What Q4FY17 has in store for FMCG companies?

We expect ITC’s sales to increase by 1.3% YoY (with a 4% decline in cigarette volumes) and PAT by 8.4% (mainly due to high 36% tax rate in the base quarter).

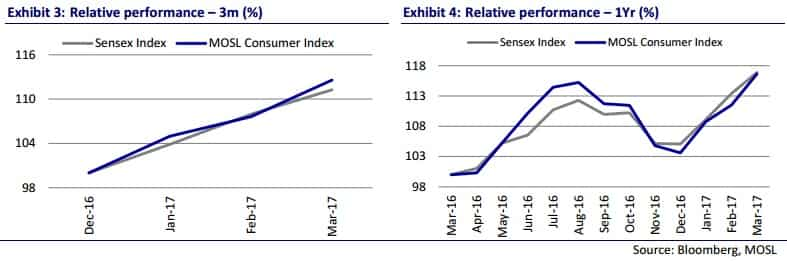

Majorly hit by the demonetisation and the rising raw material costs, the consumer sector is likely to post another quarter of muted revenue growth, a research report said.

Under the consumer sector, the lingering effects of demonetisation are likely to continue impacting the companies, particularly those with higher proportion of wholesale trade and greater exposure to rural as well as north and east regions.

According to a Motilal Oswal Securities research report, the revenues under the consumer sector expected to increase 4.5% year-on-year in Q4FY17, with Profit After Tax (PAT) growth of 5.3%. The EBITDA is likely to increase by only 2.6% y-o-y with 40 basis points margin contraction.

Here's the outlook for FMCG companies in Q4FY17.

Barring Nestle, United Spirits and Jyothy Labs, we expect near flattish/or a decline in YoY EBITDA margin for all other FMCG companies due to weak sales growth and favorable base of commodity costs coming off (with prices of many commodities sharply increasing YoY), the research report said.

Moreover, ad spends are unlikely to decline steeply enough to protect margins for most companies. We expect ITC’s sales to increase by 1.3% YoY (with a 4% decline in cigarette volumes) and PAT by 8.4% (mainly due to high 36% tax rate in the base quarter).

Hindustan Unilever's (HUVR) sales growth is estimated at 4.5% (volume decline of 0.5%), with 100bp EBITDA margin contraction. Nine of the 18 companies under our coverage are likely to report a decline in EBITDA YoY, with five others estimated to report EBITDA growth in the range of 0-5%.

Nestle, United Spirits and Jyothy Labs are likely to report double-digit EBITDA growth, mainly due to a low margin base. Godrej Consumer (GCPL) too is expected to do well as only half of its business comes from India. Mainly due to lower/higher-than-usual tax rates in 4QFY16, PAT growth variance may be higher/lower than EBITDA growth for some companies, the report added.

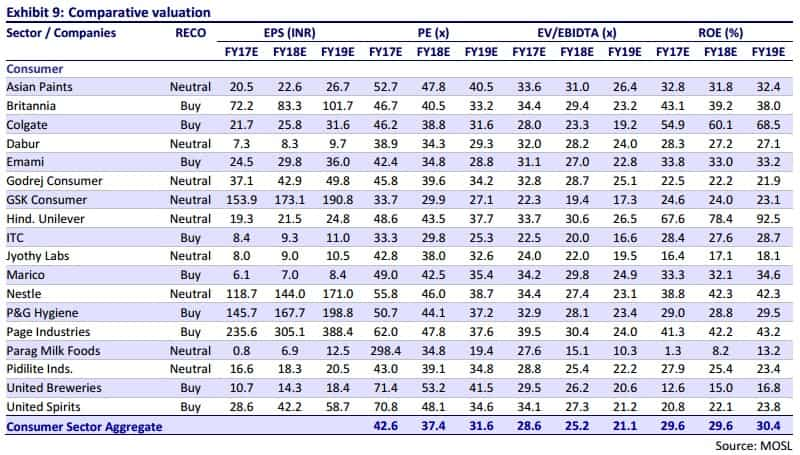

Krishnan Sambamoorthy and Vishal Punmiya, Analyst at Motilal Oswal, said, "The consumer sector is characterized by rich near-term valuations, given the market’s continued preference for quality with healthy growth. Our framework for earnings visibility, longevity of growth and quality management drives our choices in the sector universe. We continue preferring Britannia, Colgate, Marico, P&G Hygiene and Emami, notwithstanding the near-term challenges."

06:29 PM IST

'FMCG topline may rise by 300-400 bps in FY19 on rural demand'

'FMCG topline may rise by 300-400 bps in FY19 on rural demand' Rural push to boost FMCG companies' topline next year: Report

Rural push to boost FMCG companies' topline next year: Report Emami Q4: Here's what experts say

Emami Q4: Here's what experts say Note ban punches holes in Q3 results; Cos hopeful of 'gains'

Note ban punches holes in Q3 results; Cos hopeful of 'gains' Not worried about challenge from 'faith-based' products from Patanjali, Sri Sri Ayurveda: Dabur

Not worried about challenge from 'faith-based' products from Patanjali, Sri Sri Ayurveda: Dabur