BSE, NSE fall 1.6%; five key takeaways

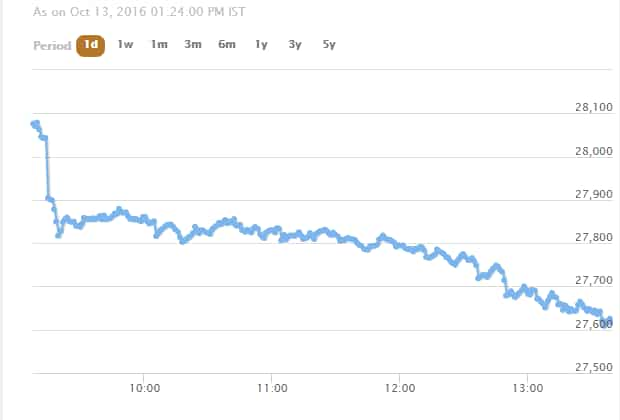

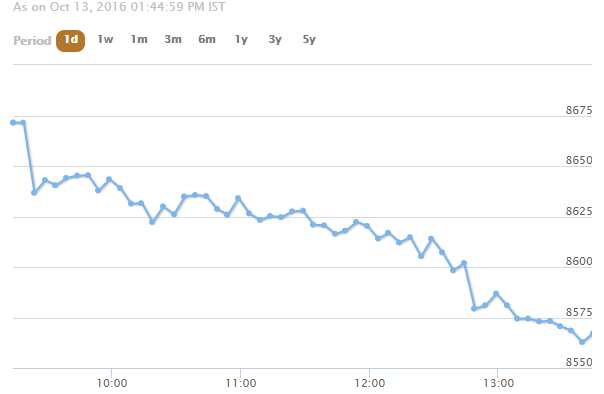

At 1.05 pm, Sensex was trading at 27,657.70 points, down 424.64 points or 1.51%. While NSE Nifty 50 tumbled 124.55 points or 1.43% to 8584.25 points.

Indian markets fell sharply on Thursday after remaining shut over the past two days.

At 1.05 pm, Sensex was trading at 27,657.70 points, down 424.64 points or 1.51%.

While NSE Nifty 50 tumbled 124.55 points or 1.43% to 8584.25 points.

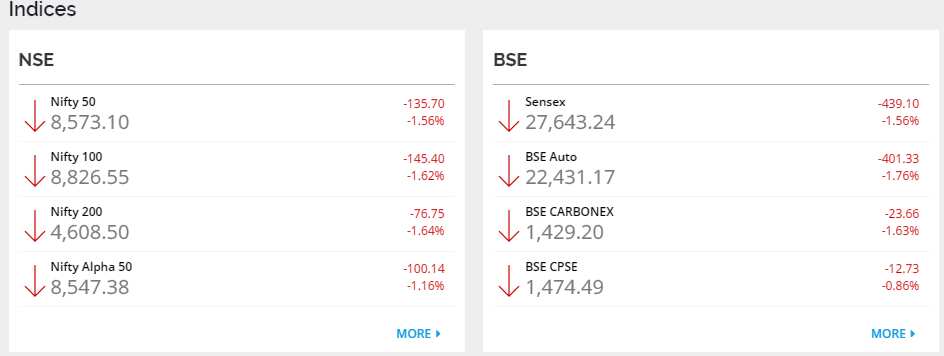

BSE recorded 5 shares advancing and 25 declines and NSE stood at 7 advances and 44 declines.

Other NSE and BSE also tumbled on Thursday trading session.

Five key things:

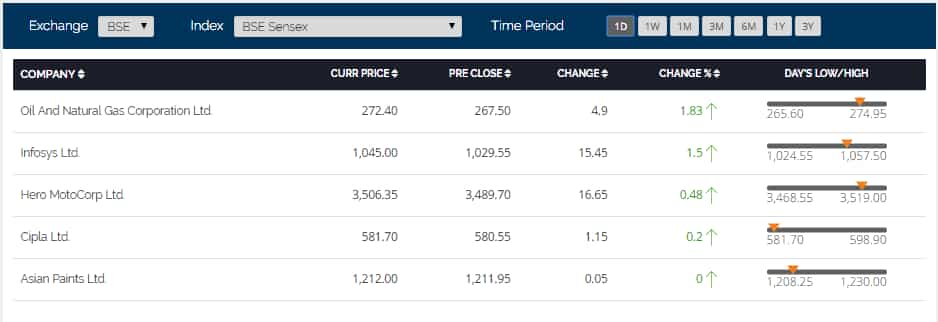

1. Top gainers on BSE were:

Investors were optimistic over Infosys which is scheduled to announce its second quarter performance on Friday while Cipla surged on receiving EIR from US FDA over its Indore Factory.

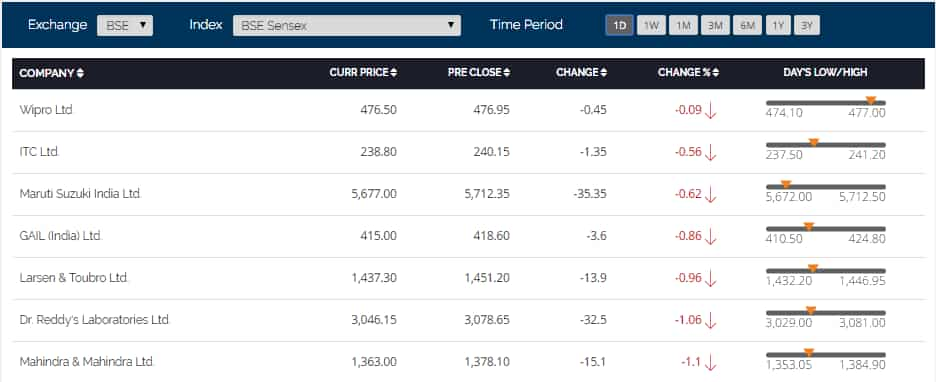

2. Top losers were:

Tata Consultancy Services (TCS) lost 1.64% or Rs 39.40 to Rs 2341 per share, ahead of earnings.

3. Global markets:

Asian shares slumped as US Federal Reserve Policy meeting indicated an increase in interest rates in a December may be on the cards.

Following this, Nasdaq ended its day on a negative note, down 0.15% and FTSE 100 fell by 0.67%, at Wednesday's closing.

Japan’s Nikkei was below 0.39%, while Hong Kong’s Hang Seng was down 1.53%. China’s Shanghai SE Composite Index was above 0.09%.

Also, China's export data disappointed investors sentiments and increased concerns over the world’s second-largest economy.

4. Sector-wise performance

BSE suffered losses on various sector - Realty taking the lead by trading at 1511.35 down by 2.77%, followed by metal index at 10410.38 (2.57%), BANKEX at 22122.72 (2.56%) and consumer durables at 13008.39 (2.17%)

While sectors on NSE declined were - Media stocks at 3,011.95 below 3.65%, Nifty Bank at 18,917.60 (2.38%), Realty stocks declined by 3.29% and metal index at 2,637.10 down by 2.70%.

All PSU banks sinked on NSE index. The Nifty PSU bank index sinked by 3.90%, trading at 3,061.55.

5. Market Capitalisation:

Sensex market cap declined by nearly Rs 67,000 crore to Rs 0.46 lakh crore compared to Rs 1.13 lakh crore of the last week.

02:24 PM IST

Coronavirus impact on investor wealth: Rs 19.49 lakh cr wiped out in 4 days of share market mayhem

Coronavirus impact on investor wealth: Rs 19.49 lakh cr wiped out in 4 days of share market mayhem Share market: Sensex tanks over 1,100 points, Nifty 335 over Coronavirus fears

Share market: Sensex tanks over 1,100 points, Nifty 335 over Coronavirus fears Share market today: Sensex drops over 200 pts; Nifty near 11,600

Share market today: Sensex drops over 200 pts; Nifty near 11,600 What are penny stocks and 5 reasons why you shouldn't buy them - Explained

What are penny stocks and 5 reasons why you shouldn't buy them - Explained These factors to drive Sensex this week; check Inflation data, Q3 earnings and other key market drivers

These factors to drive Sensex this week; check Inflation data, Q3 earnings and other key market drivers