Anil Singhvi’s Strategy February 10: Buy OMCs on dips; Auto, Banking & NBFC sectors are Negative

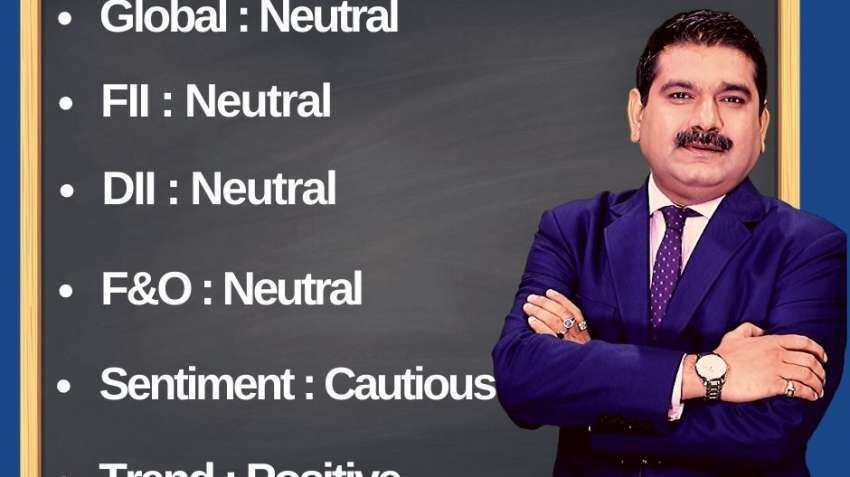

Amid neutral global markets, foreign institutional investors (FIIs), domestic institutional investors (DIIs) and futures & options (F&O) cues, the short-term trend of the Indian stock markets will be positive on Monday, February 10, 2020, while the sentiment is cautious

Amid neutral global markets, foreign institutional investors (FIIs), domestic institutional investors (DIIs) and futures & options (F&O) cues, the short-term trend of the Indian stock markets will be positive on Monday, February 10, 2020, while the sentiment is cautious.

The stock markets corrected itself on Friday, February 7, 2020, and closed in a red. The Nifty slipped below 12,100-mark. Negative global cues spoiled investors sentiment. The Sensex at the Bombay Stock Exchange slipped 164.18 points, or 0.40 per cent, to close at 41,141.85, amid mixed global cues. The Nifty 50 at the National Stock Exchange dropped 39.60 points, or 0.33 per cent, to 12,098.35. Similarly, Bank Nifty lost 102.10 points, or 0.33 per cent, to settle at 31,201.95.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for February 10:

The small day range for trading on Nifty is 12,050-12,100, while the medium and bigger ranges are 12,000-12,150 and 11,950-12,200 respectively.

The small day range for trading on Bank Nifty is 31,000-31,300, while the medium and bigger ranges are 30,900-31,350 and 30,750-31,450 respectively.

For Existing Long Positions:

Nifty intraday and closing stop loss 12,050.

Bank Nifty intraday and closing stop loss 31,000.

For Existing Short Positions:

Nifty intraday and closing stop loss 12,200

Bank Nifty intraday and closing stop loss 31,500.

For New Short Positions:

Sell Nifty with a stop loss of 12,200 and target 12,075, 12,050, 12,010, 11,975.

Buy Nifty near 12,000-12,025 range with a stop loss of 11,950 and target 12,050, 12,075, 12,100, 12,125.

Sell Bank Nifty with a stop loss of 31,375 and target 31,100, 31,000, 30,900, 30,800.

Buy Bank Nifty in 30,900-31,000 range with a stop loss of 30,800 and target 31,200, 31,300, 31,350, 31,450.

Put-Call Ratio (PCR) higher at 1.40 and the volatility index (VIX) is 13.75.

Buy Bank Nifty in 30,900-31,000 range with a stop loss of 30,800 and target 31,050, 31,200, 31,200, 31,300, 31,350, 31,450.

Still In F&O Ban: Yes Bank

Sectors:

Positive: OMC buy on dips.

Negative: Auto, Banks and NBFC.

See Zee Business Live TV Streaming Below:

Stock of the Day:

Sell Indiabulls Housing Futures: Stop loss 320 and target 302, 295. CRISIL reduced long term rating to AA.

08:55 AM IST

EMI calculation: Should you pay or not? Anil Singhvi explains what home loan, auto loan, other borrowers should do

EMI calculation: Should you pay or not? Anil Singhvi explains what home loan, auto loan, other borrowers should do Anil Singhvi: Unless coronavirus vaccine comes, things will not improve significantly

Anil Singhvi: Unless coronavirus vaccine comes, things will not improve significantly EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps

Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps