Deputy RBI Governor Viral Acharya: Modi brings back focus on banks' NPA issue?

Considering Acharya's major interest, does that mean with his appointment the Modi-led government once again shifts its focus on bank's long hanging stress – 'the bad loans'?

Viral V Acharya on Wednesday was appointed as the deputy governor of Reserve Bank of India (RBI). The post fell vacant after Urjit Patel was elevated as the governor of RBI in early September after Raghuram Rajan's three-year term ended.

Acharya is an economic professor in the New York University Stern School of Business (NYU Stern) and his research interest lie in banking, credit risk, asset pricing, liquidity risks and many other financial institutions.

In an interview with Bloomberg on October 10, 2016, Acharya raised the non-performing assets (NPA) issue currently plaguing banking sector in the country.

He had said, “A bad bank solution is what India needs to stop the bad loan wound from festering further.”

Interestingly, this is an idea that is resonating well with current RBI Governor Urjit Patel as well.

Soon after his appointment, in October 2016, a senior government was quoted by the Indian Express as stating that the idea of a "bad bank" may be back on the table.

Ex-Governor Rajan was against such an idea.

Considering Acharya's major interest, does that mean with his appointment the Modi-led government once again shifts its focus on bank's long hanging stress – 'the bad loans'?

Bad loans have been a bitter part of Indian banks' story for a few years now.

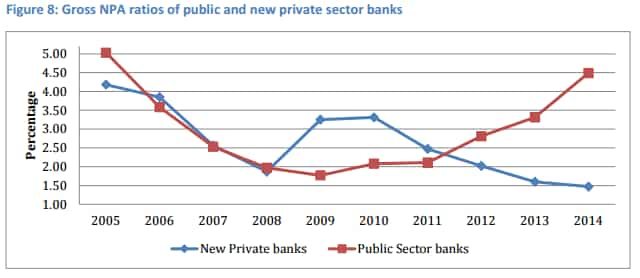

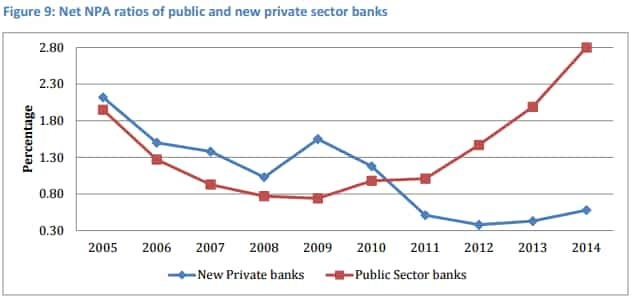

Since past few years, RBI, under Rajan's stewardship, has been resolving mounting bad loan issue. Public Sector Banks (PSBs), in particular, are presently suffering with high NPA issue, higher provisions, sluggish growth in credit off-take.

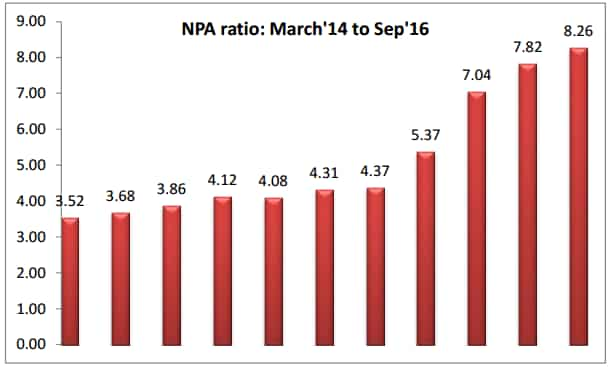

Date released by RBI stated that bad loans have crossed $ 138 billion (approx Rs 8.72 lakh crore) in June 2016, a rise of 15% in just six months.

An analysis of 18 PSBs made by Care Ratings revealed that the NPA ratio was as high as 14.5% in September 2016.

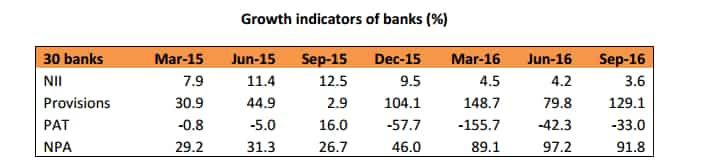

Till second quarter of current fiscal (Q2FY17), a total of 30 Indian banks had a negative profit after tax (PAT), saw slowdown in Net Interest Margin (NIM), and reported higher provisions and NPAs.

Though in Q2, the NPAs slowed down, yet its needs deep modification to resolve as it remains higher compared to March 2015 quarter.

Acharya has constantly spoken about the bad loan crisis. In one of his research reports dated June 2015, he said, "Most of the ills of the PSBs can be singularly traced back to its asset quality, as they are forced to lend at nonoptimal conditions for various non-viable private projects, welfare schemes and also to other public enterprises.”

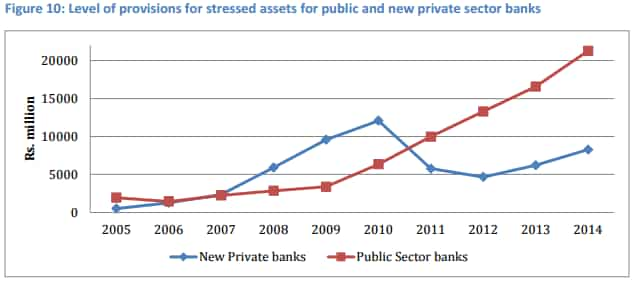

PSBs and new private banks were in a similar position in 2005. However, since then, new private banks strengthened their credit portfolio and reduced NPAs while PSBs have showed a huge increase in NPAs.

To account for stressed NPAs, banks maintain higher provisions.

Acharya had said, "Unless Indian public sector banks raise significant capital in the next five years, their balance sheets would have to shrink alarmingly for their capital to remain over the levels mandated by Basel 3 requirements."

Acharya told Bloomberg, "PSBs which receive a big chunk of the deposit savings in the economy, are not lending well at all. They are rolling over bad loans, a big chunk of their assets is stuck in the restructured category."

On consolidation move of smaller banks into larger banks for curbing bad loans, he said, "Historically any bank distress in India has been resolved by mergers. Banks in India haven’t typically failed except for small banks here and there. But the trouble is that a public sector bank cannot under the current statute be sold to a private sector bank."

A Credit Suisse report stated that it expects the overall ratio of impaired assets to rise from 12% to over 16%. This indicates the bad loans will continue to haunt banks.

With this idea to create a 'bad loan bank' to solve the NPA issue, what direction will RBI take under leadership of Urjit Patel will be interesting to watch.

03:06 PM IST

Viral Acharya's resignation: RBI union moots collegium of experts to select governors, deputy governors

Viral Acharya's resignation: RBI union moots collegium of experts to select governors, deputy governors Why RBI deputy governor Viral Acharya resigned: Here's official RBI response

Why RBI deputy governor Viral Acharya resigned: Here's official RBI response RBI deputy governor Viral Acharya resigns, may return to the US: Sources

RBI deputy governor Viral Acharya resigns, may return to the US: Sources Urjit Patel quits in shock move! Viral Acharya next?

Urjit Patel quits in shock move! Viral Acharya next? RBI vs Centre: Urjit Patel in spotlight, markets on watch

RBI vs Centre: Urjit Patel in spotlight, markets on watch