Anil Singhvi’s Strategy September 3: Market Trend & Sentiment are Negative; Sell Eicher Motors Futures with Stop Loss 16,400

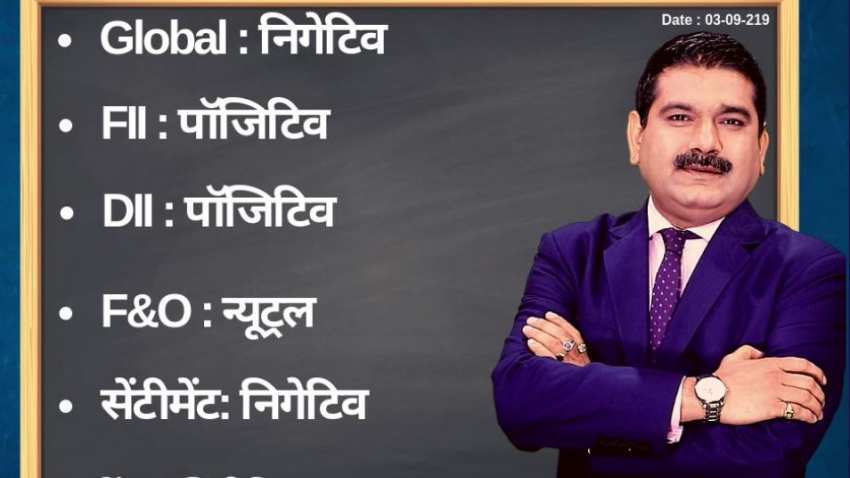

On account of positive DII, FIIs, neutral F&O and negative global cues, the short-term trend of the domestic Indian markets will be negative, says Zee Business Managing Editor Anil Singhvi.

Amid positive domestic institutional investors (DIIs) and foreign institutional investors (FIIs), neutral futures and options (F&O) and negative global market and sentiment cues the short-term trend of the domestic Indian markets will be negative on Tuesday, September 3, 2019.

Earlier on Friday, August 30, 2019, the domestic stock market bounced back amid reports that finance minister Nirmala Sitharaman met chiefs of public sector lenders. On the day, the barometer index, the S&P BSE Sensex, rose 263.86 points or 0.71 per cent to 37,332.79. The Nifty 50 index rose 74.95 points or 0.68 per cent to 11,023.25 while Bank Nifty gained 122.65 points or 0.45 per cent to settle at 27,427.85.

See Zee Business Live TV streaming below:

Zee Business's Managing Editor Anil Singhvi's Market Strategy for September 3:

Weak GDP numbers, Auto sales and GST collections below Rs1 lakh crore are a big negative.

Small day range for trading on Nifty stands at 10,925-11,000 while the medium and bigger ranges lie between 10,875-11,050 and 10,750-11,100.

Small day range for trading on Bank Nifty stands at 27,125-27,400 while the medium and bigger ranges lie between 26,950-27,500 and 26,850-27,600.

Next support range in the two indices, Nifty and Bank Nifty, lies between 10,700-10,750 and 26,850-26,950 respectively.

For Existing Long Positions:

Nifty intraday stop loss 10,875 and closing stop loss 10,950.

Bank Nifty intraday stop loss 27,100 and closing stop loss 26,950.

For Existing Short Positions:

Nifty intraday and closing stop loss 11,050.

Bank Nifty intraday and closing stop loss 27,500.

For New Positions:

Sell Nifty with a stop loss of 11,050 and target 10,925, 10,875, 10,800.

Sell Bank Nifty with a stop loss of 27,600 and target 27,125, 26,950, 26,850.

The put-call ratio (PCR) is at 1.38 and the volatility index (VIX) is 16.28.

No stock in F&O Ban

Stock of the Day:

Sell PNB Futures: Stop loss 66 and target 63, 61.5, 60. PSU Bank merger is a big negative for PNB.

Sell Eicher Motors Futures: Stop loss 16,400 and target 16,050, 15,900, 15,700, 15,500. Monthly Auto Sales Number is weaker than estimates.

Aaj ka Hero:

Sell Canara Bank Futures: Stop loss 225 and target 212, 205, 200. PSU Bank merger is a big negative for Canara Bank.

Sell IOC Futures: Stop loss 124 and target 119, 117, 115. A possible merger with BPCL is a big negative

09:05 AM IST

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend

Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day

Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day Stock Market: Sensex, Nifty pare early morning gains; Axis Bank, Coal India, MMTC shares gain

Stock Market: Sensex, Nifty pare early morning gains; Axis Bank, Coal India, MMTC shares gain