SpiceJet share price: Experts says buy this aviation stock, top 5 reasons

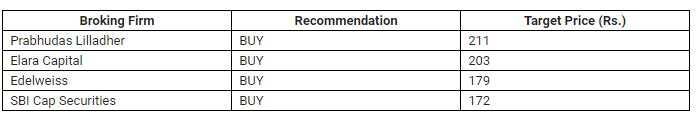

Stock market experts have pin-pointed SpiceJet share to buy today as the aviation counter is expected to touch up to Rs 211 per stock.

Share to buy today: In the wake of Narendra Modi taking over for the second term as Prime Minister of India, stock market experts are bullish about the upside momentum of the Dalal Street. However, for the small and medium-size investors, it's an opportunity to maximise their gain as they have been in catch-22 situation for the last quarter due to the Lok Sabha General Elections. For them, stock market experts have pinpointed the SpiceJet share to buy today as the aviation counter is expected to touch around Rs 211 per stock. However, some experts have expected that it may lose the rally after reaching the Rs 172/stock levels. But, one thing is sure that each expert whom we approached were bullish about the aviation counter.

Here are the top 5 reasons being cited by the share market experts that make this counter a buy:

1] As per SBI Cap Securities, SpiceJet reported Q4FY19 revenue of Rs25bn, up around 25% YoY on volume growth of around 17%. Pax yield, though, increased 6.6% to Rs3.97/RPKM; however, this came at the cost of a 300bps decline in PLFs to 91%, resulting in RASK of Rs4.06/unit, up 3.4% YoY. Our RASK estimate of Rs4.17 assumed ~Rs500mn of compensation from Boeing due to the grounding of 13 Max aircraft in Mar’19. The Sbi Cap report submitted by aviation research analysts Santosh Hiredesai and Chalasani Teja SpiceJet has, over the years, maintained a healthy premium in yields to peers owing to its differentiated network strategy of not competing with larger peers.

2] As per Edelweiss Securities, SpiceJet’s (SJ) Q4FY19 EBITDAR of Rs 5.1bn came below the consensus estimates. However, this excludes compensation from Boeing (737 Max grounding), which has been deferred to FY20. Adjusted for this, EBITDAR broadly met estimates. Over half of Jet’s domestic slots along with its entire international slots are yet to be allocated. If Jet shuts down, SJ will be the prime beneficiary given complementary fleet portfolio; this will lead to the further upside to our estimates. Edelweiss Securities expect SJ to turn profitable in FY20 as yields expand while fueling costs moderate.

3] According to Elara Securities the aviation company guided 60 aircraft addition in FY20, comprises 12 regional aircrafts Bombardier Q400, 43 Boeing-737 and five freighter aircraft. It implies fleet capacity will rise ~80% in FY20. Research analyst Gagan Dixit says, "We reiterate Buy on strong fleet growth in a supply-constrained environment. We lower our TP to INR 203 from INR 211 on lower FY21E EPS, assuming 7.5x (unchanged) FY21E EV/EBITDAR."

4] According to Prabhudas Lilladher, "In order to capitalize on the opportunity created by Jet’s grounding, SJET has drawn out plans to considerably scale up its fleet size by adding 60 planes to its existing fleet of 76 aircraft. This shall lead to an 80 YoY% increase in capacity. Of the planned 60 aircraft inductions, 25 have already in been added to the fleet."

Paarth Gala, Research Analyst at Prabhudas Lilladher says that the aviation counter may touch Rs 211 per stock levels.

5] With ~28 Q400 turboprops SJET operates the largest fleet in the high yielding regional markets. SJET’s overall yield stood 7% higher than market leader IndiGo in 4Q19.

Also as a part of its international expansion, SJET entered into a codeshare with

Emirates thereby providing SJET pax with seamless access to Emirates’ network

across Europe, Africa, America & Middle East, reports Prabhudas Lilladher.

So, it can be a good buy option for the stock market investors when the market opens on Monday, say experts.

09:37 AM IST

COVID-19: SpiceJet 'forced' to suspend most international flights till April-end

COVID-19: SpiceJet 'forced' to suspend most international flights till April-end Dedicated freight corridor: SpiceJet's pact with GMR Hyderabad Airport and Ras-Al-Khaimah International Airport - Top details

Dedicated freight corridor: SpiceJet's pact with GMR Hyderabad Airport and Ras-Al-Khaimah International Airport - Top details  IndiGo, SpiceJet share prices tumble over global travel restrictions

IndiGo, SpiceJet share prices tumble over global travel restrictions SpiceJet to finalise compensation deal with Boeing by March-end

SpiceJet to finalise compensation deal with Boeing by March-end MAX grounding: SpiceJet considering Boeing's compensation offer

MAX grounding: SpiceJet considering Boeing's compensation offer