India Inc Q4: Some 60% of firms lag profit estimates

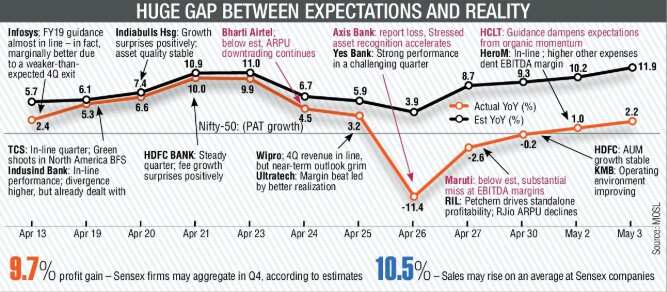

According to a report by Motilal Oswal Securities Ltd (MOSL), overall profit after tax (PAT) growth has been below its estimates till now, largely dragged by Axis Bank. The report said the Q4 earnings season has been broadly in line with expectations in terms of revenue. “We expect the performance of corporate-focused private banks and PSU Banks to drag the aggregates in fourth-quarter,” it said. Approximately, 72% of 67 MOSL coverage companies have reported Ebitda either in line or above the estimates.

The report said the Q4 earnings season has been broadly in line with expectations in terms of revenue. “We expect the performance of corporate-focused private banks and PSU Banks to drag the aggregates in fourth-quarter,” it said. Approximately, 72% of 67 MOSL coverage companies have reported Ebitda either in line or above the estimates.

The report said the Q4 earnings season has been broadly in line with expectations in terms of revenue. “We expect the performance of corporate-focused private banks and PSU Banks to drag the aggregates in fourth-quarter,” it said. Approximately, 72% of 67 MOSL coverage companies have reported Ebitda either in line or above the estimates. India Inc hails Trump's visit; hopes to raise India-US economic engagement

India Inc hails Trump's visit; hopes to raise India-US economic engagement What India Inc expects from US President Donald Trump's maiden visit

What India Inc expects from US President Donald Trump's maiden visit Ahead of Budget 2020, PM Narendra Modi meets top executives of India Inc.

Ahead of Budget 2020, PM Narendra Modi meets top executives of India Inc. Corporate tax reliefs to spur growth, create jobs: India Inc

Corporate tax reliefs to spur growth, create jobs: India Inc India Inc mourns Arun Jaitley's demise; Here's what they said

India Inc mourns Arun Jaitley's demise; Here's what they said