Looking for tax saving? Save up to Rs 45,000 every year and earn interest

Here are some tax saving options brought to you by tax consultancy ClearTax.

Key Highlights

- Tax saving options can garner Rs 45,000 per year.

- You can also earn interest while saving on income tax.

- Returns on investment is the highest for Equity Linked Saving Scheme.

Tax saving options become imperative for most toward the close of the financial year. Speaking on tax saving, technology company specialising in tax consultancy, ClearTax has put out a few tax saving options on Wednesday.

“You can now save up to Rs 45,000 every year in taxes and earn interest on top of that,” the company said.

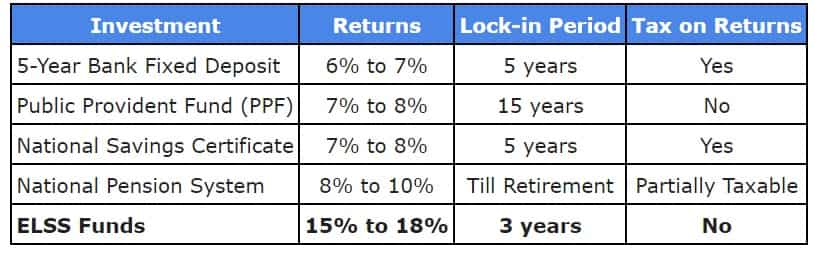

The investment options listed by the company included – five year fixed deposit, public provident fund, National Savings Certificate, National Pension Scheme and ELSS.

Returns on investment was the highest for Equity Linked Saving Scheme (ELSS) where it could go up to 18%.

ELSS are diversified mutual funds with lock in period of three years. Being equity oriented they have the potential to earn higher returns.

PPF is a long term saving scheme by the government with the lock in period of 15 years.

While the NSC is a Government Savings Bond option. It is used for small savings and income tax saving investments. Holder of NSC gets tax benefits under Section 80C.

And the NPS is a voluntary, defined contribution retirement savings scheme which has been designed to enable systematic savings during the subscriber's working life.

Note that only investments made in the period April 1, 2017 to March 31, 2018 can be claimed as deduction from the total income for this fiscal year.

ClearTax allows you to calculate your tax payable for FY 2017-18. Click here for ClearTax calculator.

It also helps you to ‘optimize and reduce the tax you pay by investing in tax-saving investment options.’

07:39 PM IST

Diwali over, now do this with your bonus; 4 step guide and yes, we added a fun part too

Diwali over, now do this with your bonus; 4 step guide and yes, we added a fun part too How to become rich: 3 top tips for success

How to become rich: 3 top tips for success Here are few important things to note before investing in an ELSS

Here are few important things to note before investing in an ELSS How much to invest to make ELSS earn you Rs 1 crore in 11 years?

How much to invest to make ELSS earn you Rs 1 crore in 11 years? Start young: Financial independence for first time investors should begin with SIPs

Start young: Financial independence for first time investors should begin with SIPs