RBI's Financial Stability Report: Recovery of bad loans lowers

RBI said that recovery of bad loans from various channels slowed down for PSBs and many Scheduled Commercial Banks (SCBs) as compared to previous years.

The Reserve Bank of India (RBI) on Thursday released its Financial Stability Report (FSR) in which it said that public sector banks (PSBs) are nowhere near revival when it comes recovery to bad loans.

RBI said that recovery of bad loans from various channels slowed down for PSBs and many Scheduled Commercial Banks (SCBs) as compared to previous years.

To reduce its non-performing assets, banks have three resolution mechanisms, namely; Lok Adalats, Debt Recovery Tribunals (DRT) and invocation of SARFAESI.

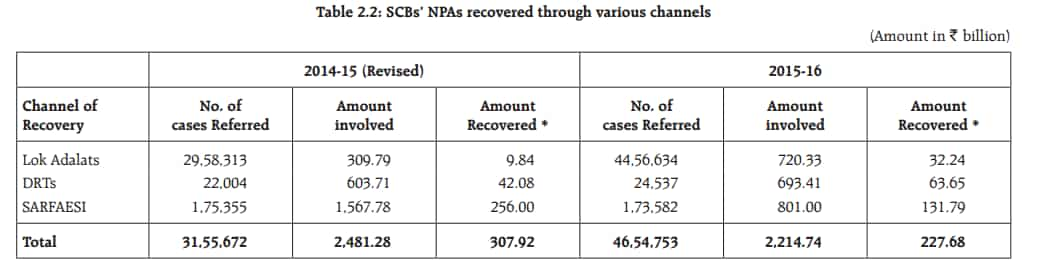

Amount recovered by SCBs lowered to Rs 22,768 crore compared to Rs 30792 crore recovered in 2014-15. The slowed down in recovery was due to 52% reduction in amount recovery under SARFAESI channel, RBI said.

Recovery through Lok Adalats increased to Rs 3,224 crore from Rs 984 crore and that of DRTs stood at Rs 6,365 crore versus Rs 4,208 crore in 2014-15.

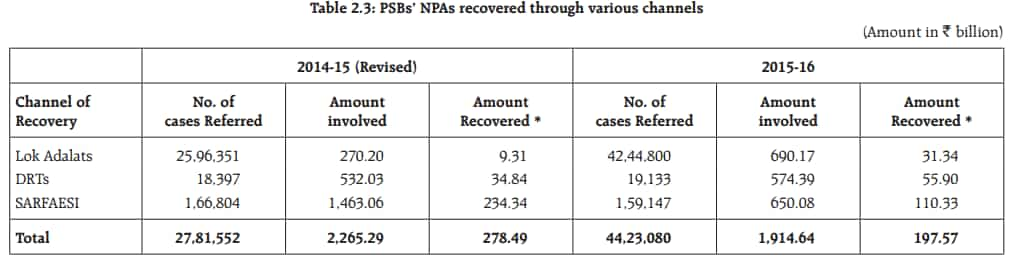

Amount that banks recovered from the above channels in 2015-16 stood at Rs 19,757 crore, a reduction from to Rs 27,849 crore recovered in 2014-15. Downward trend under SARFAESI was the major reason for slowdown in PSBs' NPA recovery, RBI's FSR report show.

For PSBs, amount recovered under SARFAESI was at Rs 11,030 crore in 2015-16 against Rs 27,849 crore in 2014-15. That of Lok Adalats and DRTs increased to Rs 3,134 crore and Rs 5,590 crore from their earlier Rs 931 crore and Rs 3,484 crore, respectively.

SARFAESI allows banks and other financial institution to auction residential or commercial properties to recover loans. Considering the movement in this act, looks like banks are finding it difficult to recover their loans via auction of properties.

Date released by RBI stated that bad loans have crossed $ 138 billion (approx Rs 8.72 lakh crore) in June 2016, a rise of 15% in just six months. Also an analysis of 18 PSBs made by Care Ratings revealed that the NPA ratio was as high as 14.5% in September 2016.

A Credit Suisse report stated that it expects the overall ratio of impaired assets to rise from 12% to over 16%. This indicates the bad loans will continue to haunt banks.

06:52 PM IST

Lenders to revalue Kingfisher House, hope to sell it shortly

Lenders to revalue Kingfisher House, hope to sell it shortly