How to pay tax on Bitcoin in India: Check in 3 steps with this new tool

Bitcoin remained the only cryptocurrency till 2011 holding 100% market capitalisation, but after 2011, over 1500 virtual currencies came into existence.

There was a time of traditional format in investment globally, where an investor would invest in either stock market, commodities or bonds, and would sell it on various occasion depending upon their interests. However, now the habit has changed now that cryptocurrencies have entered the market. There is a craze for cryptocurrencies in India and this new-found faith began when Bitcoin, a digital currency, showed promising performance, so much so that it touched a high of $19,694-level last year. It had swayed the mood of investors in favour of other virtual currencies too like Ethereum, Litecoin, Ripple, Bitcoin Cash and many more.

Bitcoin remained the only cryptocurrency till 2011 holding 100% market capitalisation, but after 2011, over 1500 virtual currencies came into existence. However, before getting carried away in the love of cryptocurrencies, it needs to be noted that, regulatory authorities, government, philanthropists and many experts believe that trading in Bitcoin is an illusion, a mass hallucination just like a soap bubble mainly because no central bank is backing this cryptocurrency and it has no legal exchange rate.

There is a war among cryptocurrency market and various regulations inked by government across countries. For instance, many banks have decided to ban card usage for transaction in cryptocurrency market.

The case is same in India, as banks have started banning purchase of cryptocurrency with their cards. Citibank recently circulated an email, guiding customers that it's credit and debit cannot be used for purchasing cryptocurrencies, followed by the largest lender State Bank of India (SBI).

BTCXIndia, which operates as a platform for buying and selling ripple, and ETHEXIndia, which helps users trade ethereum, stopped processing transactions for clients.

Interestingly, considering the potential of crypto market, it is always advisable to investors, for doing some homework while trading in digital coins, if they plan to avoid any regulatory hurdle in future ahead.

Calculating taxes on gains and loss over Bitcoin and other cryptocurrencies, is usually seen as one of the common and major problem, as this is something investors beyond understanding. But not to worry, here’s how you can calculate taxes on trading in cryptocurrency.

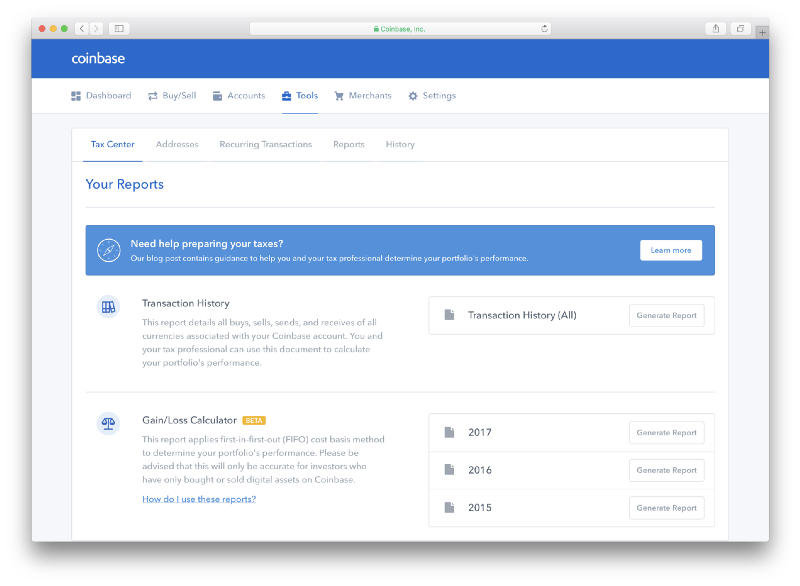

CoinBase - a trading portal in cryptocurrency, has now launched a tax tool, where an investor will be able to calculate the charges on their gains and losses.

CoinBase in it’s blog said, “We understand taxes for digital currency can be complicated, so we updated our tax tools to make reporting easier. You and your tax professional can reference the steps below to prepare your tax filings.”

In three steps, you can commute tax filings on digital currency.

Step 1. Establish a complete view of your trading activity to determine your cost basis

First, customers must create a complete view of all digital asset transactions. Coinbase customers can click here to generate a single report with all buys, sells, sends, and receives of all currencies associated with their Coinbase account.

This report provides your cost basis for all purchases and proceeds for all sales, inclusive of Coinbase fees. This information is necessary to determine your gains/losses. Please be advised that transactions with payment reversals and refunds may not be reflected in this report.

Remember, this report only details transactions associated with your Coinbase account. In order to create a complete view of your digital asset investments, you will need to download similar reports from all other exchanges you have used.

Step 2. Calculate your gains/losses

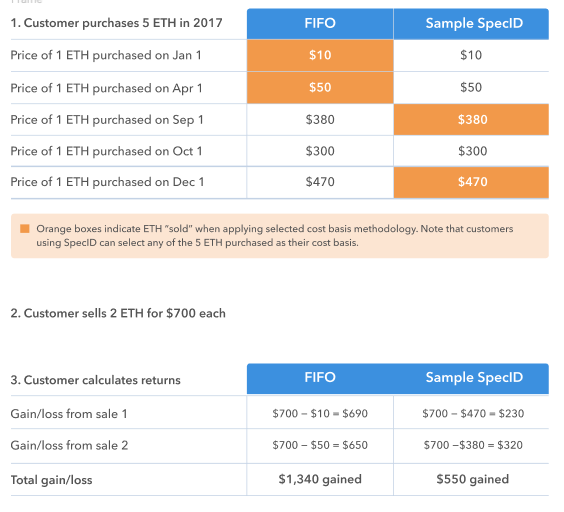

After determining your cost basis, you and your tax professional can calculate your investment gains or losses. Simply put, your gains or losses are calculated by subtracting your cost basis from the proceeds for each individual sale or exchange.

To date there is no standard guidance from the IRS on how to apply your cost basis to individual sales or exchanges of digital assets. We’ve seen two common approaches:

- First in first out (FIFO) — This method assumes that the first assets you purchased are also the first assets you sold or exchanged. Your gain/loss is calculated based on the price you paid for the oldest assets in your portfolio, and the asset price at the time of sale or exchange. This is the most common approach for traditional investments.

- Specific Identification (SpecID) — This method relies on investors to specifically identify to their tax professional the assets they sold or exchanged. This is also a common approach for traditional investments, but requires significant effort from the investor.

- Note that other approaches to calculate your cost basis may exist. We suggest you contact your tax professional before pursuing alternative approaches.

Adding the gains/losses from all of your sales and exchanges will give you your gain/loss for the year.

Step 3. File your taxes

Once you have calculated your gains or losses on your digital assets investments, you are ready to file your taxes. Consult your tax professional on how to best report this information in your tax filing.

Once logged into Coinbase, an investor can even track the performance of cryptocurrency like their gains or losses in 1 hour, 1 day, 1 week, 1 month, 1 year and since the time of its inception.

If you are an Indian investor, and has logged in Coinbase, then you can track your portfolio in domestic currency.

As per Coinbase data, in Indian rupee on Tuesday, one Bitcoin is trading at Rs 581,864, while Bitcoin Cash at Rs 65,242, Ethereum at Rs 44,698 and Litecoin at Rs 11,353.77.

In one year, the data shows, that Bitcoin has grown by 614.21% in India, while Bitcoin Cash by 131.64%, Ethereum by a whopping 2326.67% and Litecoin by a massive 4049.29%.

There are about 15 cryptocurrency exchanges that have started allowing trading in the above mentioned digital currencies.

These exchanges offer 'Buy' and 'Sell' call on these coins.

Arun Jaitley, Finance Minister of India in Budget 2018 speech said, ‘The Government does not consider cryptocurrencies legal tender or coin and will take all measures to eliminate use of these crypto-assets in financing illegitimate activities or as part of the payment system.’

Ajeet Khurana, Head, Blockchain and Cryptocurrency Committee of the Internet and Mobile Association of India (IAMAI) said, "When a platform as significant as the Union Budget speech mentions cryptocurrencies, it is clear that the sector is coming of age. We welcome this positive development, and see it as an important milestone in the journey to policy-clarity and consumer-education."

06:53 PM IST

Bitcoin plummets as cryptocurrencies suffer in market turmoil

Bitcoin plummets as cryptocurrencies suffer in market turmoil Cryptocurrency ALERT!! Ban on Bitcoin, others over, but beware, you can lose your money; read warning

Cryptocurrency ALERT!! Ban on Bitcoin, others over, but beware, you can lose your money; read warning Bitcoin plummets to a six-month low on China crackdown

Bitcoin plummets to a six-month low on China crackdown Cryptocurrency ban: RBI has no authority to ban virtual currencies, says IAMAI

Cryptocurrency ban: RBI has no authority to ban virtual currencies, says IAMAI Gold or Bitcoin? See what fear-ridden investors have gone and done now

Gold or Bitcoin? See what fear-ridden investors have gone and done now