Sensex, Nifty rebound on positive global cues; Kotak Mahindra Bank zooms on Berkshire buzz

Benchmark indices broke their three-day falling streak Friday driven by upbeat global cues, recovering rupee and a surge in Kotak Bank shares on reports that Berkshire Hathaway may pick up a stake in the lender.

Benchmark indices broke their three-day falling streak Friday driven by upbeat global cues, recovering rupee and a surge in Kotak Bank shares on reports that Berkshire Hathaway may pick up a stake in the lender.

The BSE Sensex rallied 361.12 points, or 1.02 per cent, to close at 35,673.25. Similarly, the broader NSE Nifty jumped 92.55 points, or 0.87 per cent, to 10,693.70.

However, both the indices ended lower for the week. The Sensex fell by 521.05 points, or 1.43 per cent, while the Nifty lost 183.05, or 1.68 per cent, during the week.

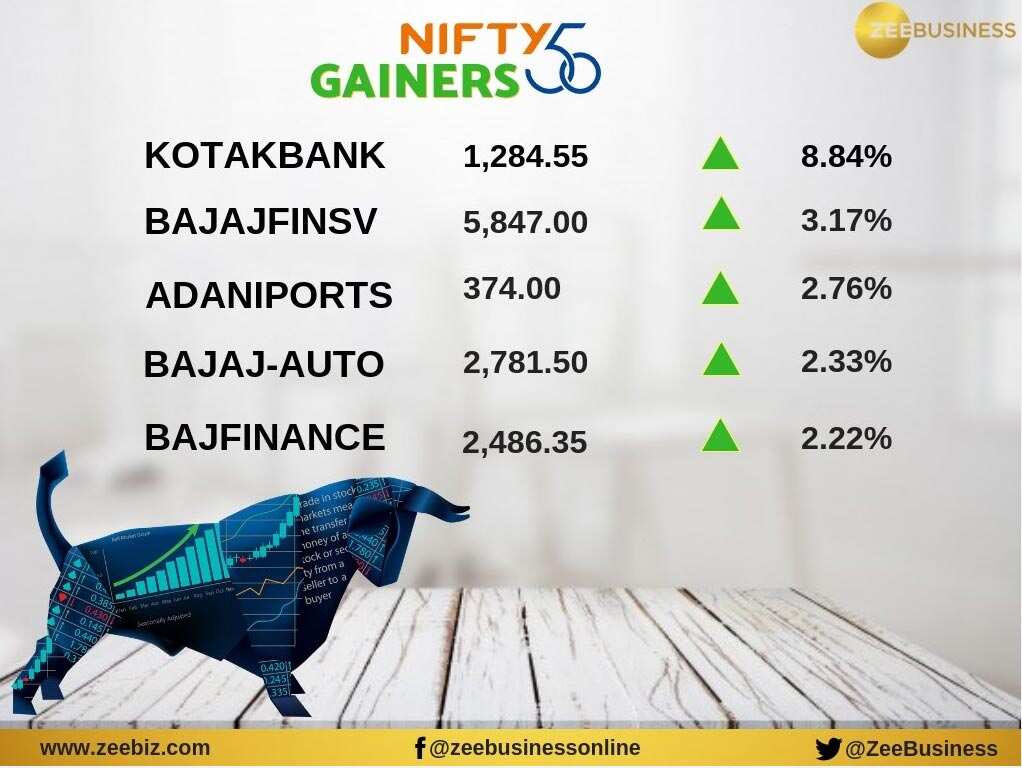

Kotak Mahindra Bank was the biggest gainer on both the indices Friday, spurting nearly 9 per cent following reports that Warren Buffett's Berkshire Hathaway Inc was planning to pick up a stake in the private sector lender.

According to media reports, Berkshire Hathaway may invest between USD 4 billion and USD 6 billion in the lender by buying promoter stake or through a preferential allotment.

Other gainers included Adani Ports, Bajaj Auto, Infosys, Asian Paints, Maruti, HUL, L&T, M&M, ICICI Bank and Reliance Industries, rising up to 3 per cent.

Top losers were Sun Pharma, Coal India, Yes Bank, PowerGrid and NTPC, sliding up to 2 per cent.

"Indian equity market had turned cautious during the week, profit booking was evident in anticipation of the final outcome of the state elections, a precursor of the general election.

"Domestic market rebounded today along with global market which has lightened up, hoping for a resolution of US-China trade war. OPEC's decision to delay the final resolution to cut oil output caused prices to fall, boosting sentiments in India," said Vinod Nair, Head of Research, Geojit Financial Services.

Investors took positive cues from Asian and European equities after US Fed Chairman Jerome Powell signalled that the three-year tightening cycle was drawing to a close, and IMF chief Christine Lagarde said that the US was not likely to see an economic contraction in the near term.

The rupee appreciated by 24 paise to 70.66 against the US dollar in intra-day trade amid weakness in the greenback against some currencies overseas.

Oil prices eased further on worries that a meeting of Opec and non-Opec producers will not agree to an output cut. Brent crude, the international benchmark, was trading 0.72 per cent lower at USD 59.63 per barrel.

Meanwhile, on a net basis, foreign portfolio investors (FPIs) bought shares worth Rs 72.47 crore Thursday, while domestic institutional investors (DIIs) were net sellers to the tune of Rs 389.78 crore, provisional data available with BSE showed.

Elsewhere in Asia, Korea's Kospi rose 0.34 per cent, Japan's Nikkei gained 0.82 per cent, Shanghai Composite Index edged 0.02 per cent higher, while Hong Kong's Hang Seng shed 0.35 per cent.

In Europe, Frankfurt's DAX rose 0.85 per cent and Paris' CAC 40 gained 1.40 per cent in early deals. London's FTSE too jumped 1.53 per cent.

06:00 PM IST

Rs 1 lakh in this stock returned Rs 1,27,000 in 7 hours today!

Rs 1 lakh in this stock returned Rs 1,27,000 in 7 hours today!  75 BSE 500 cos can pay Rs 1.1 tln more to shareholders: Report

75 BSE 500 cos can pay Rs 1.1 tln more to shareholders: Report Sebi slaps Rs 94 lakh fine on 17 entities for fraudulent trade practices

Sebi slaps Rs 94 lakh fine on 17 entities for fraudulent trade practices Stock Market Bulls! From TCS, Kotak Bank, ONGC, Infosys, SBI to Bajaj: 10 stocks that made people rich today and how

Stock Market Bulls! From TCS, Kotak Bank, ONGC, Infosys, SBI to Bajaj: 10 stocks that made people rich today and how This firm enters in BSE SME platforms; listed at 20% premium.

This firm enters in BSE SME platforms; listed at 20% premium.