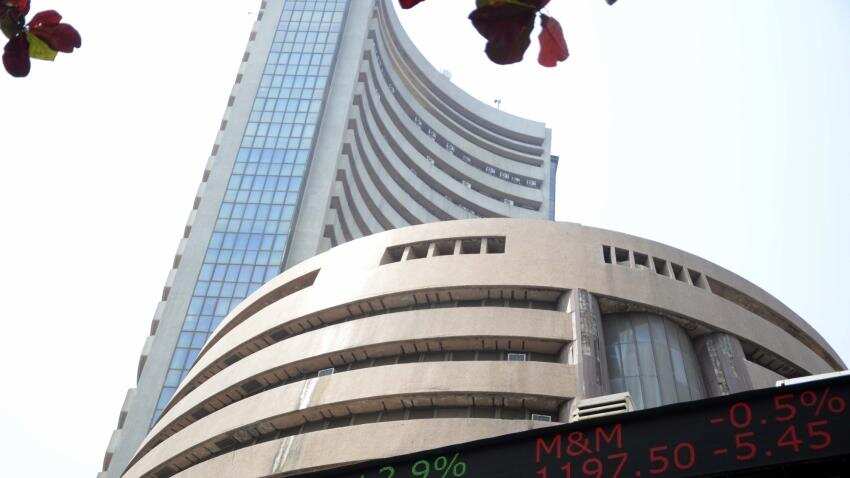

BSE brokers seek clarity from SEBI over commission paid by mutual funds

Forum said that the commission of 12 basis points is exclusive of statutory charges. The inclusion of service tax in the 12 basis point brokerage is killing the industry as the margins are wafer thin and from June 1, the rise of 50 basis points in service tax will further dent the margins, said Siddharth Shah, President of the BSE Brokers Forum in the letter.

#BaazaarKiBaat: Zee Business' #BandKaroBazaar campaign gets support from market expert Deena Mehta - What she said

#BaazaarKiBaat: Zee Business' #BandKaroBazaar campaign gets support from market expert Deena Mehta - What she said How Zee Business BSE Bull Run started? BSE MD & CEO Ashish Chauhan explains

How Zee Business BSE Bull Run started? BSE MD & CEO Ashish Chauhan explains Zee Business BSE Bull Run: Markets will run on Budget Day, says Ramesh Damani

Zee Business BSE Bull Run: Markets will run on Budget Day, says Ramesh Damani Zee Business BSE Bull run: Sakshi Subhash Pawar wins in women's category, Rajshree Salunkhe runner-up

Zee Business BSE Bull run: Sakshi Subhash Pawar wins in women's category, Rajshree Salunkhe runner-up Zee Business BSE Bull run: Indian Army's Gurjant Bhullar wins in Men's category

Zee Business BSE Bull run: Indian Army's Gurjant Bhullar wins in Men's category