Anil Singhvi’s Strategy December 20: IT, Auto, Auto Ancillary & Metals sectors are Positive; Buy Infosys Futures with Stop Loss 727

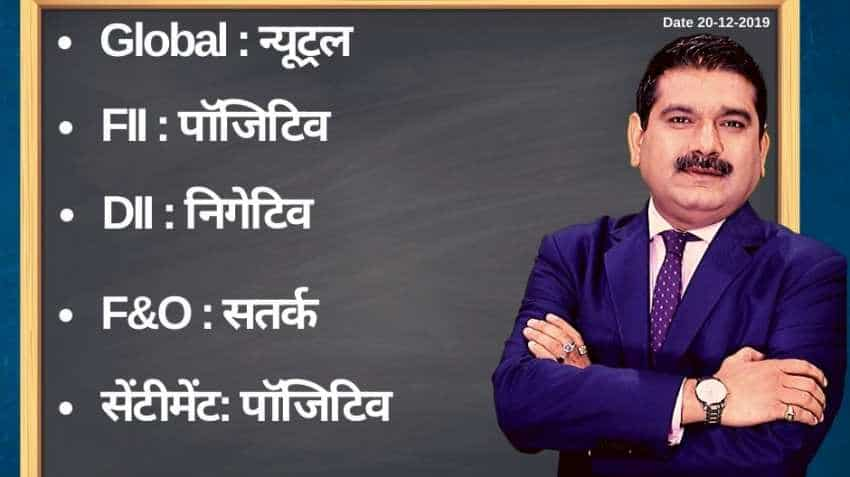

On account of positiv FIIs, negative DIIs and cautious F&O, the short-term trend of the Indian markets will remain positive, says Zee Business Managing Editor Anil Singhvi.

Amid positive foreign institutional investors (FII) and sentiment, neutral global markets, negative domestic institutional investors (DIIs) and cautious futures and options (F&O) cues, the short-term trend of the Indian markets will remain positive on Friday, December 20, 2019.

Equity benchmarks today hit record highs for the third day in a row on Thursday, December 19, 2019, on reports that China has exempted tariff on additional US products. Gains were supported by auto and IT stocks. Gains in index heavyweights like Reliance Industries, TCS and Bharti Airtel also helped lift the indices to record highs. Sensex at Bombay stock exchange climbed 115.35 points, or 0.28%, to close at 41,673.92. Nifty at National Stock Exchange also gained 38.05 points, or 0.31%, to settle at 12,259.70. However, Bank Nifty slide 2.80 points, or 0.01%, to close at 32,241.45.

See Zee Business Live TV streaming below:

Zee Business's Managing Editor Anil Singhvi's Market Strategy for December 20:

FIIs buying and strong trend to give support at lower levels.

Strong Crude, Weak Rupee and Higher PCR may see profit booking on a weekend session

The put-call ratio (PCR) 1.75, alert at higher levels volatility index (VIX) 12.12.

Strong day support zone on Nifty is 12,165-12,200 and on, Bank Nifty is 32,000-32,100.

The small day range for trading on Nifty stands at 12,225-12,275, while the medium and bigger ranges lie between 12,200-12,300 and 12,165-12,350 respectively.

The small day range for trading on Bank Nifty stands at 32,150-32,350, while the medium and bigger ranges lie between 32,025-32,450 and 31,900-32,600 respectively.

For Existing Long Positions:

Nifty intraday and closing stop loss 12,135.

Bank Nifty intraday and closing stop loss 32,000.

For Existing Short Positions:

Nifty intraday and closing stop loss 12,275.

Bank Nifty intraday and closing stop loss 32,350.

For New Positions:

Buy Nifty in 12,165-12,200 range with a stop loss of 12,125 and target 12,250, 12,275, 12,300.

Sell Nifty with a stop loss of 12,300 and target 12,200, 12,175.

Buy Bank Nifty in 32,000-32,150 range with a stop loss of 31,900 and target 32,250, 32,350, 32,450.

Sell Bank Nifty with a stop loss of 32,350 and target 32,150, 32,100, 32,025.

Still in F&O Ban: Yes Bank

Sectors:

Positive: IT, Auto, Auto Ancillary, Metals buy on dips.

Stock of the Day:

Buy Infosys Futures: Stop loss 727 and target 745, 750. Accenture results better than the estimate, positive for IT stocks.

08:38 AM IST

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend

Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day

Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day Stock Market: Sensex, Nifty pare early morning gains; Axis Bank, Coal India, MMTC shares gain

Stock Market: Sensex, Nifty pare early morning gains; Axis Bank, Coal India, MMTC shares gain