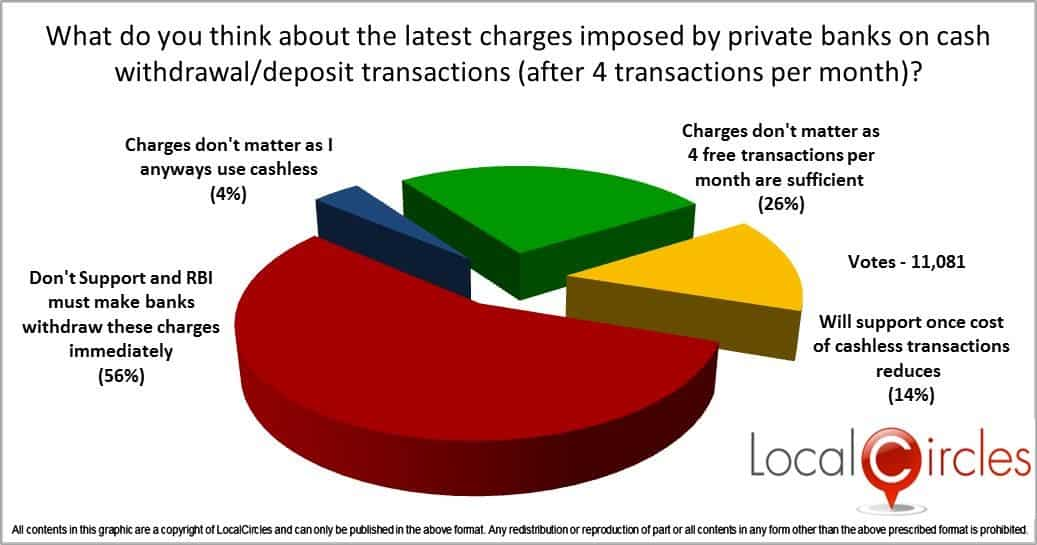

Only 70% citizens feel charges on cash transaction are a bad decision: Survey

The survey said, “Consumers are of the opinion that instead of reducing the cost of digital transactions, private banks are trying to show the stick to the customer and forcing them to go digital. Consumers are very concerned with the cost of digital transactions and many of them have reported that merchants are still charging 2% additional for debit, credit or wallet transactions.”

Need cash? Don't want to pay interest? ICICI Bank is here to help you! Get money now, pay later

Need cash? Don't want to pay interest? ICICI Bank is here to help you! Get money now, pay later Use debit cards, credit cards in bank ATMs? Alert! You just cannot miss this amazing new trend in India

Use debit cards, credit cards in bank ATMs? Alert! You just cannot miss this amazing new trend in India Carried out a cash transaction of Rs 2 lakh or more in 1 day? Income Tax dept will slap a penalty on you

Carried out a cash transaction of Rs 2 lakh or more in 1 day? Income Tax dept will slap a penalty on you Say goodbye to long queues, use cash deposit machines for your transaction

Say goodbye to long queues, use cash deposit machines for your transaction Cheque, cash transactions moderate post demonetisation: RBI study

Cheque, cash transactions moderate post demonetisation: RBI study