Sebi categorises Mutual Funds into five schemes

Following the robust performance of mutual funds market, the Sebi has now divided this industry into five categories making investment even more easier.

The market regulator Sebi on Friday categorised mutual funds into five schemes to ensure that an investors is able to evaluate different options before investing in this category.

Securities Exchange and Board of India (Sebi) in the notification said, "It is desirable that different schemes launched by a Mutual Fund are clearly distinct in terms of asset allocation, investment strategy etc. Further, there is a need to bring in uniformity in the characteristics of similar type of schemes launched by different Mutual Funds."

If you want to invest in mutual fund, here's a list of variety where you can park your money in this category.

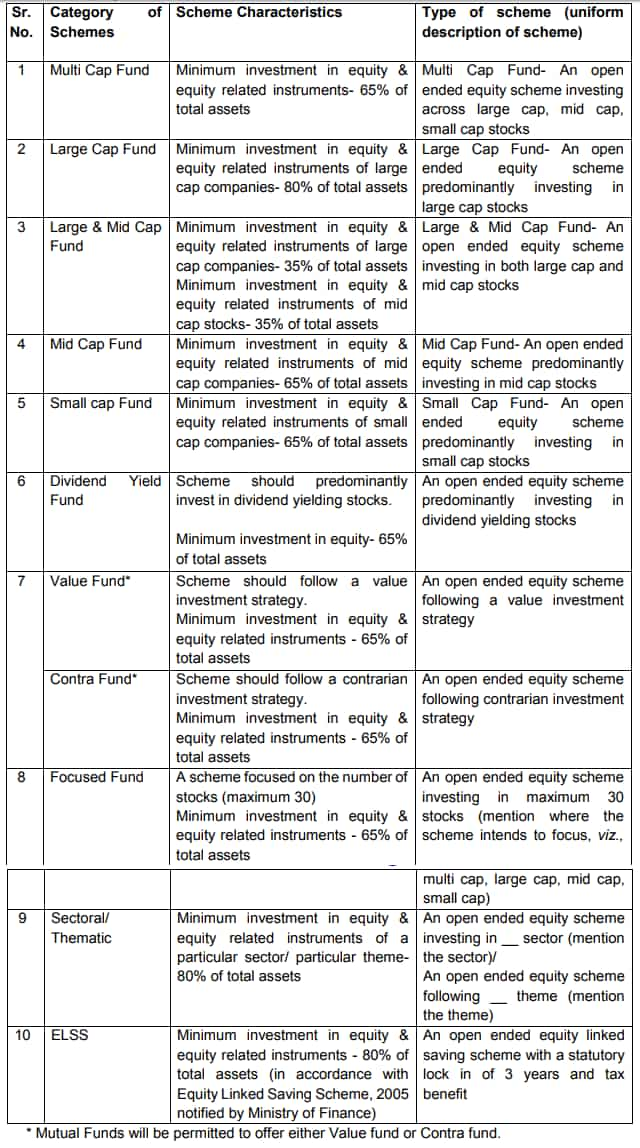

Equity schemes:

In order to ensureuniformity in respect of the investment universe for equity schemes, it has been decided to define large cap, mid cap and small capas follows.

- Large Cap:1st-100thcompany in terms of full market capitalisation

- Mid Cap:101st-250thcompany in terms of full market capitalisation

- Small Cap:251stcompany onwards in terms of full market capitalisation

There were somewhat 10 schemes defined under this category.

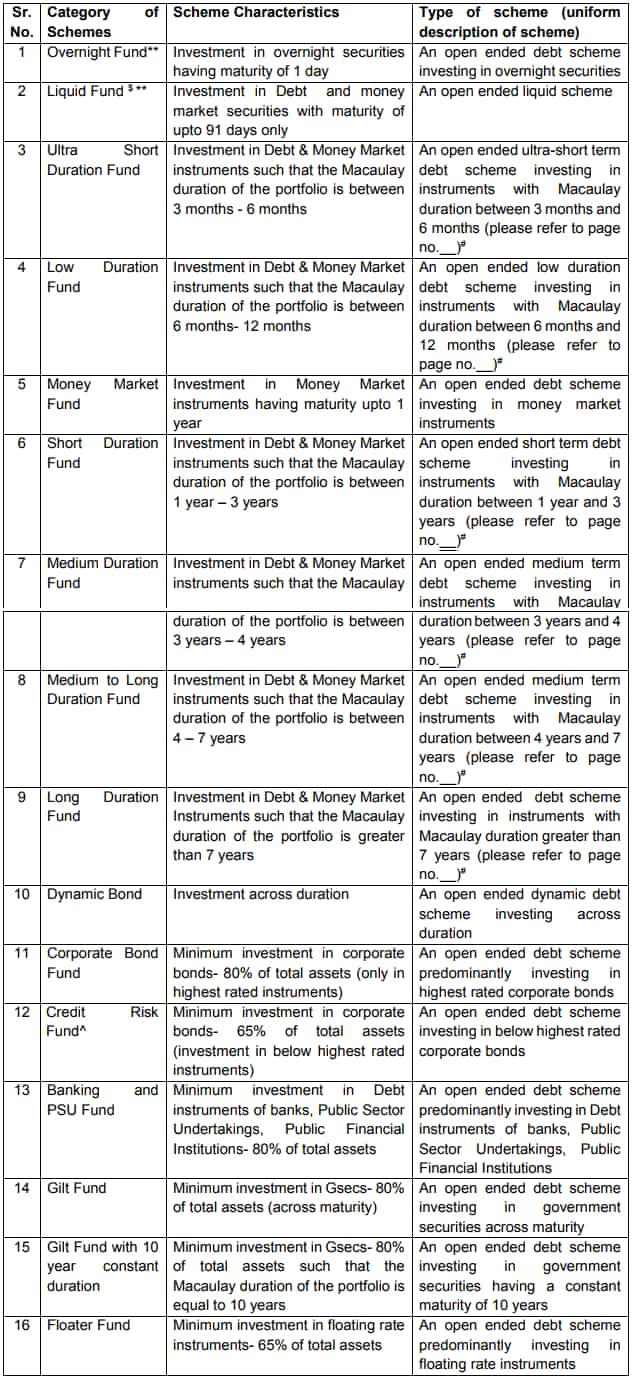

Debt Schemes:

This category has total sixteen schemes having different duration and investment cap.

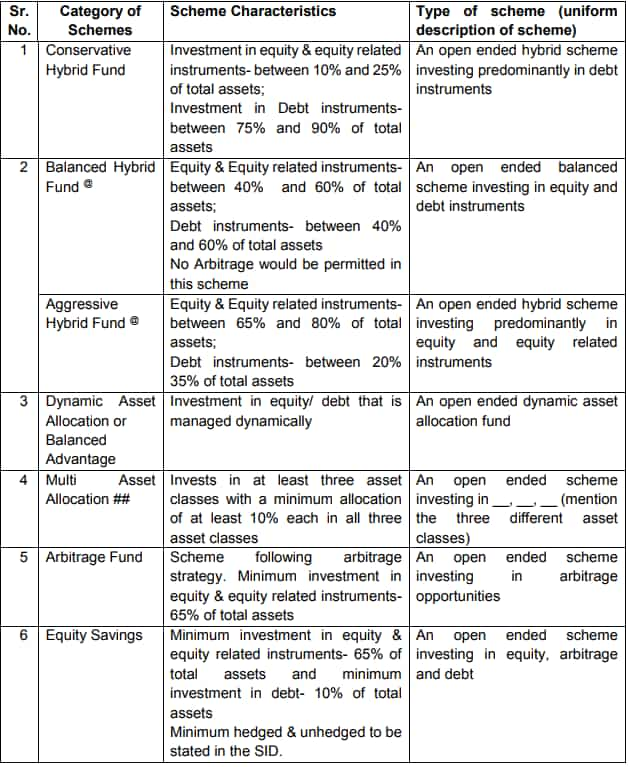

Hybrid Scheme:

While this category was put into six schemes.

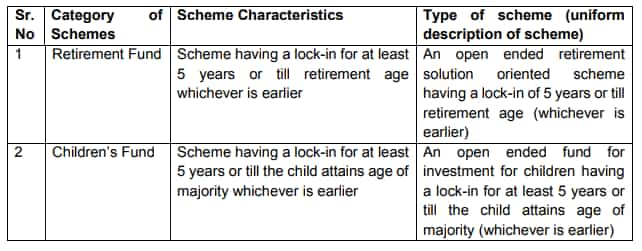

Solution Oriented Schemes:

Only two schemes were added under this category namely retirement fund and children's funds.

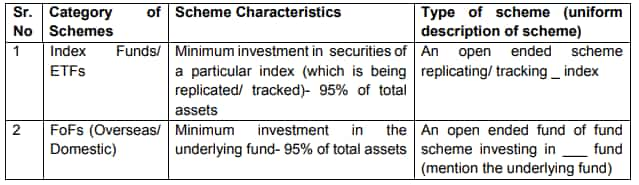

Other Schemes:

Index Funds or ETFs and Overseas domestic which are called as FoFs were added under this category.

The decision of SEBI in this regard shall be binding on all the mutual funds.

They are being advised to strictly adhere to the scheme characteristics stated herein as well as to the spirit of this circular.

Sebi said, "Mutual Funds must ensure that the schemes so devisedshould not result in duplication/minor modifications of other schemes offered by them."

In a short span of three years - the mutual fund industry has more than doubled to Rs 21 lakh crore at the end of September 2017 compared to Rs 10 lakh crore milestone it touched in May 2014.

Of the 42 fund houses, as many as 37 witnessed growth in their asset base in September, while two saw decline in their AUMs.

06:29 PM IST

SEBI comes forward to rescue security investors' interest

SEBI comes forward to rescue security investors' interest #BandKaroBazaar: Market shutdown is a good option: Anand Rathi Chairman of Anand Rathi Group

#BandKaroBazaar: Market shutdown is a good option: Anand Rathi Chairman of Anand Rathi Group Mutual Funds, PPF, NPS to gold — Your powerful guide to accumulate money

Mutual Funds, PPF, NPS to gold — Your powerful guide to accumulate money Turn your Rs 100 per day into Rs 10.72 crore! Here is how to become a crorepati

Turn your Rs 100 per day into Rs 10.72 crore! Here is how to become a crorepati Want to retire rich? Follow this mutual funds investment strategy, say experts

Want to retire rich? Follow this mutual funds investment strategy, say experts