Manufacturing contracts in April; Q4 earnings to improve: SBI

Automobile, capital goods, metals, oil and gas sectors are expected to declare double digit revenue growth, according to the report.

Corporates are likely to log in healthier set of numbers in the March quarter clocking up to 12% growth on the back of an improvement in manufacturing, says a report.

"We expect corporates to report a topline growth ranging from 10 to 12% in the March quarter, while the bottomline may surpass topline growth," SBI Research said in a report today.

While performance is expected to be varying for different sectors, FMCG and banks are expected to be better.

"Banks are expected to do better on net earnings but with low credit off take, the year is going to be a challenge on the margin front," the report said.

"The credit growth has been anemic and was at 4.36% for the fortnight ended March 24, 2017, the lowest in many years. With banks flushed with funds, we expect to see the spreads coming under pressure," it added.

Automobile, capital goods, metals, oil and gas sectors are expected to declare double digit revenue growth, according to the report. Pharmaceuticals, metals, capital goods are likely to come out with double digit growth, in terms of net profits.

Some of the best performers from the results announced so far include Hindustan Zinc (topline growth) while Goa Carbon was the best performer in the bottomline.

Besides, HDFC Bank, Yes Bank and Indusind Bank also exhibited better performance, the report noted.

"Overall, some of the well governed corporates have weathered the demonetisation storm. These companies have been the first to declare the results while some of them may yet assess the impact of demonetisation," it said.

The report also observed that the government push for infrastructure, housing and better capacity utilisation, corporate earnings may set for a better numbers in 2017-18.

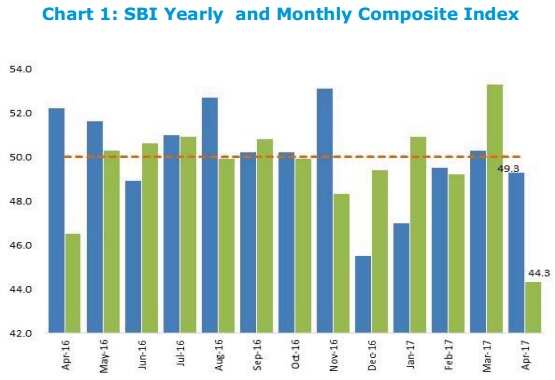

Meanwhile, the yearly SBI Composite Index, one of leading indicator for manufacturing activity in the Indian economy, for April has dipped to below 50 level to 49.3, signalling a low decline in this space.

SBI report noted that even as index numbers are showing gradual traction, the corporate results outlook for March quarter is expected to exhibit improvement in both topline and bottomline.

This, the report said is unlike in the recent past, where improvement in profits was positive while revenues and sales growth was either tepid or negative.

06:30 PM IST

SBI Life COVID-19 death claim: Useful coronavirus tips to make SBI Life Insurance claim

SBI Life COVID-19 death claim: Useful coronavirus tips to make SBI Life Insurance claim  OnlineSBI: SBI fixed deposit (FD) interest rate cut by up to 50 bps; check sbi.co.in for latest details

OnlineSBI: SBI fixed deposit (FD) interest rate cut by up to 50 bps; check sbi.co.in for latest details SBI interest rates on loans slashed by whopping 75 bps, passes on entire RBI repo rate cut to borrowers

SBI interest rates on loans slashed by whopping 75 bps, passes on entire RBI repo rate cut to borrowers Withdraw cash without your SBI debit card, ICICI Bank debit card

Withdraw cash without your SBI debit card, ICICI Bank debit card SBI business opportunity for you: Earn this much money every month, plus big allowance

SBI business opportunity for you: Earn this much money every month, plus big allowance