Five public sector banks account for nearly half of non-performing assets

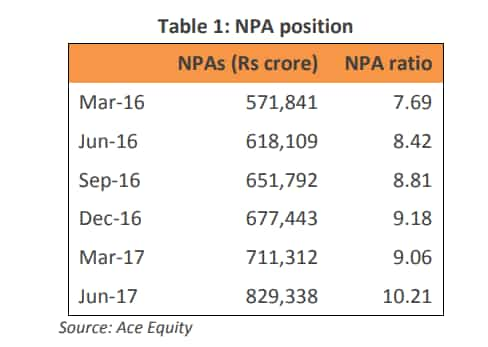

NPA problem of banks have worsen further during Q1FY18. Banks have seen sharp rise of 34% year-on-year and nearly 17% quarter-on-quarter rise in NPAs.

Key Highlights:

- NPAs of 38 banks at Rs 829,335 crore in Q1FY18

- SBI accounts for 23% of total NPAs

- Top five PSBs holds over 47% of total NPAs

Bad loans has resulted in higher provisions, deterioration in asset quality, higher slippages and thus lower earnings for banks -- not to forget their future lending is at stake.

A total of 38 banks have presented their financial performance for the quarter ended June 30, 2017 (Q1FY18) and the NPA numbers look scary.

On year-on-year (YoY) basis, these banks have seen a sharp rise of 34.17% to Rs 8,29,335 crore compared to Rs 6,18,109 crore in the corresponding period of the previous year.

NPA ratio which stood at 8.42% in June 2016 have now peaked to 10.21% in Q1FY18.

Also, this would be the highest rise of 115 basis points between April – June 2017 as against contraction of 12 basis points between January – March 2017 and rise of 37 basis points between October – December 2016.

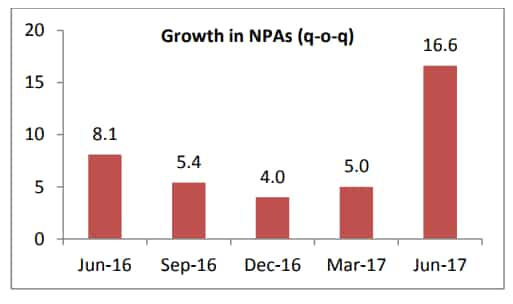

Meanwhile, on quarter-on-quarter (QoQ) basis, NPAs have been highest in Q1FY18 witnessing an double-digit increase of about 16.6% in comparison with Rs 7,11,312 crore of the preceding quarter.

In percentage terms, NPAs qoq growth has been single-digit in previous quarters. It stood at 5% in March 2017, 4% in December 2016, 5.4% in September 2016 and 8.1% in June 2016.

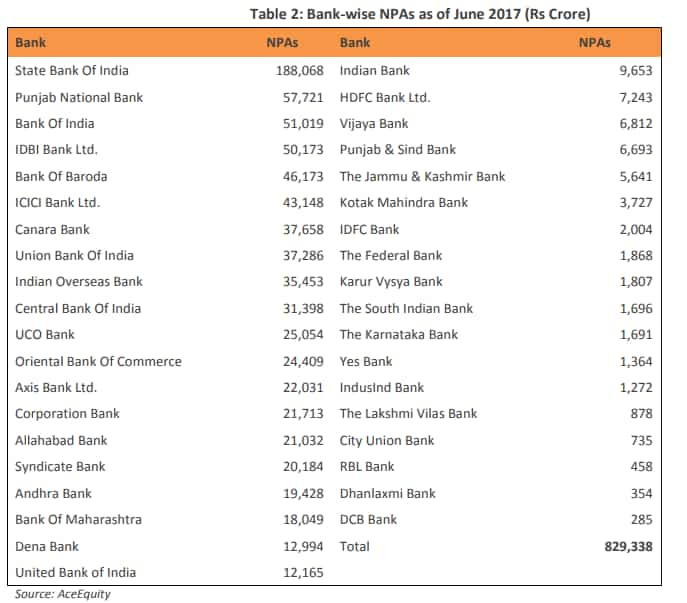

Under bank-wise performance, State Bank of India accounts for largest share of about 22.75 in total NPAs of 38 banks. The banks NPA stood at Rs 188,068 crore as June 2017 post merger with five associates and Bharatiya Mahila Bank.

Five public sector banks (PSBs) namely SBI, Punjab National Bank, Bank of India, IDBI Bank and Bank of Baroda (BoB) bagged the top five spots in highest NPA. Together they accounted a share of 47.4% totalling up to Rs 3,93,154 crore.

11 of the top 12 banks in terms of NPAs were of PSBs with the exception being ICICI Bank which has NPA of Rs 43,148 crore as on June 2017. Out of the 38 banks – 20 banks had NPA higher than Rs 10,000 crore – most of them PSBs.

ICICI Bank and Axis Bank (Rs 22,031 crore) are the only private sector banks in the top 15 with a combined share of 7.9% in the total NPAs

Things were looking positive after the December numbers, as banks were asked to recognise their NPAs under the Asset Quality Review (AQR) by end of March 2017 - leaving better room for resolution of the problem.

According to Care Ratings, the NPA reconciliation process was to be completed by March 2017; however NPAs continue to be high as of June 2017. This may be on account of two factors – the NPA reconciliation process is still going on and New (incremental) NPAs are still being generated.

RBI itself thinks that NPAs of banking universe will go up by end of March 2018. Also India Ratings earlier stated that banks have been sitting on unrecognised stressed loans worth Rs 7.7 lakh crore including both corporates and SME debt – which holds 22% of total bank credit.

Various measures have been attempted by RBI the latest one would be to address this issue with the Insolvency & Bankruptcy Code (IBC) where some of the larger NPAs have been identified for speedy resolution. The outcome would be known in course of time.

Last month, an Assocham study stated that RBI might take up the “bad loans worth over Rs 8 lakh crore” for resolution by March 2019.

It has been very clear that RBI cannot tackle the badloans problem alone. Fitch Ratings said, “RBI will not be able to address problems in the banking sector on its own. Significant efforts to resolve bad loans, for example, would leave banks in need of recapitalisation, given that haircuts and increased provisions would be required. State banks are generally in a poor position to raise new capital, which makes them largely reliant on the government for recapitalisation.”

Recently, a Global Financial Stability Report released by the International Monetary Fund (IMF) highlighted that Indian banking sector comes out as worse-off compared to other emerging economies in terms of little bank capital that it has set aside to provision for losses on its assets.

Viral Acharya, Deputy Governor, Reserve Bank of India (RBI) in his study report called 'A Bank Should Be Something One Can “Bank” Upon' explained few measures like private capital raising, asset sales, divestment and many more.

ALSO READ:

02:54 PM IST

NCLT Delays force 13 banks to auction off stressed corporate loans of Rs 33,949 cr to ARCs

NCLT Delays force 13 banks to auction off stressed corporate loans of Rs 33,949 cr to ARCs PNB scam: PSBs asked to check all NPAs above Rs 50 crore for possible fraud

PNB scam: PSBs asked to check all NPAs above Rs 50 crore for possible fraud Develop a US-style online platform to sell bad loans: Acharya

Develop a US-style online platform to sell bad loans: Acharya HDFC Bank Q3 net rises 20.10% to Rs 4,642.6 crore

HDFC Bank Q3 net rises 20.10% to Rs 4,642.6 crore Fight's on: Dud assets aplenty, to keep RBI in cleansing mode in 2018

Fight's on: Dud assets aplenty, to keep RBI in cleansing mode in 2018