Banks will easily pass on rate cut to customers due to liquidity surplus: Prashant Kumar, MD & CFO, SBI

Prashant Kumar, Managing Director & CFO, SBI told Zee Business TV, ''The rate cut of 25 bps in interest rates was expected from RBI in this monetary policy. Also the change in stance from 'neutral' to 'accomodative' is quite positive for the economy.

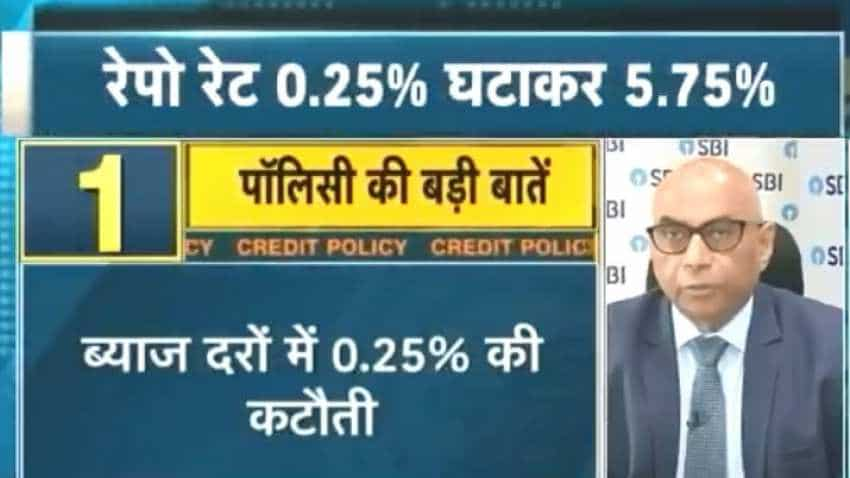

The Reserve Bank of India (RBI) on Thursday announced a rate cut in key policy rates by 25 basis points. It is for the third consecutive time the apex bank has done this in its MPC. Key interest rate (Repo rate) at which the RBI lends to the banks, will now be 5.75%, which was 6% earlier. The central bank has also changed its stance to ‘accommodative’ from ‘neutral’.

Prashant Kumar, Managing Director & CFO, SBI told Zee Business TV, ''The rate cut of 25 bps in interest rates was expected from RBI in this monetary policy. Also the change in stance from 'neutral' to 'accomodative' is quite positive for the economy, though it wasn't expected at all. The liquidity position of the banks has also improved a lot. The deficit liquidity has now been changed to surplus liquidity of Rs 1 lakh crore, which will make it easier for the banks to pass on the rate cuts to customers. SBI has already taken initiatives in this direction, with a reduction of 10 bps in MCLR. Also our one third of the loan book serves 8.25% rate, which is a rate cut of 30 bps already."

Most economists in the nation had expected a cut of 25 bps. The rate cut call came after the central bank’s Monetary Policy Committee (MPC) concluded its second bi-monthly monetary policy review for 2019-20. The decision of the rate cut was unanimous. In a statement posted on the central bank’s website, the RBI said the MPC has noted that growth impulses weakened significantly as reflected in a further widening of the output gap compared to the April 2019 policy.

“Risks around the baseline inflation trajectory emanate from uncertainties relating to the monsoon, unseasonal spikes in vegetable prices, international fuel prices and their pass-through to domestic prices, geo-political tensions, financial market volatility and the fiscal scenario," the RBI policy statement said.

The MPC revised both its growth and inflation forecasts for the current fiscal. GDP Growth has been revised downwards to 7% from the earlier projection of 7.2%. The MPC expects growth in the range of 6.4-6.7% in the first half of FY20 and 7.2-7.5% in the second half.

04:14 PM IST

SBI Life COVID-19 death claim: Useful coronavirus tips to make SBI Life Insurance claim

SBI Life COVID-19 death claim: Useful coronavirus tips to make SBI Life Insurance claim  OnlineSBI: SBI fixed deposit (FD) interest rate cut by up to 50 bps; check sbi.co.in for latest details

OnlineSBI: SBI fixed deposit (FD) interest rate cut by up to 50 bps; check sbi.co.in for latest details SBI interest rates on loans slashed by whopping 75 bps, passes on entire RBI repo rate cut to borrowers

SBI interest rates on loans slashed by whopping 75 bps, passes on entire RBI repo rate cut to borrowers Withdraw cash without your SBI debit card, ICICI Bank debit card

Withdraw cash without your SBI debit card, ICICI Bank debit card SBI business opportunity for you: Earn this much money every month, plus big allowance

SBI business opportunity for you: Earn this much money every month, plus big allowance