Budget 2020 MyPick: This real estate share can hit Rs 970 from Rs 840 level soon, say stock market experts

Budget 2020 MyPick: Expecting liquidity window for the real estate sector in Budget 2020 (#BUDGET2020ZEE), stock market experts have bet high on Phoenix Mills.

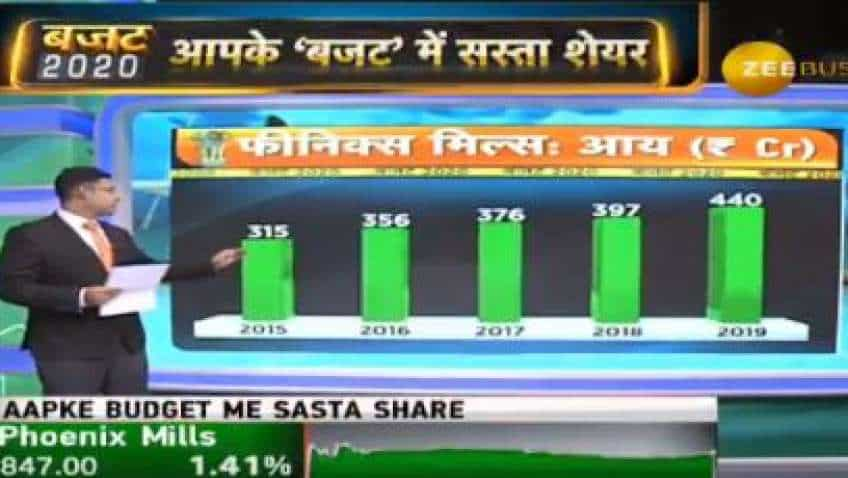

Budget 2020 MyPick: On account of the likelihood of liquidity window getting opened for the real estate sector in Budget 2020 (#BUDGET2020ZEE), stock market experts have bet high on Phoenix Mills. According to them, Phoenix Mills has been showing growth with an upward trajectory since 2018 and it's rental income ix expected to remain in the range of 14-15 per cent per annum in the next three years. Phoenix Mills is the largest mall developer in India and it is going to open its one more mall in Lucknow in February this year, which will further help the real estate company to increase its rental income.

Highlighting on the fundamentals of Phoenix Mills, Zee Business TV research team said, "Phoenix Mills is the largest mall maker in India and it has a strong grip in the commercial real estate segment. In fact, the real estate company has reported 64 per cent growth in its income in Q2FY20, which is huge, especially when we look at the performance of the real estate sector in recent years."

See Zee Business Live TV streaming below:

Zee Business show further reported that the real estate sector is facing an acute liquidity crisis and Finance Minister Nirmala Sitharaman is expected to announce some liquidity window for the real estate sector. Once that window is announced, the Phoenix Mills share price is expected to hit Rs 970 per stock levels from its current Rs 840 per stock levels. the HSBC has given the target of Rs 970 for Phoenix Mills shares after the budget 2020 is presented.

In the last one month, Phoenix Mills shares have been oscillating around Rs 840 per stock levels, but in this period Phoenix Mills shares have made a high of Rs 895.65 while it made a low of Rs 818.80 per stock levels. So, in the last one month, the Phoenix Mills shares have made a range of Rs 815 to Rs 895 and if it further goes down to around Rs 830 per stock levels, it can be a good share to buy ahead of budget 2020.

03:58 PM IST

Budget 2020 MyPick: This share can give whopping returns in long-term, says Nirmal Bang stock expert Rahul Arora

Budget 2020 MyPick: This share can give whopping returns in long-term, says Nirmal Bang stock expert Rahul Arora Budget 2020 MyPick: Hot Stock Tip! Market experts recommend a 'Buy' for BPCL stock

Budget 2020 MyPick: Hot Stock Tip! Market experts recommend a 'Buy' for BPCL stock  Budget 2020 MyPick: Go for Cummins India, this expert tells investors

Budget 2020 MyPick: Go for Cummins India, this expert tells investors Budget MyPick: Here is the share Enoch Ventures' CEO Vijay Chopra is putting his money on

Budget MyPick: Here is the share Enoch Ventures' CEO Vijay Chopra is putting his money on Budget 2020 My Pick: Keep an eye on this chemical stock for great returns

Budget 2020 My Pick: Keep an eye on this chemical stock for great returns