How Eicher Motors' changed its fortune from crisis year to present

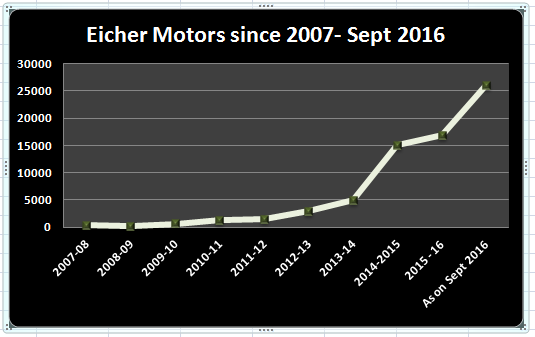

Eicher Motors has not only outperformed in 2016, the share since the economic crisis of 2007-08, has grown by whooping 7046.58%.

If you are a long-term investor and have invested in auto stocks, especially in Eicher Motors, then your good days have arrived.

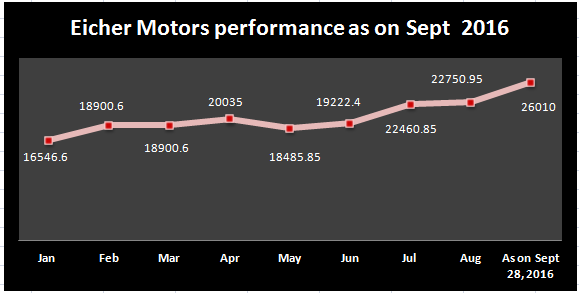

Eicher Motors on Wednesday breached the Rs 26,000 mark on NSE, the highest level ever recorded by the company.

On NSE, the shares of Eicher Motors closed at Rs 26,010, up by Rs 1366 or 5.55%. It touched a new high of Rs 26,045 in the afternoon trading session.

Traded volume were around 1.02 lakh shares at a turnover of Rs 257.72 crore on NSE exchange.

Last week, the company’s shares marked a 52-week high of Rs 25,000, which has now changed to new 52-week high of Rs 26,045 on September 28, 2016.

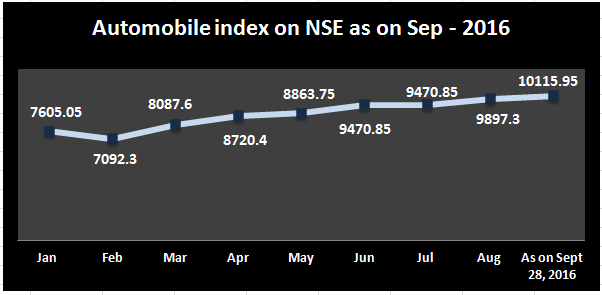

From beginning of 2016, shares of Eicher Motors have surged faster than the automobile index on NSE.

While automobile index has grown by 33%, Eicher Motors has surged by 57.19% till date.

Eicher Motors has not only outperformed in 2016, the share since the economic crisis of 2007-08, has grown by whooping 7046.58%.

In the year 2007-08, Eicher Motors was trading below Rs 500 mark and maintained below Rs 1000-level till the year 2009-10.

But after 2009-10, there was no turning back for the shares of Eicher Motors. It consistently performed better month-by-month. In the year 2014-15, the stock crossed above Rs 15,000.

Interestingly, till the year 2015-16, the stock of the company was trading below Rs 17,000, which means that Eicher Motors' fate has changed commendably in this fiscal year.

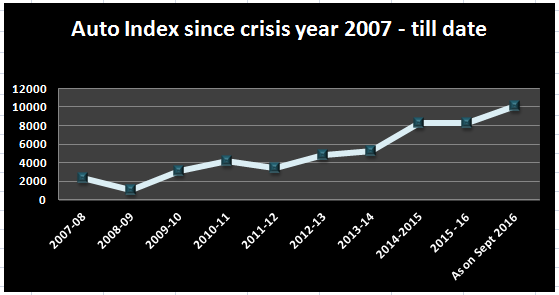

Since the crisis year 2007-08, the Nifty Auto index has grown by 330%.

In crisis year 2007-08, Nifty Auto stood at 2351 level and was trading below 5000-level for nearly six years. In the year 2013-14, it managed to reach near 5300 mark.

The volatility of Nifty Auto changed when investors pushed the index over 8000-mark in 2014-15. The same sentiments of investors were carried till last year.

It is only this fiscal year, that the era of Nifty Auto has changed surprisingly. Now the Nifty Auto trades above 10,000-mark, mainly tapped by developments on 7th Pay Commission, passage of Goods and Service Tax (GST) bill and robust sales from auto industry.

What makes Eicher Motors so special?

This financial year 2016 - 17, Eicher has offered nearly 41,300 shares under employee stock ownership plan (ESOP).

An employee stock ownership plan (ESOP) is a qualified defined-contribution employee benefit (ERISA) plan designed to invest primarily in the stock of the sponsoring employer. ESOPs are "qualified" in the sense that the ESOP's sponsoring company, the selling shareholder and participants receive various tax benefits.

Earlier in May, Anita Lal, Rukmani Joshi and The Eicher Goodearth Trust – part of the promoter group of Eicher Motors – sold a part of their stake for around Rs 2,100 crore.The proceeds will be utilised to provide liquidity to the promoters, and the proceeds are to be utilised for personal use, such as portfolio and other investments, and for charitable purposes.

Also, the company re-appointed Sidhartha Lal as Managing Director for another term of five years.

Eicher Motors' strong financial portfolio involving its stellar performer Royal Enfield has also supported it to make it big.

Total revenue of Eicher Motors was around Rs 13.121 crore in the fiscal 2016, which grew by 40% from Rs 9382 crore of fiscal year 2015.

Further, net profit after tax of Eicher Motors recorded a 62.2% rise to Rs 1236 crore in FY16 compared to Rs 762 crore in FY15.

Sales volume has also been robust, by nearly 5,08,099 units sold, a 53.42% growth compared to 3,31,169 units sold in FY15.

EBITDA - earnings before interest tax depreciation and amortization, improved consistently in FY16 to Rs 2081 crore, rose by 65.28% against Rs 1259 crore in FY15.

While the net worth of the company has risen to Rs 3464 crore, almost 28% growth from Rs 2707 crore in FY15.

Currently Eicher Motors is a debt free company. It's Royal Enfield has captured nearly 96% of market share in the mid-size motorcycles segment.

The Royal Enfield's EBITDA margins in FY16, has set a 28.3% benchmark in the automobile industry.

During the April-June, 2016 quarter (Q1FY17). Royal Enfield's total sales stood at 147483 units, which grew by 38.33% versus 106613 units sold in the same period of the previous year.

In August sales, Royal Enfield sales jumped by 32% to 55721 units against 42360 units in the similar month of the previous year.

Going ahead, it VE Commercial vehicles have captured a 34% market share in domestic LMD segment. It's EBITDA margin in FY16 was recorded at 8.1% best in class.

The company's return on asset (ROA) grew by 16.2% in FY16, from 12.5% in FY15 and 12% of FY14. While return on captial employed grew by 36.9% in FY16 versus 26.5% in FY15 and 24.6% in FY14.

Outlook ahead for Eicher Motors also looks positive with the festive season right across the corner.

Vinod Agarwal, CEO-VE CV of Eicher Motors in an interview with Economic Times said," We are positive for this short- to medium-term. Especially for the festive seasons, I think the demand is going to be good and more especially because September still will be sluggish because last year in September there was lot of pre-buying because of ABS and few other regulatory implementations and this year, of course, from October because last year October was low, so this year October onwards which is also festive season, we should see good demand. "

11:03 PM IST

Davos 2020: Government should put more money in infrastructure through budget, says Siddhartha Lal, Eicher Motors

Davos 2020: Government should put more money in infrastructure through budget, says Siddhartha Lal, Eicher Motors Sensex, Nifty gain ahead of crucial Brexit Summit; Eicher Motors, Vedanta, TVS Motor stocks gain

Sensex, Nifty gain ahead of crucial Brexit Summit; Eicher Motors, Vedanta, TVS Motor stocks gain Crorepati Crash Course! Bought Royal Enfield Bullet in 2001? You MISSED chance to mint Rs 5.5 crore!

Crorepati Crash Course! Bought Royal Enfield Bullet in 2001? You MISSED chance to mint Rs 5.5 crore! Stock market tips: Shares to buy to make money fast from Dalal Street – Check list

Stock market tips: Shares to buy to make money fast from Dalal Street – Check list Maruti Suzuki to Motherson Sumi, here are stocks that are top picks of experts in auto sector

Maruti Suzuki to Motherson Sumi, here are stocks that are top picks of experts in auto sector