RBI policy review 2018 highlights: Here are top 10 points

RBI policy review 2018 highlights: The MPC decision is consistent with the neutral stance of monetary policy in consonance with the objective to achieve medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

RBI policy review 2018 highlights: The Monetary Policy Committee (MPC), headed by RBI Governor Urjit Patel, announces the resolution of the MPC on its first bi-monthly monetary policy for financial year 2018-19 today.

Here are the key highlights:

1-RBI Governor Urjit Patel along with six-member Monetary Policy Committee (MPC) decided to maintain status quo for the fourth time in a row.

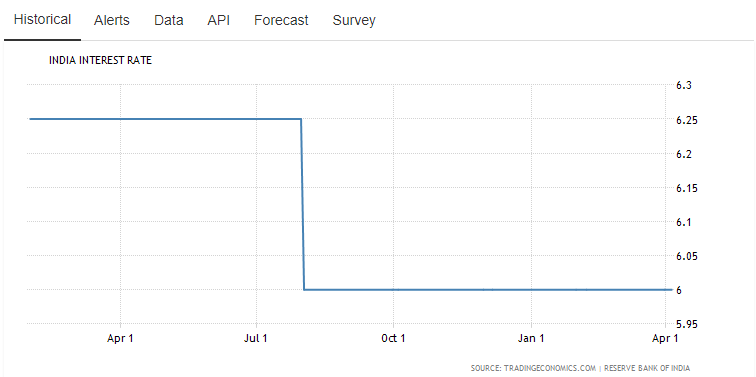

2-Policy repo rate under the liquidity adjustment facility (LAF) remained unchanged at 6.0%.

3-The reverse repo rate under the LAF remains at 5.75%

4-The marginal standing facility (MSF) rate as well as the Bank Rate stands at 6.25%.

5-The RBI remains firm on its neutral stance, from its earlier stand of being accomodative.

6-The MPC decision is consistent with the neutral stance of monetary policy in consonance with the objective to achieve medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

7- Deciding to keep the policy repo rate on hold and continue with the neutral stance, the MPC reiterates its commitment to achieving the mediumterm target for headline inflation of 4 per cent on a durable basis.

8-Dr Chetan Ghate, Dr Pami Dua, Dr Ravindra H Dholakia, Dr Viral V. Acharya and Dr Urjit R Patel voted in favour of the monetary policy decision. Dr Michael Debabrata Patra voted for an increase in the policy rate of 25 basis points.

9-The minutes of the MPC’s meeting will be published by April 19, 2018.

10-The next meeting of the MPC is scheduled on June 5 and 6, 2018.

03:02 PM IST

Budget 2020 Expectations: Monetary Policy Framework may change

Budget 2020 Expectations: Monetary Policy Framework may change RBI policy review 2019 highlights: Repo rate cut by 25 bps, know top 10 points

RBI policy review 2019 highlights: Repo rate cut by 25 bps, know top 10 points RBI Monetary Policy: Shaktikanta Das says closely monitoring NBFCs, HFCs - Here's how they reacted

RBI Monetary Policy: Shaktikanta Das says closely monitoring NBFCs, HFCs - Here's how they reacted  Monetary Policy alert: RBI raises CPI Inflation target for 1HFY20 - Vegetable, crude oil, households to play this role

Monetary Policy alert: RBI raises CPI Inflation target for 1HFY20 - Vegetable, crude oil, households to play this role  RBI raises retail inflation forecast for Apr-Sept FY20 to 3-3.1 pct

RBI raises retail inflation forecast for Apr-Sept FY20 to 3-3.1 pct