RBI's monetary policy: 12 factors and 10 charts that you must know

RBI is set to present second monetary policy of FY18. Analysts expect a status quo in this policy too. However, rate cut or not, a total of 12 factors that the central bank will look into before making a decision.

Second bi-monthly monetary policy for FY18 will be announced by the Reserve Bank of India (RBI) on June 7, 2017.

This will be the fifth policy review of central banks governor Urjit Patel and the six-member Monetary Policy Committee (MPC).

Major highlights from April 2017 policy were – repo rate kept unchanged at 6.25%, liquidity corridor narrowed to 25 basis points from 50 basis points; reverse repo rate increased to 6% from 5.75%, marginal standing facility from 6.75% to 6.50%.

Furthermore, banks were allowed to invest in REITs and InvITs to an extent of 20%, while corporate bonds were asked to be rated by minimum two rating agencies.

Now that second policy meet is around the corner, here is an list of 11 things that will surround RBI's decision whether they follow a rate cut or not.

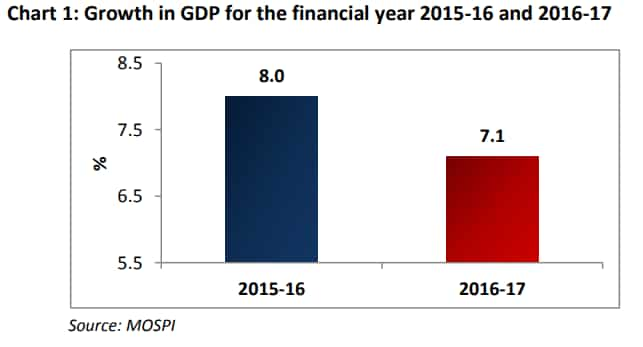

GDP growth:

In last quarter of FY17 (Q4FY17), India's GDP data missed estimates and dropped to a two year low at 6.1% due to slow down in growth of sectors like mining & quarrying, construction and services. Real GDP at constant (2011-12) prices for FY17 is estimated at Rs 121.90 lakh crore showing a growth rate of 7.1% over the year 2015-16 of Rs 113.81 lakh crore, as per CSO.

GDP number for FY16 has undergone revision due to use new Index of Industrial Production (IIP) and Wholesale Price Index (WPI) with base 2011-12 for the compilation of GDP.

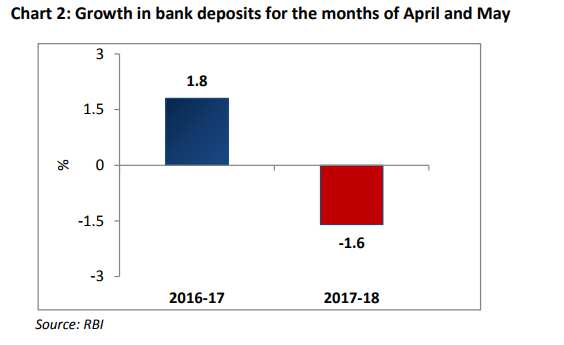

Deposit growth:

Between April - May period, growth in deposits contracted by 1.6% as compared to the growth of 1.8% in the corresponding period of the previous year. Spike in deposits which came in during the last fortnight of March 2017 have been corrected subsequently.

As on March 2017, aggregate deposits growth of Scheduled Commercial Bank slowed down to 11.3% compared to 16.4% growth in December 31, 2016 ended quarter and 12.9% in September 30,2016 ended quarter.

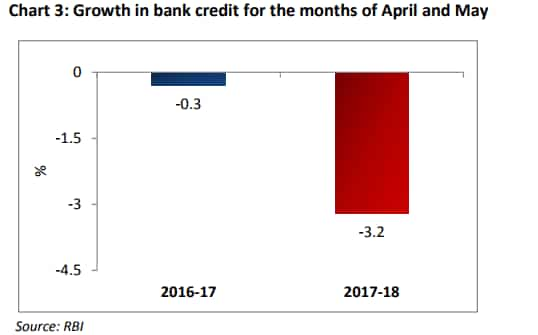

Credit Growth:

Just like deposits, banks credit growth contracted further but by higher margins. Between April - May 2017, the credit growth stood negative at 3.2% versus negative performance of 0.3% a year ago similar period.

Rising NPA problems, increasing capital requirement of banks under Basel - 3 norms, lack of pick up in investment and partly added by demonetisation drive has limited the scope for growth in this section.

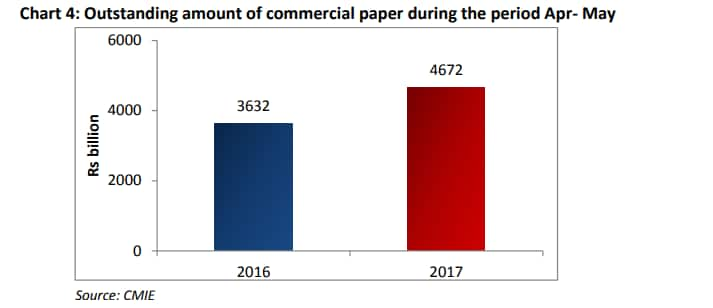

Commercial Paper:

Despite outstanding commercial papers rose by 29% at Rs 4,67,200 crore in May as against Rs 3,63,200 crore in May 2016.

Amount raised through commercial papers have declined by 35% for the combined months of April - May 2017 to Rs 2,24,200 crore as against Rs 3,42,700 crore in the similar period of the previous year.

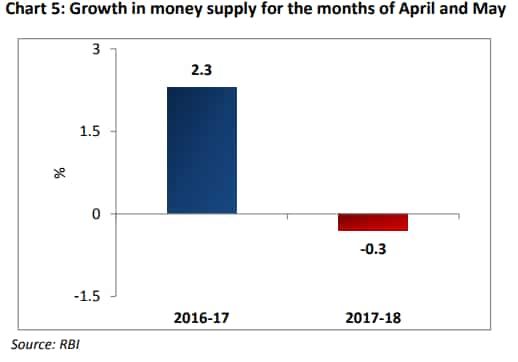

Money Supply:

Performance of money supply in India has sequentially contracted by 0.3% in first two months of FY18 versus growth of 2.3% a year ago same period. Growth in money supply continues to be lower even after reaching at remonetisation level.

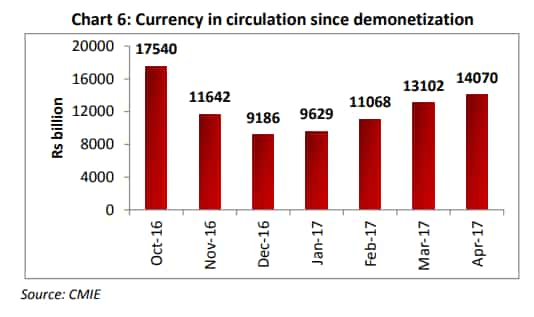

Currency In Circulation (CIC):

RBI may have printed enough currency into the system but has yet not managed to reach at pre-demonetisation level. CIC has declined to Rs 14,07 lakh crore in April 2017 if compared with Rs 16.48 lakh crore of the previous fiscal same month.

Before demonetisation was announced, a total of Rs 17.54 lakh crore stood in the system which reached to a low of Rs 9.18 lakh when the move ended in December 2016.

Consumer Price Index (CPI) Inflation:

RBI has been quite categorical about risk revolving around CPI inflation in its previous policy meet. CPI inflation declined to a multi-year low at 2.99% in April’17 as compared to 3.89% recorded in previous month.

source: tradingeconomics.com

The decrease in inflation in April was attributed to the decline in food prices viz a fall in the prices of fruits, fish and meet, sugar and spices.

However, core inflation still continues to be sticky at 5% and a cause concern for RBI.

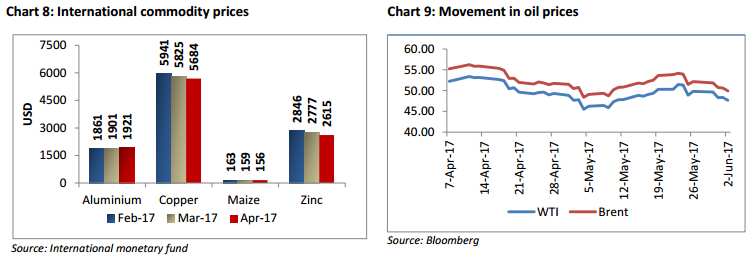

International Commodity Price & Oil Prices:

Global commodities have moderated with metal prices declining since few months. Oil prices, too, have seen declining trend even after OPEC members decided to extend production cuts for nine months due to increased oil production in US.

Prices have since then averaged to $44 per barrel.Markets were expecting either more deeper cuts in the production or an extension of up to 12 months.

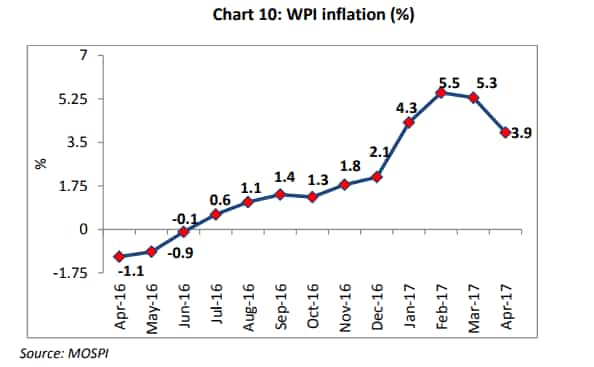

Wholesale Price Index (WPI):

In the month of April 2017, WPI Inflation decelerated to 3.9% from 5.29% in March 2017 with introduction of new base year 2011-12 by CSO that is now comparable with the gross domestic product, consumer prices index and newly introduced index of Industrial production.

Decline in WPI inflation was on the back of decrease in inflation in fuel and power and primary articles. With moderation in global commodity prices and decline in the oil prices, WPI could further moderate in the coming months.

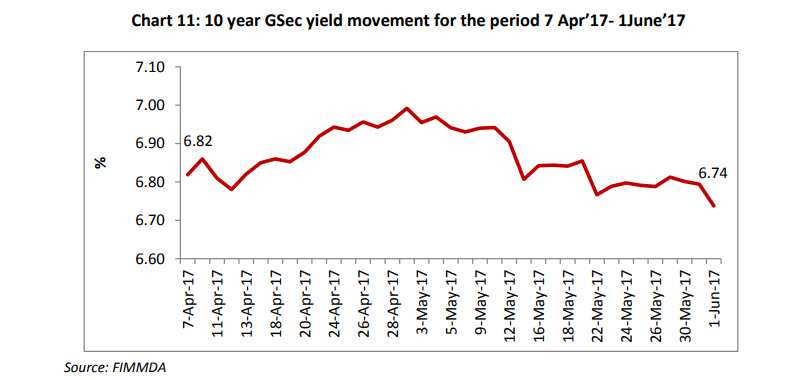

Movement in 10-year GSec:

From April 2017 - till date, 10-year GSec yields have come down to 6.74% from 6.82% as demand for the securities increased among both domestic and foreign investors. Capital flow in this market was at $2856 million in the debt segment compared to $900 million during October 2016.

Care Ratings in its report said, "Domestic demand has mainly been driven by banks are flushed with liquidity post demonetization. There has been a surge in foreign inflows into the debt segment on the back of improving sentiments about the domestic economy."

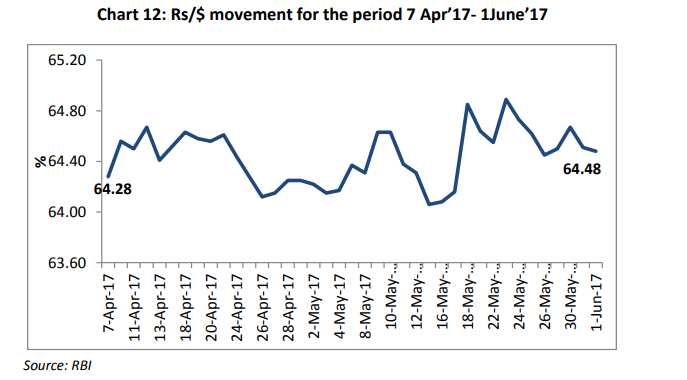

Movement in exchange rates:

Indian rupee has been continuously appreciating against US dollar and has outperformed its peers since the start of 2017.

Between April - May 2017, INR has appreciated over 3% against dollar. In last five months of 2017, INR has appreciated by more than 5% against the dollar on account of continued foreign flows into the Indian markets.

Excess liquidity in banking system:

There is an increase in the liquidity with the increase in reverse repo flows since demonetization. The reverse repo flows stands at Rs 402,612 crores as on June 2, 2017. Therefore, a decrease in Cash Reserve Ratio from the current level of 4% seems unlikely.

Madan Sabnavis and Manisha Sachdeva economists at Care Ratings said, " We believe that there will be no rate cut in the upcoming RBI policy view as RBI would continue to monitor the inflation situation and could initiate a rate cut after September’17 if the inflationary impact, if any, of GST and pay hike is within the acceptable limits of RBI."

The duo added, "We expect only a 25 bps cut in 2017 – in second half. More likely in the month of October, once the picture is clearer."

12:02 PM IST

EMI calculation: Should you pay or not? Anil Singhvi explains what home loan, auto loan, other borrowers should do

EMI calculation: Should you pay or not? Anil Singhvi explains what home loan, auto loan, other borrowers should do EMI Moratorium Latest News: What it is? What it means for car, home and other loans? Should you postpone payment or keep paying? Check best advice for you

EMI Moratorium Latest News: What it is? What it means for car, home and other loans? Should you postpone payment or keep paying? Check best advice for you Took home loan, car loan from this bank? Good news for you - Check details

Took home loan, car loan from this bank? Good news for you - Check details SBI interest rates on loans slashed by whopping 75 bps, passes on entire RBI repo rate cut to borrowers

SBI interest rates on loans slashed by whopping 75 bps, passes on entire RBI repo rate cut to borrowers RBI steps will ease pressure on the financial system: Amitabh Chaudhry, Axis Bank

RBI steps will ease pressure on the financial system: Amitabh Chaudhry, Axis Bank