GST Council: Annual turnover of composition scheme will be increased to Rs 2 crore

On November 10, the GST Council cut tax rates of over 175 products that were in the highest tax slab of 28% under the regime. Currently only 50 items have been left in the 28% category out of a total of 227 items that were present earlier.

The GST Council headed by Finance Ministery Arun Jaitley have decided to increase the annual turnover eligibility for the composition scheme to Rs 2 crore.

In its 23 meeting which was held in Guwahati, the GST council said, "Annual turnover eligibility for composition scheme will be increased to Rs 2 crore from the present limit of Rs 1 crore under the law. Thereafter eligibility for composition will be increased to Rs 1.5 crore per annum."

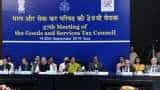

In- pic : Recommendations made by the GST Council on changes in Composition Scheme to be implemented only after necessary amendment of CGST and SGST Act pic.twitter.com/sW5qOd0lm3

— CBEC (@CBEC_India) November 10, 2017

Further the supply of services by composition tax payer up to Rs 5 lakh per annum will be allowed by exempting the same.

While the uniform rate of tax @1% under composition scheme for manufacturers and traders (for traders, turnover will be counted only for supply of taxable goods).

No change for composition scheme for restaurant.

As per the council, the changes recommended will be implemented only after necessary amendment of the CGST Act and SGST Acts.

On the changes made by the GST Council, Prime Minister Narendra Modi tweeted, "The recommendations made by the GST Council today will further benefit our citizens and add strength to the GST. These recommendations are in spirit of the continuous feedback we are getting from various stakeholders on GST."

The recommendations made by the GST Council today will further benefit our citizens and add strength to the GST. These recommendations are in spirit of the continuous feedback we are getting from various stakeholders on GST.

— Narendra Modi (@narendramodi) November 10, 2017

02:04 PM IST

GST Council Meeting: Due date for goods and service tax return filing extended; Key points that businessmen need to remember

GST Council Meeting: Due date for goods and service tax return filing extended; Key points that businessmen need to remember Stocks in Focus on December 18: Telecom Stocks, BoB and NMDC; here are the 5 Newsmakers of the Day

Stocks in Focus on December 18: Telecom Stocks, BoB and NMDC; here are the 5 Newsmakers of the Day Good news! Spending less money, driving licence to SpiceJet, how things have changed from October 1

Good news! Spending less money, driving licence to SpiceJet, how things have changed from October 1 GST Council meeting: Nirmala Sitharaman says rate on hotel room tariffs from Rs 1,001 to Rs 7,500 cut to 12%

GST Council meeting: Nirmala Sitharaman says rate on hotel room tariffs from Rs 1,001 to Rs 7,500 cut to 12% GST Council likely to recommend tax cuts on 20-25 products:

GST Council likely to recommend tax cuts on 20-25 products: