Your telecom service provider of the future could look like this

Future of India’s vastly changing telecom industry landscape leads us to believe there’s something more than pursuing revenue from data services.

Key Highlights

- Data usage per SIM per month has grown from 60 MB in Q3FY14 to 1,248 MB in Q1FY18.

- Ambani said, "“Data is the new oil in India.”

- Some operators have forayed into home broadband, DTH, enterprise solutions, leasing of fiber network, operating data centers.

Envisaging the future of the telecom industry in India currently revolves around predicting the number of exits from the market and the next trend in tariff plans. Focus in this highly competitive sector is largely to drive data revenues through the roof. But what’s next after data?

“With the number of players now at more manageable levels, a new player now well-entrenched, and more assured growth opportunity in the form of data services, the industry is set to enter its next phase, one that looks more promising than the past few years, notwithstanding the pressures likely to be witnessed over the next 2-3 quarters,” said analysts of ICRA in a report dated October 30.

The launch of Reliance Jio services in September 2016 was probably the epitome of the underlying focus of telecom operators to now work on improving subscriber base. Jio’s ‘Welcome offer’ gave subscribers unlimited benefits for three whole months. And in order to sustain subscribers, competing operators also doled out similar plans.

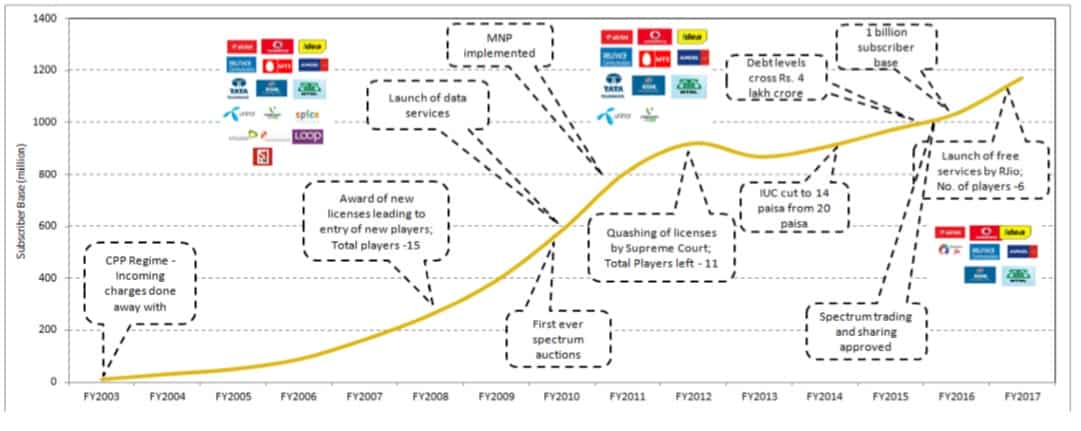

Image Source: ICRA

“The industry has migrated from the revenue per minute and average revenue per MB approach to a more subscriber centric gross APRU approach,” the report said.

Data usage per SIM per month has grown from 60 MB in Q3FY14 to 1,248 MB in Q1FY18.

Airtel, Idea and Vodafone are now ramping up their networks to include 5G technology as well.

Even average revenue per user (ARPU), the report pointed out has grown from a low of Rs 97 for FY12, the ARPU levels improved steadily to Rs 125 for FY16.

Image Source: ICRA

The man behind the youngest telco and India’s richest man, Mukesh Ambani once said, “Data is the new oil in India.”

This ‘oil’ will soon fuel other projects that telecom operators may now be working toward.

“Over a longer term, the telcos would innovate to look for other revenue streams beyond the staple voice and data services,” ICRA report said

Building on their already laid foundation operators will be looking at automatic control of household appliances or home automation, car connectivity and even health care.

“In the past, some telcos have expanded into services like home broadband, DTH, enterprise solutions, leasing of fiber network, operating data centers etc. But the revenue diversification benefit from these services has been limited as the scale remains lower than that of retail mobile services. The industry would need to identify services with significant scale potential to find a material revenue growth driver. Some options include home automation, connected-cars, healthcare, cloud and energy management services and contribution to the Government’s smart cities initiative, which form a part of Internet of Things (IoT),” the report said.

In May this year, Airtel partnered with taxi aggregator platform, Ola to bring Wi-Fi in cabs. Ola is now bringing its Wi-Fi services to its auto rickshaw – Ola Auto services as well.

Vodafone may launch its narrowband Internet of Things (NB-IoT) network for businesses in India, a report by ET Telecom said on October 29. Bharti Airtel has also taken to Payments banks to expand its portfolio. Vodafone and Airtel are also tying up services to offer GST solutions to entrepreneurs.

“However, lack of awareness of IoT uses, unfavourable device ecosystem, data security concerns and poor availability of talent pool are some of the inhibitors which have to be overcome for growth and development of IoT in India in the near term,” ICRA added.

02:38 PM IST

Tatas pay additional Rs 2,000 crore to Govt towards AGR dues: Sources

Tatas pay additional Rs 2,000 crore to Govt towards AGR dues: Sources BSNL Salary Latest News Today Update: Check what government asked Bharat Sanchar Nigam Limited for payment

BSNL Salary Latest News Today Update: Check what government asked Bharat Sanchar Nigam Limited for payment REVEALED: How India's 5G infrastructure will be impacted if government bans Huawei

REVEALED: How India's 5G infrastructure will be impacted if government bans Huawei BEWARE! Got suspicious international call from Pakistan or some other country? Here is what to do

BEWARE! Got suspicious international call from Pakistan or some other country? Here is what to do Bharti Airtel results show loss of Rs 2,866 cr in Q1 FY19-20; consolidated revenues grew 6.8 per cent

Bharti Airtel results show loss of Rs 2,866 cr in Q1 FY19-20; consolidated revenues grew 6.8 per cent