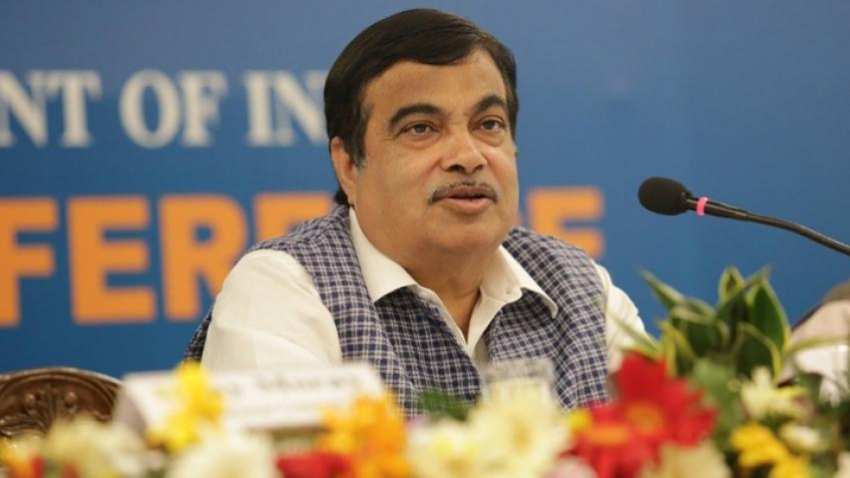

For sake of industry, job creation, Nitin Gadkari says expecting support for road projects from banks

If funding to the road developers slows down further, the Union government is likely to bid out more projects through engineering, procurement and construction (EPC) route instead of the hybrid annuity model that is being used at present.

If funding to the road developers slows down further, the Union government is likely to bid out more projects through engineering, procurement and construction (EPC) route instead of the hybrid annuity model that is being used at present.

Under the EPC model, the financial risk is significantly less for the private players as the government funds the project and provides regulatory clearances.

The private firms execute the project either directly or by subcontracting and have to complete the work within a given timeline.

Nitin Gadkari, minister of road transport and highways said that the lending towards HAM projects is slowing down.

“It is one of the problems we are facing.”

DNA Money had earlier reported that road developers are increasingly facing challenges in getting their projects financed as banks are saddled with a high number of non-performing assets.

The need for financing has become even more crucial with a slew of highway projects lined up under the ambitious Bharatmala Programme.

Earlier this year, IRB Infrastructure Developers’s chairman and managing director Virendra Mhaiskar in an earnings call had said, “It is going to be challenging to fund all the hybrid annuity model projects.”

It has been three years since HAM was brought in as EPC projects faced significant delays and cost escalation, which hurt the margins of road developers.

Even projects under build-operate-transfer were not faring well.

Under HAM, 40% of the project cost is borne by the government (paid across first five years through annual payments/annuity) and the rest can be raised by the contractor via debt or equity.

Moreover, there has been a flood of road HAM projects in a short span of time.

There are a total of 104 road projects, of which 56 are stuck due to the want of financial closure.

In 2016, there were HAM projects worth Rs 7,700 crore.

Now, the same has shot up to Rs 76,500 crore, which is nearly 50% of the overall projects awarded.

Going forward, HAM projects are expected to constitute 60% of the projects awarded by the National Highways Authority of India.

In a recent meeting with the bankers, Gadkari was told that the banking sector is ready to finance road projects, if bid out on EPC mode. Otherwise, it will be difficult to finance the contractors due to certain ‘risks’ involved.

“For the sake of the industry, investment, contractors and job creation within the economy, we are expecting positive support from the bankers. Now they are giving support, but the process is slow. I have met chairmen and managing directors of various banks and I am confident that the situation will improve in due course of time,” the minister said.

Already, several stalled road projects have been revived through various decisions, including fund infusion.

“I am expecting that they (banks) should co-operate. Otherwise, the National Highways Authority of India and we (MoRTH) don’t have any problems. I can raise money from the market, go for EPC mode. I will construct the roads. Through toll-operate-transfer mode (ToT), I will get foreign investment and get my money back. For me, it is a proven track. For the interest of the economy, I am more interested in investment of the stakeholders and contractors,” Gadkari said.

At the moment, the NHAI has come up with second TOT auction with an aim to generate a minimum of Rs 5,362 crore from eight road assets in four states of Rajasthan, Gujarat, Bihar and West Bengal.

Under TOT, in March, NHAI had received the highest bid of Rs 9,681.50 crore from Macquarie Group-Ashoka Buildcon as against the reserved bid price of Rs 6,258 crore to manage 648 km of National Highways in the states of Andhra Pradesh, Odisha and Gujarat. The first bundle of TOT was floated in December 2017.

Source: DNA Money

09:54 AM IST

Good news from NHAI for you! FASTag to be available free of charge for 15 days

Good news from NHAI for you! FASTag to be available free of charge for 15 days FASTag rules: Alert! 30-day relaxation for these 65 NHAI toll plazas - Here is why | FULL LIST

FASTag rules: Alert! 30-day relaxation for these 65 NHAI toll plazas - Here is why | FULL LIST FASTag alert! Toll Plaza coupon recharge introduced! Check how to benefit

FASTag alert! Toll Plaza coupon recharge introduced! Check how to benefit FASTag: NHAI to keep 25% hybrid lanes at 523 toll plazas

FASTag: NHAI to keep 25% hybrid lanes at 523 toll plazas FASTag: NHAI has this plan for toll plazas to ensure smooth roll-out of electronic toll collection

FASTag: NHAI has this plan for toll plazas to ensure smooth roll-out of electronic toll collection