India's GDP growth: Economists cut their forecasts

Fitch alone is not disappointed by the country's current growth rate, CRISIL too has projected India's GDP at 6.8% with downside bias from previous 7% for FY18.

Even though India's Gross Domestic Product (GDP) revived to 6.3% in second quarter of FY18 (Q2FY18), experts are still not convinced that the country's economy is moving on a sustainable path.

Many rating agencies have also trimmed down their GDP growth forecast, with the latest one being Fitch Ratings which believes that Indian economy will grow to 6.7% in FY18 from earlier 6.9% citing weaker than expected rebound.

The US based agency stated that the GDP growth has "repeatedly disappointed" in recent quarters, partly because of one-off factors including the demonetisation programme of November 2016 and disruptions related to the implementation of the Goods and Services Tax (GST) in July 2017.

Fitch alone is not disappointed by the country's current growth rate, CRISIL too has projected India's GDP at 6.8% with downside bias from previous 7% for FY18.

GDP in Q2FY18 revived to 6.3% compared to 5.7% in June quarter, however it was lower from 7.5% in the corresponding period of the previous year.

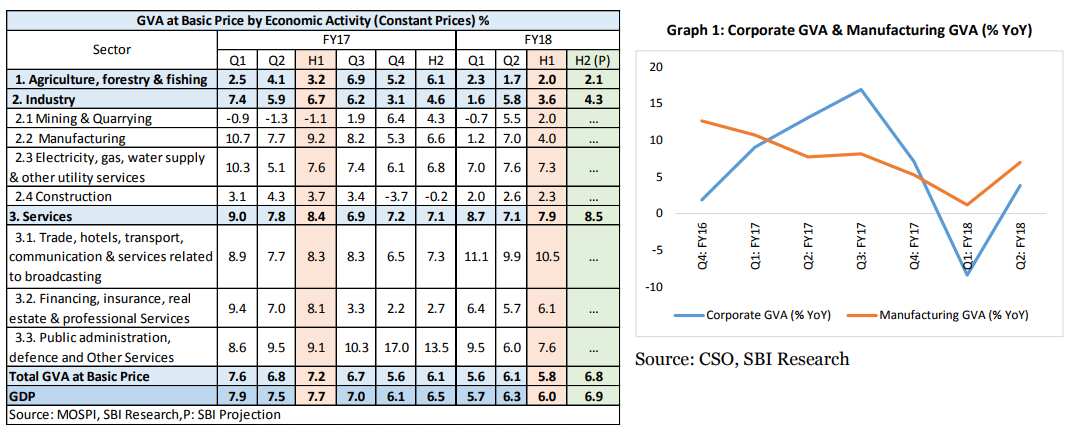

Quarterly GVA at Basic Price is estimated at Rs 29.18 lakh crore as against Rs 27.51 lakh crore in Q2 of 2016-17, showing a growth rate of 6.1% from 5.6% in Q1FY18.

Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, SBI, said, "Lower GVA deflator was one of the primary reasons for higher GVA growth."

"Industry sector was the sole best performer among GVA indicators. This sector grew at 5.8% in Q2 versus 1.6% in Q1FY18 due to growth recorded by mining at 5.5% (from -0.7% in Q1), manufacturing at 7% (from 1.2% in Q1), electricity, gas, water supply and other utility services at 7.6% (from 7% in Q1) and construction at 2.6% (from 2% in Q1)," he informed.

Indicators like agriculture and allied activities and services sector moderated during Q2FY18.

Service sector came in at 7.1% in Q2 from 7.8% in Q1FY18 with trade, hotels, transport and communication services at 9.9% (from 11.1% in Q1), while financing, insurance, real estate and professional services remained at 5.7% (from 6.4% in Q1) and public administration, defence and other services at 6% (from 9.5% in Q1).

The agriculture and allied activities came in at 1.7% in Q2FY18 compared to 2.3% in Q1FY18.

Commenting on the agriculture sector, Ghosh said, “This low growth is quite unexpected and disturbing as the outlook for subsequent quarters are also bleak. The 1st Advance Estimates for 2017-18 indicates that total production of Kharif Foodgrains is likely at 134.7 million tonnes, about 2.8% below last year’s record crop of 138.5 million tonnes. Also, the uneven spread of monsoon will definitely played a role this year.”

At one point Indian economy's rise in Q2 indicates that the impact of demonetisation and Goods and Services Tax (GST) has started to fade out.

source: tradingeconomics.com

Indian economy, however, is still at its low level. The GDP which stood at 9.2% in FY16 dropped to 6.1% in FY17 and further to 5.7% in Q1FY18.

Anand Rathi agency said, "Yet, despite the acceleration, India is still growing well below the trend rate of the last decade.”

Major hurdles like low investment, private capex and government spending still remain in GDP data and until they do not perform well Indian economy's true growth picture will still be foggy.

Investment continues to remain subdued, declining to 28.9% of GDP compared with 29.8%. Along with low capacity utilisation and twin balance sheet problem, GST-related uncertainties have deferred recovery in the investment cycle.

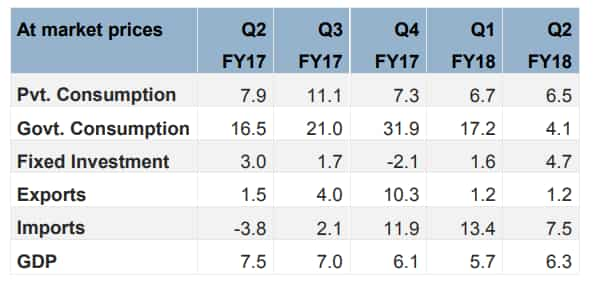

Private final consumption expenditure gradually decelerated to 6.5% in Q2FY18 from 6.7% in Q1FY18 and 7.9% in Q2FY17. This indicator accounts 57.3% of GDP this quarter and has remained muted at this level in the last one year.

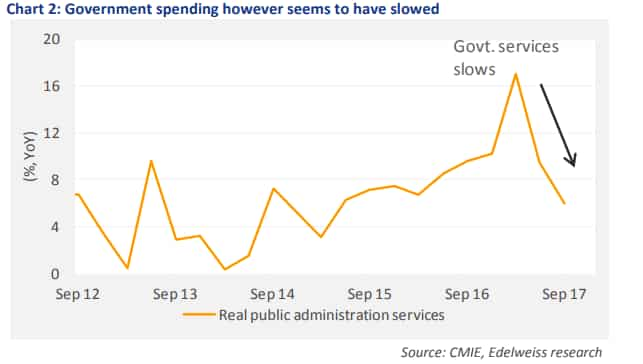

Interestingly, government's final consumption expenditure also fell to a single-digit at 4.1% this quarter from 17.2% in Q1FY18 – holding 13.5% of GDP. Slower growth in the government spending has been reflected in both GVA and GDP growth figures.

Government revenue expenditure has been the primary growth driver in FY17.

Dharmakirti Joshi, Adhish Verma and Krupa Parambalathu, economists at CRISIL, said, “Administrative issues related to tax refunds under GST and repeated changes being made to the structure/ tax rates continue to lead to uncertainty for businesses and may weigh on growth in the road ahead, particularly for small scale units. That would have negative implications for employment.”

“India's labour-intensive exports have been hurt the most. With commodity prices showing sustained rise, there would be additional pressure on the bottom-line in certain sectors which may add downside pressure to growth this FY18,” the trio at CRISIL added.

Ghosh too added, “We believe that the Q3 & Q4 GVA growth will remain in the range of 6-6.5%. Though the monsoon 2017 was only 5% below normal yet the uneven distribution of rains will impact adversely for the agriculture GVA in subsequent quarters.”

Ghosh further said, “The impact of GST on Trade, hotels, transport, communication & services is still cloudy and hence it is difficult to say that by how much this sector will grow in Q3 and Q4.”

Also, Kapil Gupta, Prateek Parekh and Akshay Gattani at Edelweiss Financial Services said, “Construction weakness is persisting longer than we anticipated and chances of scale back in government expenditure are rising amid weaker than anticipated revenues.”

As for private capex, Derrick Y Kam and Chetan Ahya, economists at Morgan Stanley Asia Limited, are confident that a recovery will be underway in 2018, for the first time in six years - which means this fiscal will not see much improvement in Indian economy.

The duo at Morgan said, "Aggregate demand is improving with a synchronous recovery in consumption and exports, which will lift capacity utilisation. Corporate balance sheet fundamentals are improving. State-owned banks will be recapitalised, which will improve the overall banking system's ability to meet investment credit demand."

Morgan expects real GDP growth to accelerate to 7.5% in FY2019 and further to 7.7% in FY2020, from 6.7%Y in FY2018.

While Fitch expects GDP growth to pick up in the next two years on the back of gradual implementation of the structural reform agenda and higher real disposable income.

01:07 PM IST

Government pegs FY19 GDP growth at 7.2%: Which sectors will boost Indian economy?

Government pegs FY19 GDP growth at 7.2%: Which sectors will boost Indian economy? Nomura optimistic on India; sees GDP to grow by 7.7 pct in January-March

Nomura optimistic on India; sees GDP to grow by 7.7 pct in January-March India GDP growth forecast: World Bank says 8 pct acceleration possible, but there is a catch

India GDP growth forecast: World Bank says 8 pct acceleration possible, but there is a catch First revised GDP estimates of FY15, FY16 and FY17 to be released today

First revised GDP estimates of FY15, FY16 and FY17 to be released today IMF's 7.4% growth forecast for India in FY19 a boost to Modi govt

IMF's 7.4% growth forecast for India in FY19 a boost to Modi govt