Has demonetisation tackled black money? Finance Ministry explains in four points

On November 08, 2017, Prime Minister Narendra Modi announced the withdrawal of high-denomination currency notes like Rs 1000 and Rs 500 to tackle black money and terror financing.

Key Highlights:

- Old Rs 500 and Rs 1000 were scrapped on November 08, 2016 to tackle black money

- RBI's annual report says 995 of banned banknotes are back into system

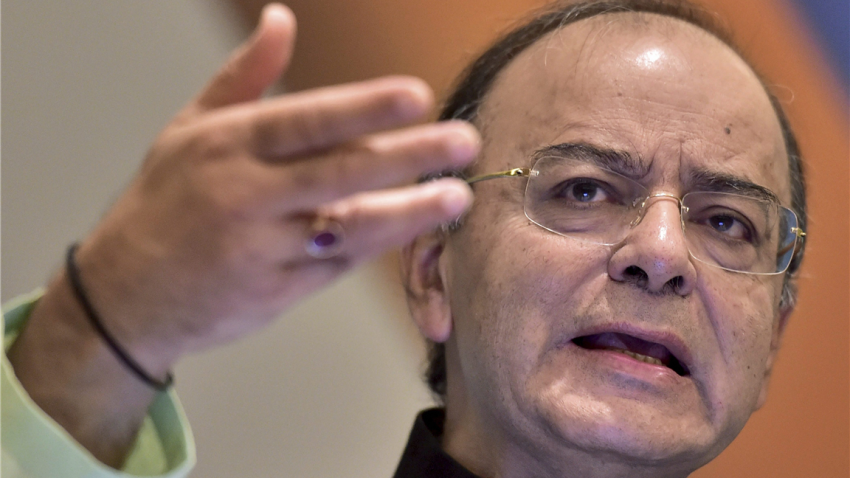

- Jaitley says demonetisation main object was to increase tax base in India

Finance Minister Arun Jaitley on August 30 made it clear that the object of demonetisation was not confiscation of money, but significantly altering India's pre-dominantly high cash economy towards a less-cash one.

He said, “We intended to give a blow of black money and for doing that expand the tax base of the country. It is obvious that post demonetisation, the direct tax base has already started expanding substantially.”

There were lot of questions asked after when the Reserve Bank of India (RBI) released its annual report 2016-17 and revealed that Rs 15.28 lakh crore – or 99% of the Rs 15.44 lakh crore demonetisated by withdrawal of old Rs 500 and old Rs 1000 notes – came back to the system.

Taking into consideraton, the value of specified bank notes now reported to have been counted approximately 98.96% of SBNs in value terms – have been deposited to the RBI post demonetisation. Thus, only an estimated Rs 16,000 crore worth of scrapped SBNs have not returned to RBI.

Jaitley said, “Nearly how much money comes back to the system and how much does not, that was never the real object of demonetisation.”

Further to proof its point, Ministry of Finance on August 31, revealed reports on what has demonetisation impact been on black money.

Quantum jump in Enforcement actions based on Demonetisation data:

According to the ministry, there was 1585 increase in number of searched (from 447 to 1152 groups), while 106% increase in seizures (from Rs. 712 crore to Rs.1469 crore) and 38% increase in admission of undisclosed income (from Rs.11,226 crore to Rs. 1,54,96 crore).

Operation Clean Money:

In the first phase of OCM, 18 lakh suspect cases were identified through use of data analytics where cash transactions did not appear to be in line with the tax profile of depositors.

First phase saw the scale witnessed responses of 9.72 lakh persons in respect of 13.33 lakh accounts involving cash deposits of around Rs.2.89 lakh crore, as per pre-defined parameters on sources of the cash deposits was captured by the Income Tax Department within a short span of 3-4 weeks.

Online queries were also raised in more than 35000 cases and online verification was completed in more than 7800 cases

Under the second phase, OCM included enforcement actions in high risk cases, taxpayer engagement through a dedicated website in medium risk cases and close monitoring in low risk cases.

During the period, there large number of transactions being suspected - about 14,000 properties of more than Rs 1 crore each where persons have not even filed Income Tax Returns. Investigations are in process.

Widening of Tax-base:

Number of e-returns of individual taxpayers filed till August 05, 2017 (due date of filing) increased to 2.79 crore from 2.22 crore returns filed during the corresponding period of last year, registering an increase of about 57 lakh returns.

Ministry said, “This shows marked improvement in the level of voluntary compliance as a result of action taken by the Income Tax Department on the basis of data of cash deposits in the wake of demonetisation.”

Total number of all returns (electronic + paper) filed during the entire FY17 was 5.43 crore which is 17.3% more than the returns filed during FY 16.

Direct Tax Collections:

Collection of Advance Tax under Personal Income Tax between April - August 05, 2017 showed a growth of about 41.79% over the corresponding period in FY17. Collection of Self-Assessment Tax under Personal Income Tax showed a growth of 34.25% over the corresponding period in FY17.

ALSO READ:

01:15 PM IST

Rs 2000 notes to be banned or not? All doubts cleared! Check latest news, answer directly from Modi government

Rs 2000 notes to be banned or not? All doubts cleared! Check latest news, answer directly from Modi government Zero tolerance! After demonetisation and surgical strike, Modi govt is gearing up for this huge action - Must know for Indians

Zero tolerance! After demonetisation and surgical strike, Modi govt is gearing up for this huge action - Must know for Indians Good news for homebuyers! Finally, branded real estate developers beat non-branded entities

Good news for homebuyers! Finally, branded real estate developers beat non-branded entities Impact of Demonetisation, GST on Textile Industry: Modi government says this now

Impact of Demonetisation, GST on Textile Industry: Modi government says this now Did you get fake Rs 500, Rs 2000, other currency notes? Find out fast

Did you get fake Rs 500, Rs 2000, other currency notes? Find out fast