Even without El-Nino possibility, these factors may keep inflation at 5%

Michael Debabrata Patra, member of MPC, in minutes of meeting of the RBI policy meet said, "True to projections made at the time of the last meeting of the Committee, inflation is turning up. It seems to me that it is coming out of the U-shaped compression imposed by demonetisation and is now positioned on the rising slope. Several factors merit pre-emptive concern."

Although Indian Meteorological Department (IMD) shrugged off uncertainties by stating this monsoon would be normal, there are other factors that haunt India's consumer price index (CPI) inflation.

IMD, on April 18, said this year's monsoon is set to be normal. It said that monsoon rainfall may be 96% of the normal with an error margin of 5% on either side. However, IMD said, “There are more than 50% chance of El-Nino developing from August.”

Last month, Skymet Weather predicted a below normal monsoon this year at 95% of the long period average (LPA) of 887 mm (89 cm) for the four-month period from June - September.

Reserve Bank of India (RBI), in its first bi-monthly monetary policy this year, said, “The main one stems from the uncertainty surrounding the outcome of the south west monsoon in view of the rising probability of an El Niño event around July-August, and its implications for food inflation.”

Recently, a Motilal Oswal report said, "While the forecast is not as optimistic as last year, the prediction of normal monsoon is a welcome sign, considering that agriculture in India is heavily dependent on rains and that June-September monsoon accounts for ~70% of annual rainfall. While good rainfall aids crop production and thus agricultural gross value added (GVA), there is no direct correlation of monsoon with food inflation."

RBI has been pointing out at various risks as reasons for keeping policy rates unchanged.

Michael Debabrata Patra, member of MPC, in minutes of meeting of the RBI policy meet said, "True to projections made at the time of the last meeting of the Committee, inflation is turning up. It seems to me that it is coming out of the U-shaped compression imposed by demonetisation and is now positioned on the rising slope. Several factors merit pre-emptive concern."

source: tradingeconomics.com

As per ministry of of Statistics and Programme Implementation (MOSPI) data, CPI inflation in March 2017 stood at 3.81% compared to 3.65% in February and 3.17% in January.

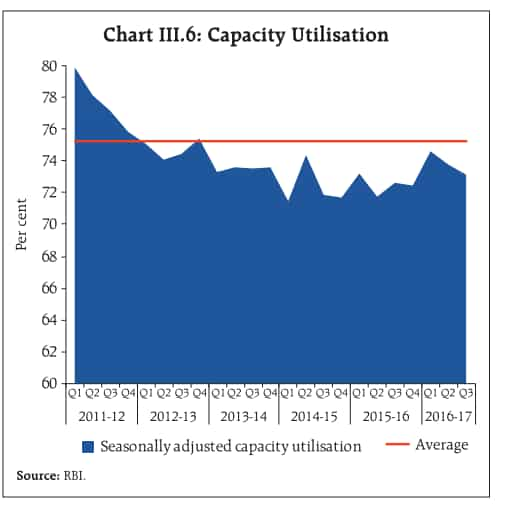

Capacity Utilisation:

Dr Ravindra H. Dholakia Deputy Governor of RBI said, "The capacity utilisation in industries has remained persistently low indicating at least continuing, if not widening, output gap.

He added, "Against this, the headline inflation has been substantially below 4% largely on account of vegetables and pulses. Inflation excluding food and fuel (core inflation) has been fairly sticky though has marginally declined to 4.8% in February."

Since financial year 2013-14 till now, seasonally adjusted capacity utilisation has remained below average. This has indicated weak demand and raising concerns on the sustainability of the recent pick-up in private investment.

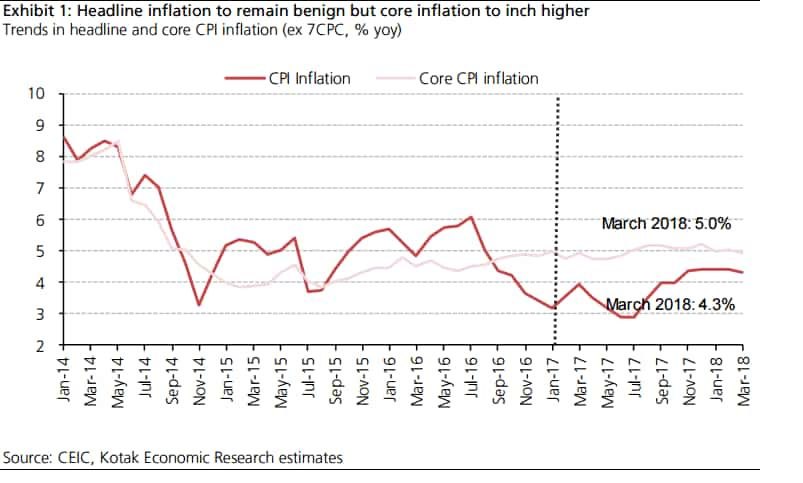

Core Inflation:

Core Inflation has been the cause of concern for quite sometime now for RBI. Core WPI, which sequentially eased in 4.8% in February, CPI core inflation excluding gasoline items was unchanged at 4.4% in March month.

Dholakia said, " The core inflation according to my calculations is likely to show a declining trend over the year. Moreover, the dynamics of pass-through from the non-core to the core inflation is changing such that volatility in the food/fuel prices would penetrate into core less easily than before."

ICICI Bank in its report said, "As stickiness in core inflation has been a cause of concern and will be watched going ahead to assess the sustainable achievement of the 4% medium term target. We believe the focus on medium term inflation, rising global yields and global political uncertainty implies that further easing is unlikely in the near term."

Analysts at Kotak Institutional Equities expects a 70 basis point difference between CPI and core inflation by end of FY18.

Led by adverse base effect and the narrowing of output gap, Kotak expects core inflation to remain sticky and inch up to an average of 5.1% in FY2018 from 4.7% in FY2017.

7th Pay Commission and GST roll out:

RBI feels there is a prominent risk from the implementation of the allowances recommended by the 7th Pay Commission (CPC).

7th CPC has recommended increase in house rent allowance and RBI expects this to push up the baseline trajectory by an estimated 100-150 basis points over a period of 12-18 months, with this initial statistical impact on the CPI followed up by second-order effects.

While for GST, RBI said, "Another upside risk arises from the one-off effects of the GST. The general government deficit, which is high by international comparison, poses yet another risk for the path of inflation, which is likely to be exacerbated by farm loan waivers."

However, Michael Debabrata Patra another member of MPC said, "Effect of the GST - small relative to the 7th pay commission and short lived, it could still last a year and push up inflation."

Normura in its report said impact of GST will be minimal less than 20 basis point on inflation in near term.

Hence, RBI expects inflation is projected to average 4.5% in the first half of the year and 5% in the second half of FY18.

03:43 PM IST

Is Indian economy better prepared to deal with COVID-19 than it was during 2008 Global Financial Crisis?

Is Indian economy better prepared to deal with COVID-19 than it was during 2008 Global Financial Crisis? Three-month home loan EMI waiver hailed by realty sector; what they said

Three-month home loan EMI waiver hailed by realty sector; what they said Have EMIs to pay? WAIVER relief for home loan, auto loan takers! No need to pay for 3 months

Have EMIs to pay? WAIVER relief for home loan, auto loan takers! No need to pay for 3 months Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps

Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps RBI Repo Rate cut announced; EMI payment delay to loan rates, check top 5 takeaways

RBI Repo Rate cut announced; EMI payment delay to loan rates, check top 5 takeaways