Anil Singhvi’s Strategy March 17: Sell shares of IT, Banks, NBFC, Auto, Aviation & Multiplexes on Rise

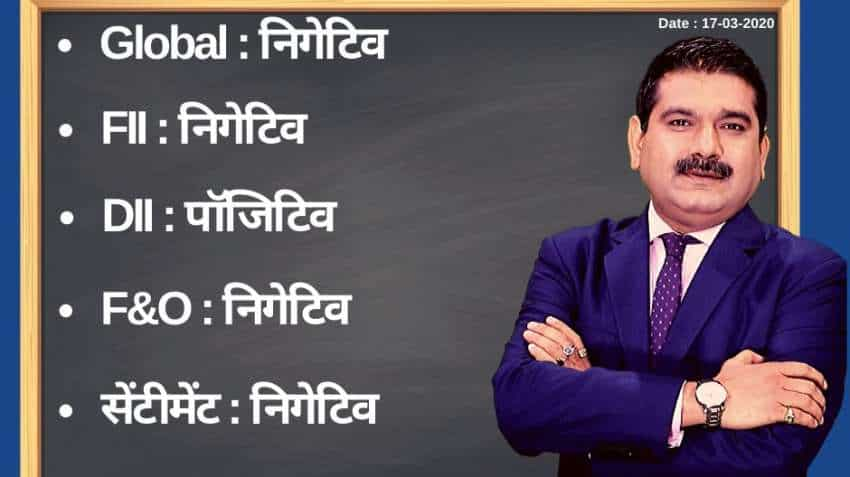

Anil Singhvi’s Strategy March 17: On account of positive DIIs, negative FIIs and F&o, the short-term trend of the Indian stock markets will be negative.

Anil Singhvi’s Strategy March 17: Amid positive domestic institutional investors (DIIs), negative global markets, foreign institutional investors (FIIs), futures & options (F&O) and sentiment cues, the short-term trend of the Indian stock markets will be negative on Tuesday, March 17, 2020.

After a day's halt, the share market resumed sell-off on Monday, March 16, 2020, as investors respond to a rapidly escalating economic hit from the coronavirus and a massive emergency move by the US Federal Reserve to ease policy. The market posted its second-biggest single-day fall yesterday. The barometer index, the S&P BSE Sensex, slumped 2,713.41 points or 7.96% at 31,390.07. The Nifty 50 index crashed 757.80 points or 7.61% at 9,197.40. Likewise, Bank Nifty lost 2,065.30 points or 8.21% to 23,101.15.

With this decline, the Nifty 50 index has fallen 26.01% from its record high of 12,430.50 hits on January 20, 2020. In the broader market, the BSE Mid-Cap index slumped 5.94% and the BSE Small-Cap index dropped 5.66%.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for March 17:

Next Important Support Zone on Nifty is 8,900-9,050, 8,600-8,800 and Bank Nifty is 22,000, 21,350-21,500.

Big higher range on Nifty is 9,500-9,600, 9,950-10,150 and Bank Nifty is 24,000, 25,000-25,200.

If for any reason Nifty and Bank Nifty come in 8,600-8,800 and 22,200-22,500 range, then INVEST 20% CASH in Mutual Funds or Invest Directly.

For TRADERS still do not take… do not take… do not take…

Exit on the rally as and when stock prices come near to your cost…

For Existing Long Positions:

Nifty intraday and closing stop loss 9,000.

Bank Nifty intraday and closing stop loss 23,000.

For Existing Short Positions:

Nifty intraday and closing stop loss 9,600.

Bank Nifty intraday and closing stop loss 24,100.

For New Positions:

Sell Nifty near 9,600 with a stop loss of 9,700 and target 9,200, 9,000, 8,800, 8,650.

Buy Nifty, Only for aggressive traders, with strict stop loss 9,150 and target 9,500, 9,600.

Sell Bank Nifty near 24,000 with a stop loss 24,200 and target 23,500, 23,100, 23,000, 22,000.

Buy Nifty, Only for aggressive traders, with a strict Stop loss of 23,000 and target 23,000 and target 23,500, 24,000.

Negative: Sell on a rise IT, Banks, NBFC, Auto, Aviation, Multiplexes

Put-Call Ratio (PCR) High 0.99, Volatility Index (VIX) up by another 14% to 58.88.

No stock in F&O Ban

09:10 AM IST

EMI calculation: Should you pay or not? Anil Singhvi explains what home loan, auto loan, other borrowers should do

EMI calculation: Should you pay or not? Anil Singhvi explains what home loan, auto loan, other borrowers should do Anil Singhvi: Unless coronavirus vaccine comes, things will not improve significantly

Anil Singhvi: Unless coronavirus vaccine comes, things will not improve significantly EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps

Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps