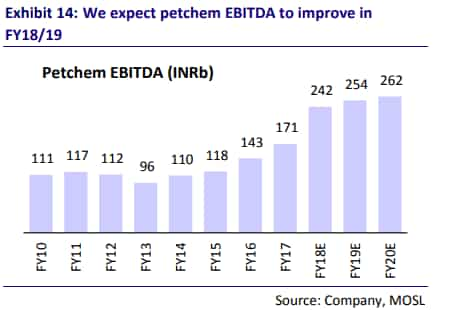

Reliance's petrochemical portfolio, while being focused on commodity chemicals, has still earned 20% ROCE over cycles.

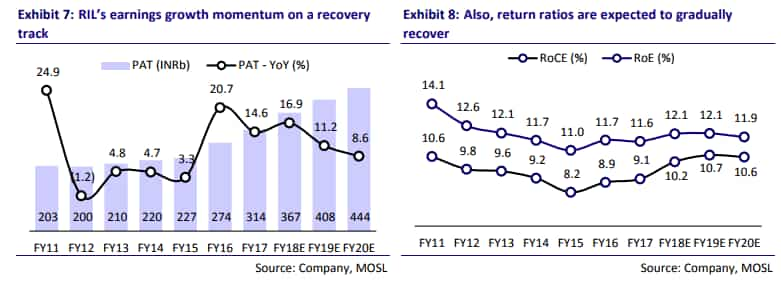

Motilal expects EBITDA to rise in petrochem business ahead.

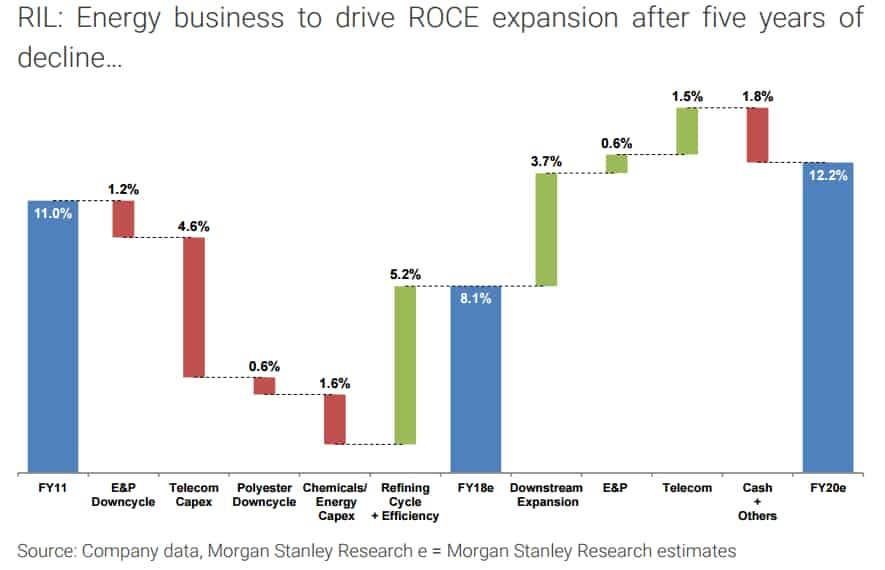

After nearly doubling its energy business investments in the past four years, RIL's energy earnings are poised to inflect over the next two years, benefiting from slowing oil oversupply, a rising global gas glut, and the start of a polyester upcycle.

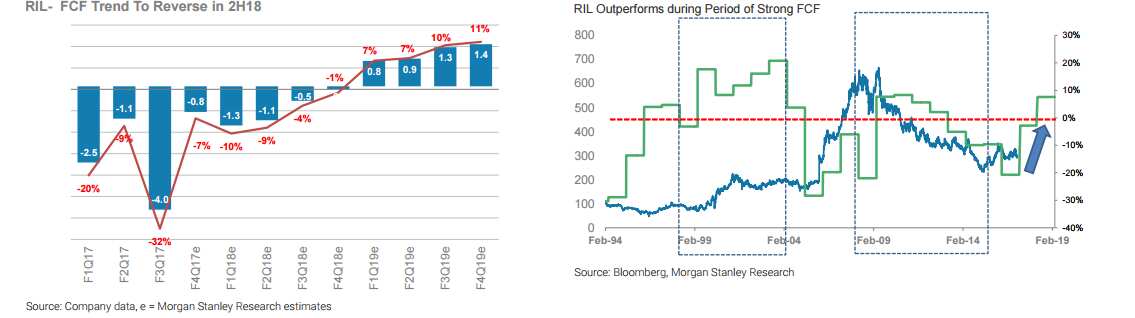

Trend in FCF is also expected to change in the second half of FY18.

RIL's energy business is set to rise by 500 basis points (bps) by FY2020E, to 15% in the top five in returns and FCF growth globally, it said.

What's the new target price?

Considering the above reason, Motilal Oswal has increased its target price to Rs 950 per share - up 13% from its previous Rs 750 per share.

Morgan Stanley, for long term basis, has set the target price of RIL at Rs 1,823 per share.

It said, "RIL is an integrated refining and petrochemical player with operating assets similar to global peers’,and hence we expect it to trade in line with them."

ALSO READ:

03:11 PM IST

HDFC Bank voted 'Best Managed', 'Best Governed' in India

HDFC Bank voted 'Best Managed', 'Best Governed' in India Bloodbath on stock markets! Sensex crashes 2,919 points, Nifty closes at 2-year low; SBI shares bleed

Bloodbath on stock markets! Sensex crashes 2,919 points, Nifty closes at 2-year low; SBI shares bleed Stock Market Today: Sensex, Nifty tank over 6.5% on Reliance Industries selloff; SBI shares crash over 9 pct

Stock Market Today: Sensex, Nifty tank over 6.5% on Reliance Industries selloff; SBI shares crash over 9 pct  Reliance Industries posts record profits on consumer strength

Reliance Industries posts record profits on consumer strength Sensex, Nifty dip on Reliance Industries selloff; Bharat Forge, Delta Corp, BPCL stocks bleed

Sensex, Nifty dip on Reliance Industries selloff; Bharat Forge, Delta Corp, BPCL stocks bleed