Anil Singhvi’s Strategy September 19: OMC & cement sector are Positive; NBFC is Negative

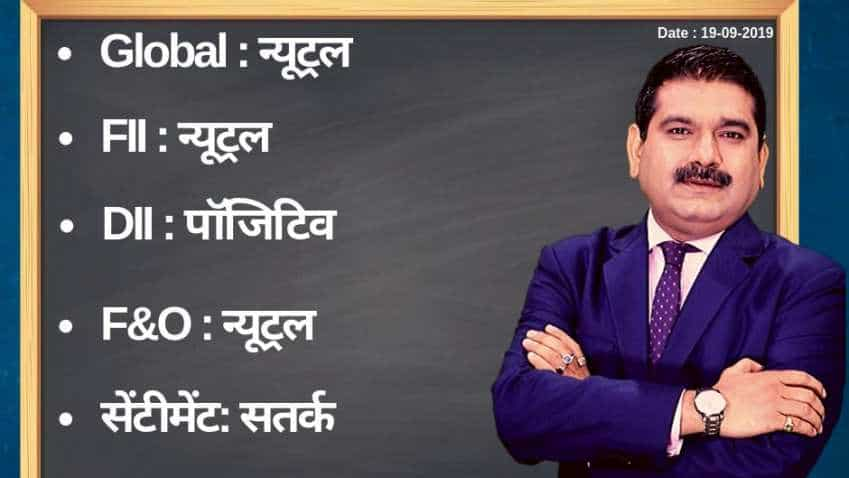

Amid positive domestic institutional investors (DIIs), neutral global market, foreign institutional investors (FIIs) and futures and options (F&O) cues, the short-term trend of the domestic Indian share market is going to be negative today, while sentiment is cautious.

Amid positive domestic institutional investors (DIIs), neutral global market, foreign institutional investors (FIIs) and futures and options (F&O) cues, the short-term trend of the domestic Indian share market is going to be negative on Thursday, September 19, 2019, while sentiment is cautious.

The domestic stock markets on Wednesday, September 18, 2019, closed with gains amid mixed global cues. The Sensex at the Bombay Stock Exchange climbed 82.79 points, or 0.23 per cent, to end at 36,563.88. The Nifty at the National Stock Exchange also added 23.05 points or 0.21 per cent to settle at 10,840.65 while Bank Nifty gained 40.90 points or 0.15 per cent and closed at 27,172.65.

Tata Steel (up 3.70 per cent), BPCL (up 3.59 per cent), Vedanta (up 3.16 per cent), GAIL (up 2.77 per cent) and SBI (up 2.35 per cent) were the top gainers of the day while the biggest losers included Britannia (down 2.88 per cent), Indiabulls Housing Finance (down 2.78 per cent) and Coal India (down 2.61 per cent).

Zee Business's Managing Editor Anil Singhvi's Market Strategy for September 19:

Small day range for trading on Nifty stands at 10,800-10,900 while the medium and bigger ranges lie between 10,750-10,925 and 10,700-10,950.

Small day range for trading on Bank Nifty stands at 27,000-27,400 while the medium and bigger ranges lie between 26,800-27,500 and 26,700- 27,650.

Next support zone on the two indices, Nifty and Bank Nifty, lies between 10,750-10,800 and 26,700-26,800 respectively.

For Existing Long Positions:

Nifty intraday and closing stop loss 10,800.

Bank Nifty intraday and closing stop loss 27,000.

For Existing Short Positions:

Nifty intraday and closing stop loss 10,900.

Bank Nifty intraday and closing stop loss 27,500.

For New Positions:

Buy Nifty near 10,800 with a stop loss of 10,775 and target 10,875, 10,900, 10,925.

Sell Nifty 10,875-10,900 range with a stop loss of 10,950 and target 10,850, 10,825.

Buy Bank Nifty with a stop loss of 27,000 and target 27,400, 27,500.

Sell Bank Nifty in 27,400-27,550 range with a stop loss of 27,600 and target 27,200, 27,100.

No stock in F&O Ban

The put-call ratio (PCR) is at 1.02 and the volatility index (VIX) is 15.35.

Watch Zee Business Live TV

Sectors

Positive: OMC & cement buy on dips

Negative: NBFC

09:00 AM IST

EMI calculation: Should you pay or not? Anil Singhvi explains what home loan, auto loan, other borrowers should do

EMI calculation: Should you pay or not? Anil Singhvi explains what home loan, auto loan, other borrowers should do Anil Singhvi: Unless coronavirus vaccine comes, things will not improve significantly

Anil Singhvi: Unless coronavirus vaccine comes, things will not improve significantly EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps

Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps