GST Rollout: This is what you will pay for movie tickets, airline & railway tickets, footwear, cab rides and mobile phones

Lets see how GST impacts your daily expenses. Purely from a taxation perspective, GST is likely to be neutral.

Key Highlights:

- Goods & Service Tax (GST) bill to be in effect from July 01, 2017

- GST tax rates are in five slabs 0%, 5%, 12%, 18% and 28%

- GST is expected to boost consumption and consumer demand

Countdown has begun for the roll out of most awaited Goods and Service Tax (GST) later today. However many are still trying to figure out how it will impact their day-to-day life.

At mid-night (12 am) today, the government will launch India's "biggest ever economic reform" GST.

Recently, Arundhati Bhattacharya, Chairperson, State Bank of India (SBI) in an interview with Zee Business said , GST will boost consumption and consumer demand

Purely from a taxation perspective, GST is likely to be neutral.

The GST council has finalised rates for 1,211 goods and 36 broad categories of services – in five slabs 0%, 5%, 12%, 18% and 28%, respectively.

Nearly 50% of goods fall under the 18% tax rate, 14% of goods fall under 5% tax rate, 17% under 12% tax rate and 19% under 28% tax rate. In case of services, the majority of services come within the 18% tax rate.

Set to be launched on July 1, here's how GST will impact your basic expenses. Or is it just myth.

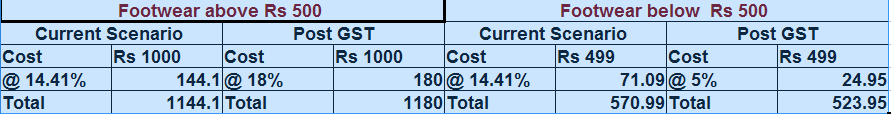

Footwear, garments:

Post the launch, footwear costing above Rs 500 will see GST rate of 18% from 14.41 of current tax rate. While below Rs 500, GST rates brought down to 5%.

Under this, footwear above Rs 500 will just face increase of Rs 35.9.

Meanwhile, ready-made garments are brought down from 18.16% to 12%- making them cheaper.

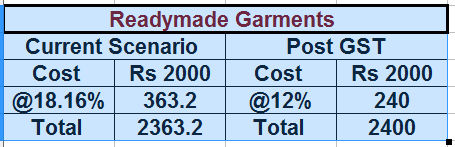

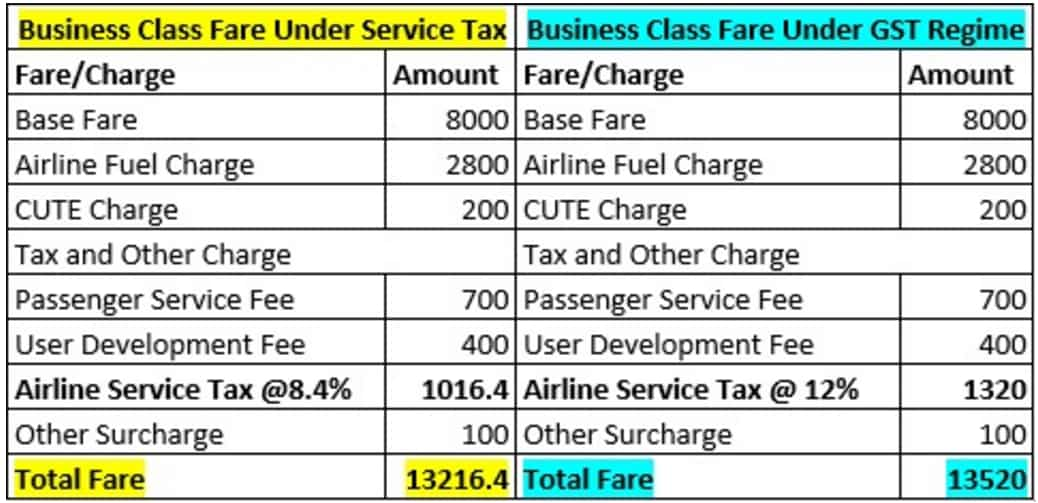

Train tickets and Airline tickets:

Where government kept GST rate of 5% for airlines economy class from previous 6%, it has increased GST rate to 12% for airlines business class from current 9% rates.

Image Source (ClearTax)

A major portion of the revenue generated from airlines comes from economy travellers - which means the air tickets will be cheaper for them.

Image Source (ClearTax)

AC and first-class train travel has been brought at 5% slab under GST from 4.5% current tax - slightly higher.

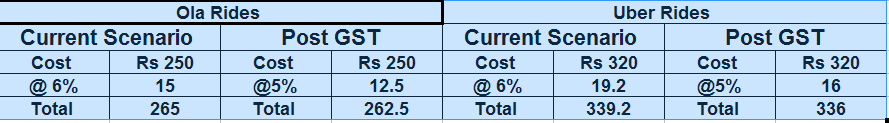

Cab rides

After GST, travelling from Ola or Uber cab will become cheaper, as the incidence of tax will come down a bit to 5% from 6% for booking made on cab aggregators like Ola, Uber, Meru Cab and Mega Cab.

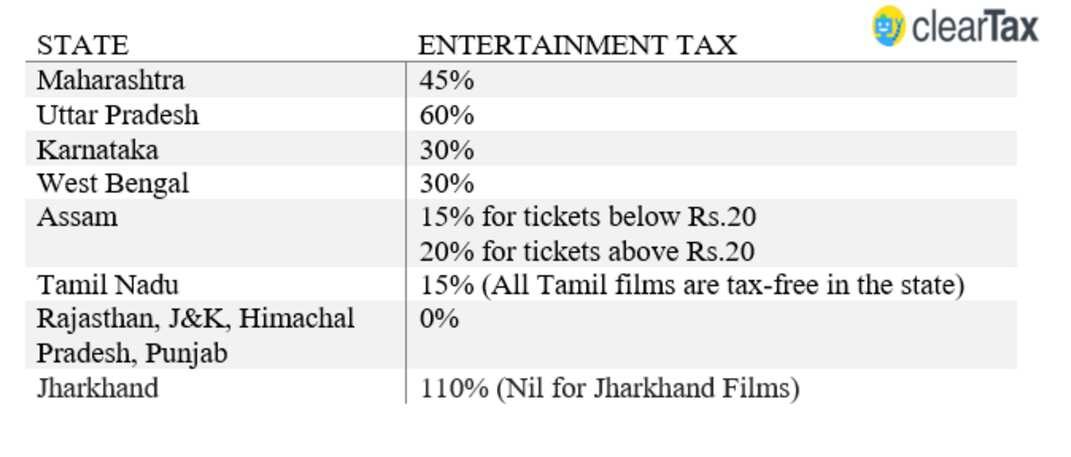

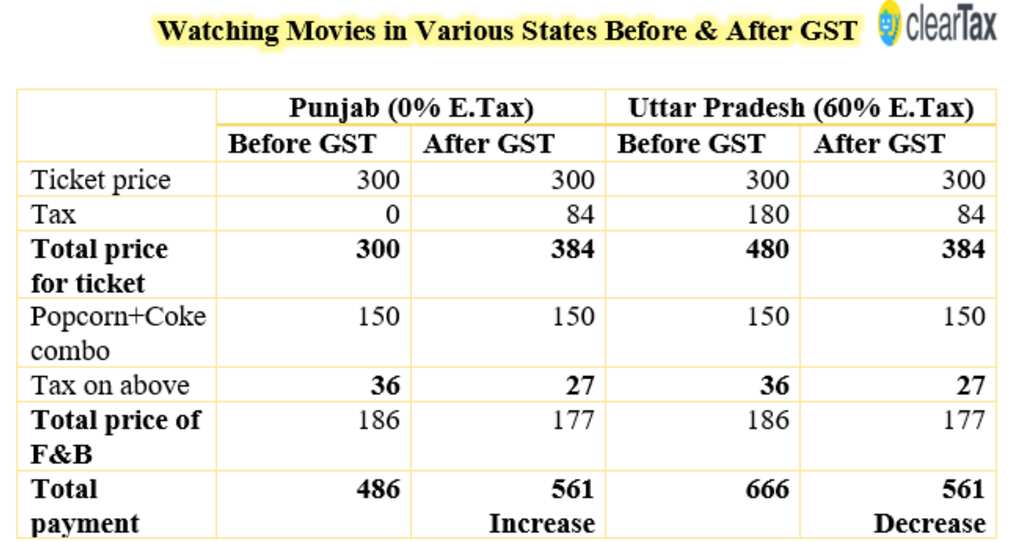

Movie Tickets

Movies ticket below Rs 100 will be taxed at a GST rate of 18% and while tickets above this will be taxed at highest tax slab of 28%.

At present, entertainment tax are levied by state government and ranges from zero to 110%.

If you are a high entertainment tax state in states like Jharkhand (110%) or Uttar Pradesh (60%), you will only pay 28% tax now, so you are going to pay much less for the ticket.

Mobile Phones:

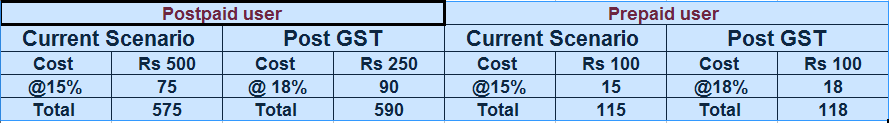

All the mobile phone users will pay 3% extra service tax for their mobile phone usage. The GST Council has put telecom services under the 18% slab from current telecom service tax of 15%.

Under this the impact is just Rs 15 in postpaid and Rs 3 in prepaid for mobile users.

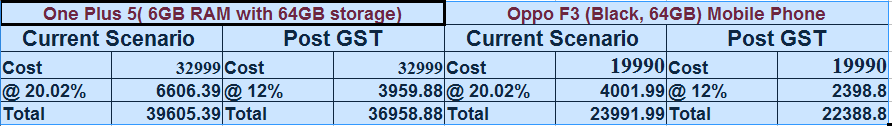

On the other hand, mobile phones are brought under GST tax slab of 12% compared to current tax rate of 20.02%.

10:01 PM IST

Yet again, Finance Minister pays heed to Zee Business Managing Editor Anil Singhvi's call, extends ITR filing deadline

Yet again, Finance Minister pays heed to Zee Business Managing Editor Anil Singhvi's call, extends ITR filing deadline Coronavirus: Big ATM cash, minimum balance, Income Tax, GST, PAN, Aadhaar announcements made by Modi government- All details here

Coronavirus: Big ATM cash, minimum balance, Income Tax, GST, PAN, Aadhaar announcements made by Modi government- All details here GST Returns Filing: New dates announced

GST Returns Filing: New dates announced  Smartphones to get expensive from April; makers seek relief from government

Smartphones to get expensive from April; makers seek relief from government 39th GST Council Meeting: Full list of decisions taken - All you need to know

39th GST Council Meeting: Full list of decisions taken - All you need to know