Anil Singhvi’s Strategy January 17: NBFC, FMCG & Metals are Positive; Telecom sector is Negative

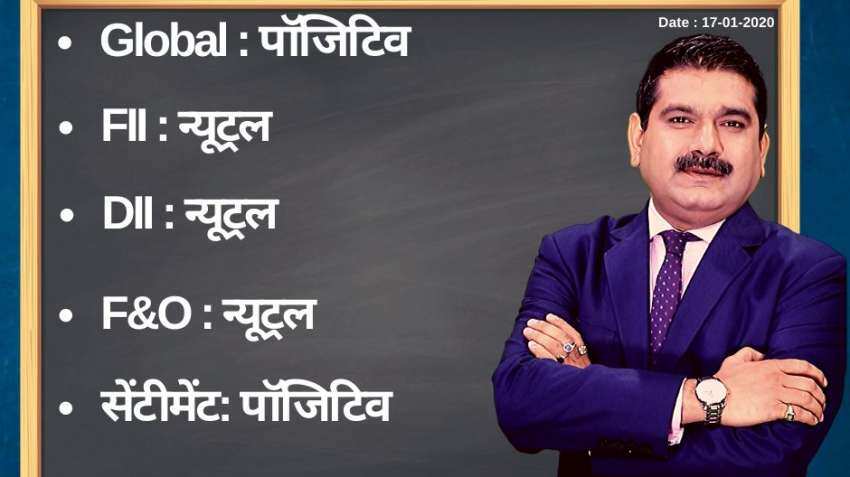

On account of neutral FIIs, DIIs and F&O, the short-term trend of the Indian stock markets will remain positive, says Zee Business Managing Editor Anil Singhvi.

Amid positive global markets and sentiment, neutral foreign institutional investors (FIIs), domestic institutional investors (DIIs) and futures & options (F&O) cues, the short-term trend of the Indian stock markets will remain positive on Friday, January 17, 2020.

Market benchmarks Sensex and Nifty on Thursday, January 16, 2020, ended marginally higher amid positive Asian cues. Trading was volatile on account of weekly index options expiry on the NSE. Investors booked some profits after the US and China signed a preliminary trade agreement on Wednesday, expectations for which had driven global equities to record highs.

See Zee Business Live TV streaming below:

The key indices added around 0.10 per cent. The Sensex gained 59.83 points, or 0.14%, to close at 41,932.56. Likewise, the broader Nifty added 12.20 points, or 0.10%, to settle at 12,355.50. Likewise, Bank Nifty gained 27.85 points, or 0.07%, to close at 31,852.75.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for January 17:

Strong support zone on Nifty is 12,275-12,325 and Bank Nifty is 31,650-31,700.

Fresh Buying and big short-covering ONLY IF sustains above 12,400 and 32,000 level.

The small day range for trading on Nifty is 12,325-12,390, while the medium and bigger ranges are 12,300-12,425 and 12,275-12,475 respectively.

The small day range for trading on Bank Nifty is 31,700-32,000, while the medium and bigger ranges are 31,650-32,075 and 31,500-32,200 respectively.

For Existing Long Positions:

Nifty intraday and closing stop loss 12,300.

Bank Nifty intraday and closing stop loss 31,650.

For Existing Short Positions:

Nifty intraday and closing stop loss 12,400.

Bank Nifty intraday and closing stop loss 32,000.

For New Positions:

Buy Nifty with a stop loss of 12,300 and target 12,385, 12,425, 12,475.

Sell Nifty near 12,400 with a stop loss of 12,425 and target 12,375, 12,350, 12,325.

Buy Bank Nifty with a stop loss of 31,650 and target 31,900, 32,000, 32,075, 32,175.

Sell Bank Nifty in 32,000-32,200 range with a stop loss of 32,250 and target 32,000, 31,900, 31,800, 31,700.

Put-Call Ratio (PCR) is 1.52. The volatility index (VIX) is 14.18.

Still in F&O Ban: Yes Bank

Sectors:

Positive: NBFC, FMCG, Metals buy on dips

Negative: Telecom

Stock of the Day:

Buy Max Financial: Stop loss 525 and target 545, 550, 555. Munjal and Bain Looks to buy stakes in MFSL

08:41 AM IST

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend

Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day

Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day Stock Market: Sensex, Nifty pare early morning gains; Axis Bank, Coal India, MMTC shares gain

Stock Market: Sensex, Nifty pare early morning gains; Axis Bank, Coal India, MMTC shares gain