Reliance Jio to buy RCom's wireless business; what’s next?

Here's what comes next as Reliance Jio and Reliance Communications prepare for the sale of assets.

Key Highlights:

- Jio will acquire 122.4 MHz of 4G spectrum.

- Over 100,000 miles of optic fiber and more than 43,000 cell phone towers will be offered to Jio.

- RCom's debt was estimated to be Rs 45,733 crore as on March 2017.

It’s big brother Mukesh Ambani to the rescue as Reliance Jio announced its intentions to buy out the Anil Ambani backed Reliance Communications’ wireless business. The Reliance empire was left divided after the death of Dhirubhai Ambani in 2002.

Now Jio, a subsidiary of Reliance Industries on Thursday announced signing of ‘definitive agreement’ to buy out debt laden RCom’s assets. The operator run by the younger Ambani sibling was estimated to be over Rs 45,000 crore in debt.

RCom is putting up for sale its towers, optic fibre cable network, spectrum and media convergence nodes to pare losses.

“The acquisition is subject to receipt of requisite approvals from Governmental and regulatory authorities, consents from all lenders, release of all encumbrances on the said assets and other conditions precedent. The consideration is payable at completion and is subject to adjustments as specified in the agreement,” Jio said.

The wireless business in question entailed over 100,000 miles of optic fiber and more than 43,000 cell phone towers, as per Moody's estimates.

What this means for Jio

After months of speculation over a possible merger since both companies share spectrum in over seven circles, RCom and Jio have finally given in to rumours.

More than subscribers, this deal with RCom is crucial for Jio on account of spectrum. Jio will acquire 122.4 MHz of 4G spectrum.

RCom owns 262MHz airwaves in four bands including its most coveted 800MHz band that has a longer validity until 2033, a report by Bloomberg Quint said. Rolling out 4G services on that frequency would mean lower infrastructure cost, the report added.

From the sale of spectrum alone, RCom was estimated to cut its debt by Rs 19,000 crore. However, nearly 50% of Jio’s spectrum in the 800 MHz and 1800 MHz may expire by 2021, a report by Business Today said.

Moody’s said that the sale of its wireless business would help Jio for a ‘large scale’ roll-out of its wireless and fiber-to-the-home (FTTH).

Coming to subscribers, analysts do not estimate this to work much in favour of the youngest telecom operator as it acquires RCom subscribers. The latter’s subscribers have been dropping for the longest time.

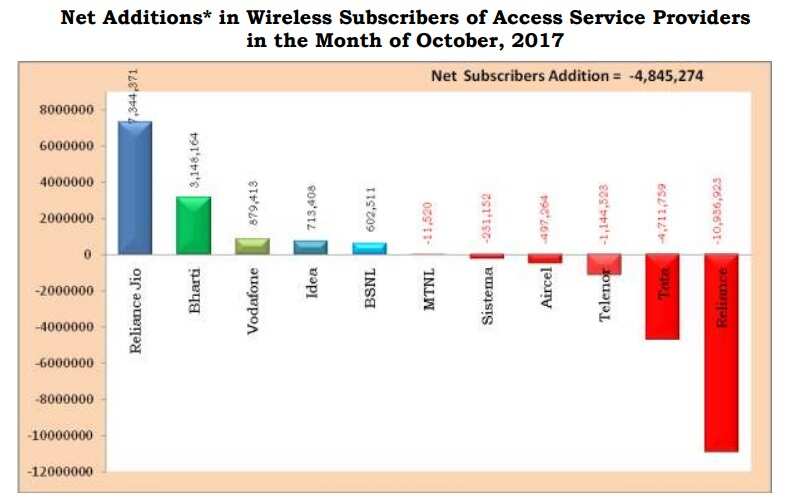

In October 2017, RCom ‘net addition’ to subscribers was the worst among all operators at 10,936,923.

Image Source: TRAI data

Jio currently stands at fourth place in the Indian telecom market with 14.59 crore subscribers, as per TRAI data.

Post the merger, Jio and RCom are estimated to have a little over 20 crore subscribers. This is a little higher than the third largest operator, Idea with over 19 crore subscribers.

However Idea is slated for a merger with India’s second largest telecom player – Vodafone in 2018.

How does the competition fair?

Fight to be India’s number one operator would be ongoing in the coming years. Sunil Bharti-led Airtel said that the market would consolidate to a three player market by 2020.

Bharti Airtel currently leads the pack with over 28 crore subscribers. It had also taken over Norwegian telecom firm Telenor.

Idea and Vodafone are estimated to build a 40 crore subscriber base post its merger.

When it comes to spectrum, Airtel holds 1767.5 MHz while Vodafone and Idea together were estimated to hold 1850 MHz.

The Jio-RCom entity are estimated to hold 1357.4MHz only, the report by Business Today said.

Also Read: RCom's rise and fall, and the white knight

WATCH:

06:02 PM IST

Telcos pay over Rs 8,000 cr to govt in dues; DoT to write fresh letters to firms questioning AGR gap

Telcos pay over Rs 8,000 cr to govt in dues; DoT to write fresh letters to firms questioning AGR gap Airtel Wi-Fi calling feature now on over 100 smartphones; Check full list

Airtel Wi-Fi calling feature now on over 100 smartphones; Check full list Want to make more money in 2020? Here are top 10 IPOs to watch

Want to make more money in 2020? Here are top 10 IPOs to watch Stock Market: Sensex, Nifty open cautious on weak global cues; Telecom stocks rise on Rs 42,000 crore relief package

Stock Market: Sensex, Nifty open cautious on weak global cues; Telecom stocks rise on Rs 42,000 crore relief package Big relief for Airtel, Vodafone, others! Modi Cabinet approves Rs 42,000 crore cash flow to telcos in a two-year moratorium

Big relief for Airtel, Vodafone, others! Modi Cabinet approves Rs 42,000 crore cash flow to telcos in a two-year moratorium