Has demonetisation helped India become a less-cash economy?

On November 08, PM Narendra Modi banned old Rs 500 and Rs 1000 with an objective to tackle black money, make India a cashless economy and expand the country's tax-base.

Key Highlights:

- RBI's annual report says 99% demonetised cash back in the system

- Electronic payment stood at Rs 107.48 lakh crore in July 2017

- Digital payments in India recorded 55% growth during FY17

The Reserve Bank of India's (RBI) annual report 2016-17 stated that nearly 99% of the demonetised high denomination bank notes namely old Rs 500 and Rs 1000 have been brought back to system.

Finance Minister Arun Jaitley on RBI's annual report said, “Nearly how much money comes back to the system and how much does not, that was never the real object of demonetisation.”

Demonetisation, which took place on November 08, 2016, was inked with several objectives. They were- flushing out black money, eliminate Fake Indian Currency Notes (FICN), to strike at the root of financing of terrorism and left wing extremism, to convert non-formal economy into a formal economy to expand tax base and employment and to give a big boost to digitalisation of payments to make India a less cash economy.

Jaitley stated that India is pre-dominantly high cash economy and that scenario needed to be altered towards less-cash economy.

There have been various measures taken by both the Government of India and RBI to bring down the cost of digital transactions in order to push people in operating as cash-less economy.

So has demonetisation's push towards digitalisation worked?

Although performance of electronic payment system in India has been volatile; it has definitely risen post demonetisation.

As per RBI, there are ten digital payment mode – RTGS, NEFT, CTS, IMPS, NACH, UPI, USSD, Debit and Credit cards usage at Point of Sale (PoS) and mobile banking.

Data compiled by RBI showed that total electronic payment system which stood at 67.15 crore in volume, reached to a whopping 95.75 crore in December 2016 (end of demonetisation move), further to 89.69 crore by March 2017 and to 86.24 crore by end of July 2017.

In value terms, electronic payment stood at Rs 94 lakh crore – touched Rs 104.05 lakh crore in December 2016 further to Rs record of Rs 149.58 lakh crore and halting at Rs 107.48 lakh crore in July 2017.

Explaining the rise in March 2017, Ravi B Goyal, Chairman and Managing Director, AGS Transact Technologies Limited said, “Digital transaction numbers having increased in the days’ post demonetisation showed slight decline across most channels in January and February. An upward trend was also noticed in March again part due to year-end investments and tax payments by individuals. We believe that Internet accessibility/ digital divide might be holding back digital transactions rather than behavioral issues.”

A Niti Aayog analysis showed that digital payments in India rose 55% growth in the financial year 2016-17 (FY17) compared to CAGR (compounded annual growth rate) of 28% during the five year period ending 2015 – 16.

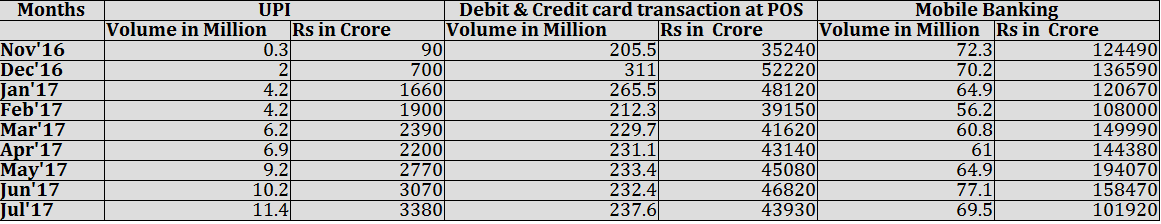

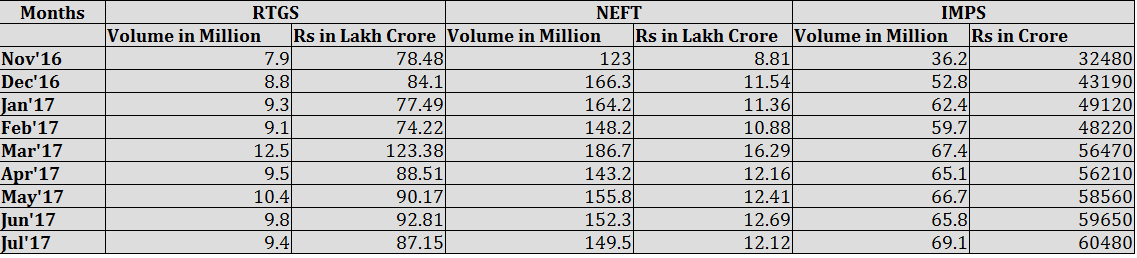

Except mobile banking, transactions at portals like Immediate Payment Service (IMPS), Unified Payment Interface (UPI) and transaction of debit & credit cards has seen consistent growth.

Government's UPI since its launch in the month of August 2016 has witnessed nearly 12 million transactions valuing up to Rs 3,380 crore as on July 2017. Volume transaction in UPI was just a 0.3 million totaling at Rs 90 crore in November 2016, jumped to 2 million (Rs 700 crore) in December 2016 and 4.2 million (Rs 1,600 crore) in January 2017.

Debit and credit card transactions at POS stood at 205.5 million (Rs 35,240 crore) in November 2016 – which later increased to 311 million (Rs 52,220 crore) in December 2016 and by end of July 2017 stands at 237.60 million (Rs 43,930 crore).

Transactions via IMPS also rose from 36.2 volume (Rs 32,480 crore) in November 2016 – to 52.8 million volume (Rs 43,190 crore) in December 2016 and now stood at whopping 69.1 million (Rs 60,480 crore) in July 2017.

However, mobile banking which recorded growth of 72.3 million volume transaction (Rs 1,24,490 crore) in November 2016, has come down to 69.5 million volume (Rs 1,01,920 crore) by end of July 2017.

Ministry of Finance, in its report dated August 30, stated that as part of fillip to digitalisation, about 52.4 crore unique Aadhaar numbers have been linked to 73.62 crore accounts in India.

As a result, every month now, about 7 crore successful payments are made by the poor using their Aadhaar identification. The government now makes direct transfer of Rs. 74,000 crore to the financial accounts of 35 crore beneficiaries annually, at more than Rs. 6,000 crore per month.

"Now with the BHIM App and the Unified Payments Interface (UPI), a secure and seamless digital payments infrastructure has been created so that all Indians, especially the poor can become part of the digital mainstream, " said the ministry.

Goyal further said, "New age payments options like virtual cards, sound waves and one-touch pay technology are also being explored to improve user convenience and encourage more people to switch from traditional style of transactions. However, a strong banking know-how and robust infrastructure will be critical for long term sustenance. "

ALSO READ:

05:23 PM IST

Rs 2000 notes to be banned or not? All doubts cleared! Check latest news, answer directly from Modi government

Rs 2000 notes to be banned or not? All doubts cleared! Check latest news, answer directly from Modi government Zero tolerance! After demonetisation and surgical strike, Modi govt is gearing up for this huge action - Must know for Indians

Zero tolerance! After demonetisation and surgical strike, Modi govt is gearing up for this huge action - Must know for Indians Good news for homebuyers! Finally, branded real estate developers beat non-branded entities

Good news for homebuyers! Finally, branded real estate developers beat non-branded entities Impact of Demonetisation, GST on Textile Industry: Modi government says this now

Impact of Demonetisation, GST on Textile Industry: Modi government says this now Did you get fake Rs 500, Rs 2000, other currency notes? Find out fast

Did you get fake Rs 500, Rs 2000, other currency notes? Find out fast