A Historic Low: What's really happening with bank credit growth?

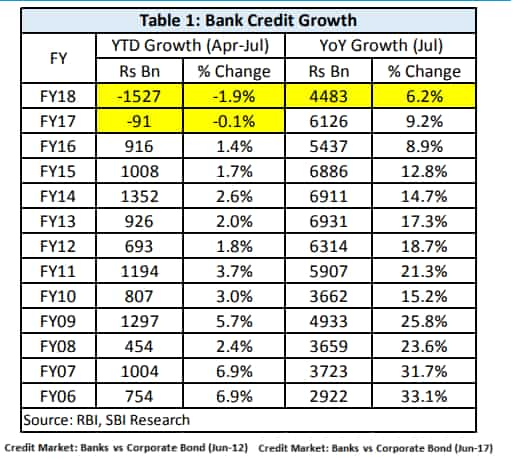

Since the start of fiscal year 2017-18 (FY18) all scheduled commercial banks (SCBs) business ( advances and deposits has seen decline in both year-to-date (YTD) and year-on-year (YoY) basis.

Key Highlights:

- Bank credit growth to historic low

- Bank credit growth decelerated to Rs 1.5 lakh crore from April 2017 - till date

- MCLR rate even below 8% in Q1FY18

Reserve Bank of India's (RBI) repo rate cuts to revive investment in India has managed to bring down interest rates but bank credit growth continues to remain abysmally low.

Latest data show that credit growth has decelerated by Rs 1.5 lakh crore between April 2017 till date -- a historic low.

Shashin Upadhyay, analyst at ICICI Securities earlier said, "With relative improvement in the macro-economy, we estimate systemic loan growth rate to rise to 10% YoY in FY18."

He believed three things will aid the performance of loan growth in FY18. First, waning credit substitution as banks effectively price as per the MCLR curve; second, continued growth momentum in retail, aided by declining product rates and a modicum of revival in corporate credit on higher inflationary expectations and lastly, improved utilisation of industrial capacity.

This, however, has not happened.

Between April 2017 – July 2017, all scheduled commercial banks (SCBs) business ( advances and deposits has seen decline in both year-to-date (YTD) and year-on-year (YoY) basis.

Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India, said, "Decline in deposits growth is expected, as huge amounts of money that flowed into the banking system post demonetisation is now mean reverting."

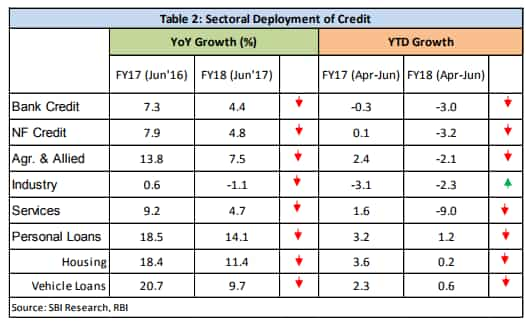

In quarter ended June 30, 2017, credit saw growth of just 4.4% compared to growth of 7.3% a year ago same period.

Credit to agriculture sector came in at 7.5% in Q1 down compared to 13.85 growth seen in Q1FY17. While credit to service sector was at 4.7% versus 9.2% in Q1FY17.

Personal loans have also seen slowdown in Q1 by witnessing only 14.1% growth compared to 18.5% in Q1FY17. Under which, housing loans was at 11.4% from 18.4% in Q1FY17 and vehicle loans were at 9.7% from 20.7% growth in Q1FY17.

Credit to industry continued to remain a major problem with it reaching negative 1.1% in first quarter as against 0.6% growth recorded a year ago same period.

Ghosh said, “ The worrying thing is that pace of growth in personal loans (especially housing) have been declining since Sep’16, which was the growth driver among all the sectors.”

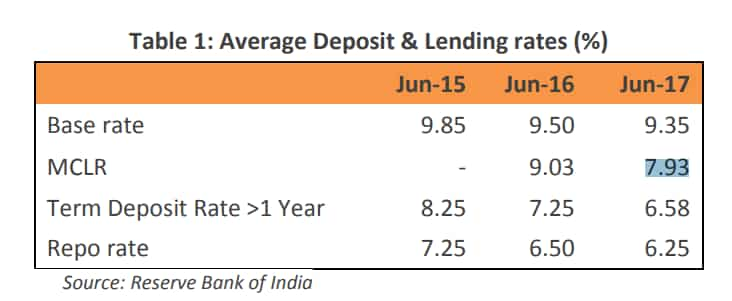

This comes in as a surprises considering the marginal cost of fund based lending rate (MCLR) has reached below 8% in Q1FY18 compared to 9.03% rate in Q1FY17.

RBI, in August 2017 monetary policy had said, “The experience with the Marginal Cost of Funds Based Lending Rate (MCLR) system introduced in April 2016 for improving the monetary transmission has not been entirely satisfactory, even though it has been an advance over the Base Rate system.”

What's hurting credit growth?

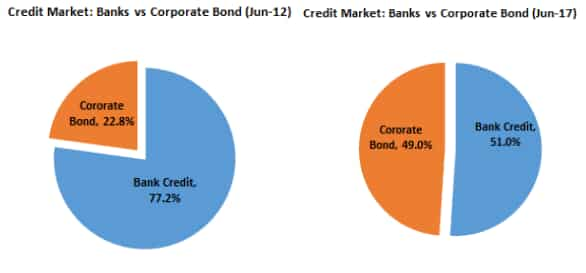

Two things – rising corporate bond market and banks' unwillingness to lend to industry owing to their high bad debt.

Share of credit towards industry reduced to 38.4% in FY17 compared to 40.7% from FY12-16. While credit to remaining category saw surger in their share during FY17.

RBI's financial stability report on June 30, 2017 showed that although there is a fall in stressed advances ratio in agriculture, services and retail sectors, the stressed advances ratio in industry sector, however, rose from 22.3% to 23%, mainly on account of sub-sectors such as cement, vehicle, mining & quarrying and basic metals.

By end of FY17, banks had gross non-performing assets (NPAs) of 9.5% of gross advances valuing up to Rs 7.65 lakh crore.

Kavita Chacko – Senior Economist, Care Ratings, said, "The decline in credit growth is largely due to the banks unwilling and unable to lend to industry owing to their high bad debt, low demand for credit from industry who are faced with weak balance sheets and corporate’s viz. the larger and better rated ones, increasingly resorting to the bond markets for their funding requirements."

Even though banks announced rate cut in their lending rates, the rates offered by the debt capital markets remain lower than bank rates.

Moreover, securitisation transactions in India touched a lifetime high of Rs 1,02,500 crore in fiscal 2016 – 17 (FY17), rising 47% as against last year.

Dr VK Vijaykumar, Chief Investment Strategist, Geojit Financial Services, "Interest rate is only one of the factors determining credit demand. Even if credit is available at attractive rates, if demand for goods is deficient, businessmen will not borrow and invest. On the contrary, if demand is buoyant and capacity utilisation is at high levels, businessmen will borrow and invest even if interest rates are high. This explains the present state of poor credit growth."

SBI said, “A depressed investment cycle, persisting excess capacity in manufacturing, and deleveraging on the part of corporates to improve their credit ratings have contributed to the slowdown in credit growth.”

ALSO READ:

05:12 PM IST

Happy New Year 2019! Good news! RBI Financial Stability Report out; Banks back on track

Happy New Year 2019! Good news! RBI Financial Stability Report out; Banks back on track RBI concerned over banks' rising exposure to sovereign bonds

RBI concerned over banks' rising exposure to sovereign bonds RBI modifies average base rate for NBFC, MFIs

RBI modifies average base rate for NBFC, MFIs Credit demand from private corporate sector remained subdued: RBI

Credit demand from private corporate sector remained subdued: RBI Double digit loan growth possible next year, says HDFC Bank

Double digit loan growth possible next year, says HDFC Bank