Pharma Q3: FDA inspection, US pricing market key

Piyush Nahar and Anurag Mantry analysts of Jefferies said, “We expect another muted quarter for the pharma sector led by weakness in US business. USFDA inspections and pricing in US market will continue to dominate the results. Recent comments from global peers have indicated that pricing scenario will likely remain unchanged in 2017.”

Pharmaceutical companies in India are expected to post muted results for the third quarter ended December 31, 2016.

Piyush Nahar and Anurag Mantry analysts of Jefferies said, “We expect another muted quarter for the pharma sector led by weakness in US business. USFDA inspections and pricing in US market will continue to dominate the results. Recent comments from global peers have indicated that pricing scenario will likely remain unchanged in 2017.”

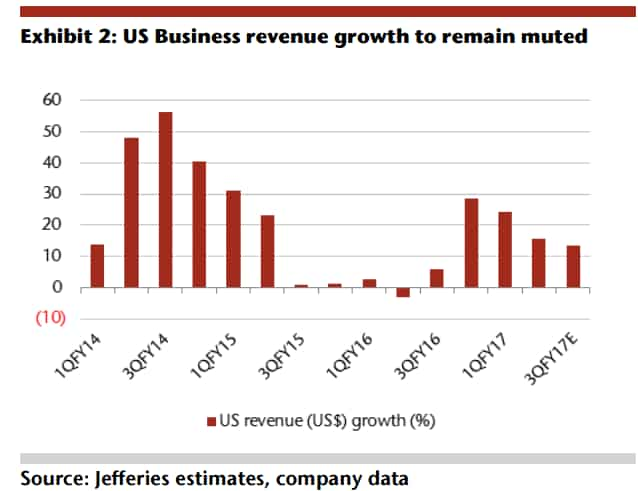

Revenue growth from US market is expected to be hampered mainly on account of the pricing. Jefferies said, "Some global peers have indicated that pricing is likely to remain under pressure in 2017 also."

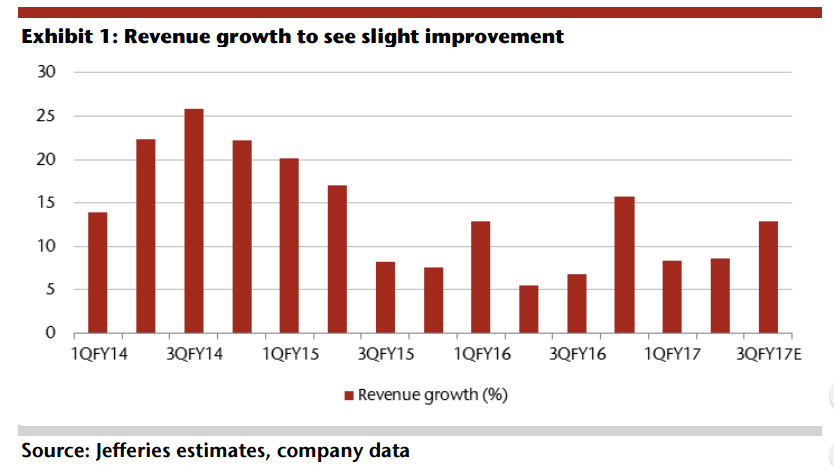

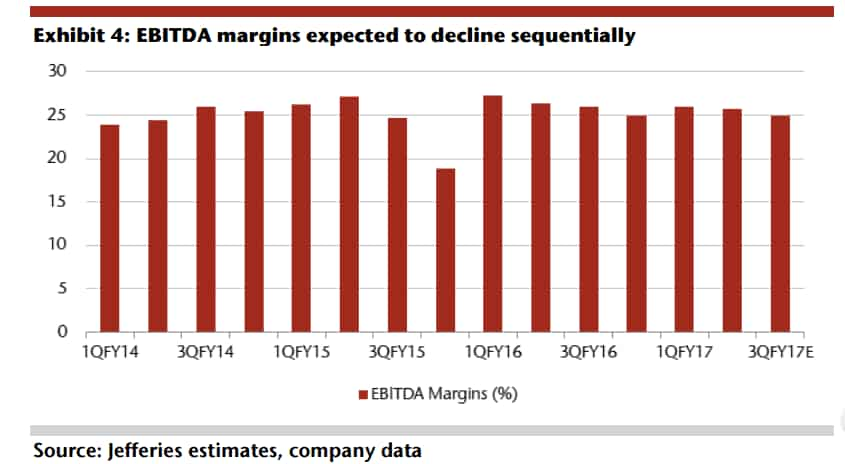

They added, “We expect Indian pharma to report revenue growth of 12% and margin decline of 100 basis points on year-on-year (YoY) basis. US business will remain the key focus given regulatory and pricing headwinds.”

Analysts believe USFDA inspection to remain in focus.

Jefferies said, "ANDA filings in Dec quarter at 424 filings were 1.7x vs. quarterly run-rate of ~250 over the past 3 years (Ex 7). This will put significant pressures on GDUFA timelines and will imply FDA focus will largely be on issuing CRLs. Approval rates will consequently suffer as FDA commitments take precedence and the buck is passed to quality of filings. ARBP is, in our view, the best placed in this regard."

Here are the performance of key listed pharma companies as per Jefferies.

Sun Pharma: Taro pharma and Halol unit will be in focus. The company is expected to report 14% top-line (revenue) growth and 280 bps YoY margin improvement led by Glivec and Golmesartan.

Lupin: The company's EBITDA margins are seen declining to 200 bps YoY and 120bps QoQ margin led by pricing pressure and competition in Fortamet.

Cipla: Expected to report 300bps YoY margin improvement driven by low base and cost cutting.

Dr Reddy's Laboratories: The company is seen to report slight improvement in QoQ margin. Key for the stock remains FDA inspection of facilities and resolution of USFDA letter.

Aurobindo Pharma: Top-line growth is seen at 13% along with 90bps margin improvement led by US business. Key to watch will be commentary on launches on pending products.

Companies like Syngene International and Strides Shasun are also expected to bring in 15% and 27% growth in their top-line this Q3.

01:29 PM IST