Anil Singhvi’s Strategy September 20: Market Trend is Negative; Buy Adani Transmission Cash with Stop Loss 219

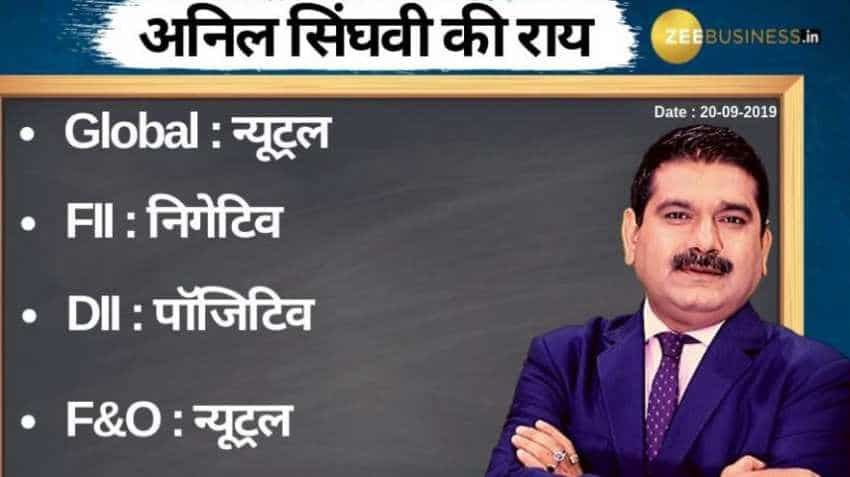

Amid positive domestic institutional investors (DIIs), neutral global market and futures and options (F&O) and negative foreign institutional investors (FIIs) cues, the short-term trend of the domestic Indian share market is going to be negative on Friday, September 20, 2019.

Amid positive domestic institutional investors (DIIs), neutral global market and futures and options (F&O) and negative foreign institutional investors (FIIs) cues, the short-term trend of the domestic Indian share market is going to be negative on Friday, September 20, 2019, while sentiment is cautious.

Earlier on Thursday, September 19, 2019, domestic equity indices closed with losses of more than one per cent amid mixed cues from global markets. Sensex at Bombay Stock Exchange plunged 470.41 points or 1.29 per cent to end at 36,093.47. Nifty at National Stock Exchange also declined 135.85 points or 1.25 per cent to settle at 0,704.80. Similarly, Bank Nifty fell by 415 points or 1.53 per cent and closed at 26,757.65.

Zee Business's Managing Editor Anil Singhvi's Market Strategy for September 20:

Next important support zone on Nifty 10,600-10,650 and Bank Nifty 26,500-26,650.

Small day range for trading on Nifty stands at 10,650-10,800 while the medium and bigger range lies between the mark of 10,625-10,825 and 10,600-10,850.

Small day range for trading on Bank Nifty lies between 26,650-27,000 and 26,500-27,100.

For Existing Long Positions:

Nifty intraday and closing stop loss 10,650.

BankNifty intraday and closing stop loss 26,650.

For Existing Short Positions:

Nifty intraday stop loss 10,800 and closing stop loss 10,850.

BankNifty intraday stop loss 27,000 and closing stop loss 27,200.

For New Positions:

Buy Nifty near 10,700 with a stop loss of 10,625 and taregt 10,750, 10,800, 10,825.

Sell Nifty in 10,825-10,850 range with a stop loss of 10,900 and target 10,750, 10,700.

Buy Bank Nifty with a stop loss of 26,500 and target 26,950, 27,050, 27,125.

Sell Bank Nifty in 27,000-27,100 range with a stop loss of 27,200 and taregt 26,800, 26,650.

No stock in F&O Ban

The put-call ratio (PCR) is at 1.04 and the volatility index (VIX) is 15.55.

Stock of the Day:

Buy Adani Transmission Cash: Stop loss 219 and target 225, 228. Qatar Fund may invest in Rs3000-4000 Crore in the company.

Aaj Ka Hero:

Buy Axis Bank Futures: Stop loss 632 and target 645, 650. Mega QIP launched by Axis, floor price Rs. 661.50

09:06 AM IST

Anil Singhvi: Unless coronavirus vaccine comes, things will not improve significantly

Anil Singhvi: Unless coronavirus vaccine comes, things will not improve significantly EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend

Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day

Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day