Airlines hit by weak demand on Mumbai route as passengers snub India's financial hub; whom to blame?

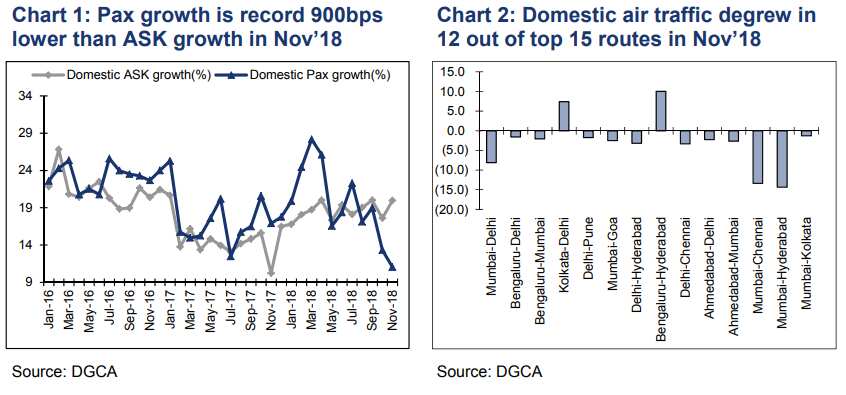

During November 2018, domestic aggregate pax growth has been a record ~900 bps lower than the capacity growth (measured in ASK).

In a shock to the system, airlines like Jet Airways, Indigo, SpiceJet and others' Mumbai flights have seen the heavy demand hit by a slowdown. Yes, a mixed trend is being witnessed in domestic airlines passenger growth and capacity performance over the last two months. What has happened is that the passenger (pax) growth has been significantly below the capacity growth as measured in Available Seat Kilometres (ASK). Simply put, passengers are travelling less with airlines. A data revealed that, top routes were seeing lackluster demand from passengers, especially in India’s financial hub Mumbai which for airlines like Jet Airways, Indigo and SpiceJet is favorite haven. Demand to routes in Mumbai has always been hefty, however, looks like from October - November month it has taken a reverse trend.

During November 2018, domestic aggregate pax growth has been a record ~900 bps lower than the capacity growth (measured in ASK).

Ansuman Deb, analysts at ICICI Securities stated that, if we split the air passenger in November between key routes, there are three key takeaways.

Firstly, there was decline in key metro routes led by Mumbai–Delhi (down 8%), Mumbai-Chennai (down 13%), Mumbai-Hyderabad (down 14%), Bengaluru-Mumbai (down 2%), Mumbai-Goa (down 2.5%), and Delhi-Hyderabad (down 3%) among others.

Secondly, corollary implies that the traffic growth in non-metro routes would continue to have strong traffic growth, more than 20% to come at an aggregate ~11% traffic growth.

Finally, most routes involving Mumbai reported a decline passenger growth.

Deb explained that, a deep dive into the traffic data of November indicates that there was actually a decline in terms of passenger in 12 of the top 15 domestic routes.

In Deb’s view, the decline in passenger growth can be blamed on fare hikes by domestic airlines.

Till date in FY19, Indigo has posted ~25.5% ASK as well as pax growth. Total ASK growth in Oct/Nov’18 has been 33%. For Indigo which is the largest airline in terms of market share in India, Deb said, “To meet the guidance of 35% ASK growth in Q3FY19, IndiGo would have to grow its capacity by 40% in December 2018.”

After Indigo, it was private carrier SpiceJet which posted double-digit growth of 11% in ASK, however, 9% growth in PAX so far in FY19.

On SpiceJet, Deb said, “We factor 13% capacity growth as well as capacity growth for SJet in FY19. There was a spike in capacity growth (22%) in Dec’18. However, SJet is also entering a high base period from Dec’18. As such, the capacity growth likely to be ~10-15% going ahead unless there is significant increase in max aircraft induction.”

Another private carrier Jet Airways which as expected saw single-digit demand in ASK and PAX compared to its peers. Jet Airways is currently trapped under cash crunch and negative ratings as they have delayed in repayment of debt to a consortium of banks led by SBI.

So far in FY19, Jet Airways posted 6% ASK and ~1% pax growth.

In regards to Jet Airways, “Capacity as well as pax decline has been higher in the int’l segment. This is one of the reason between a reverse spread (pax growth higher than ASK growth) in the international traffic carried by Indian airlines.”

In case of passenger growth ahead in these airlines over top routes especially in Mumbai, Deb highlighted that the, situation could turn into positive and traffic would come back once airlines rollback fare hikes under the current low crude prices because the discretionary demand will be high in top routes.

01:23 PM IST

Wings for aviation sector! What Modi government is doing for complete overhaul of DGCA

Wings for aviation sector! What Modi government is doing for complete overhaul of DGCA Kerala floods claim 42 lives; over 1 lakh in relief camps; Rail and air traffic hit

Kerala floods claim 42 lives; over 1 lakh in relief camps; Rail and air traffic hit India's February domestic air traffic up 10%: IATA

India's February domestic air traffic up 10%: IATA Aviation: Flight cancellations affect Jan air passenger growth

Aviation: Flight cancellations affect Jan air passenger growth Local air traffic rises by 17% in August; IndiGo tops market-share chart

Local air traffic rises by 17% in August; IndiGo tops market-share chart