Top five sectors with most exposure to banks NPAs; What can be done?

Sectors like steel, textile, power, telecom and infrastructure accounts for most of banks stressed assets. About 60% of banking systems stress belongs to these sector.

Key Highlight:

- 60% of banks stressed assets are from five sectors

- Gross NPAs of banks expected to reach Rs 9.5 lakh crore by FY18

Five sectors alone account for 60% of the total stressed assets on the books of banks in India.

These sectors are steel, power, telecom, infrastructure and textile.

By end of FY17, banks had gross non-performing assets (NPAs) of 9.5% of gross advances valuing up to Rs 7.65 lakh crore.

GNPAs of a total 21 PSBs stood at Rs 6.19 lakh crore, rising by 19.96% compared to Rs 5.16 lakh crore in the similar period of the previous year.

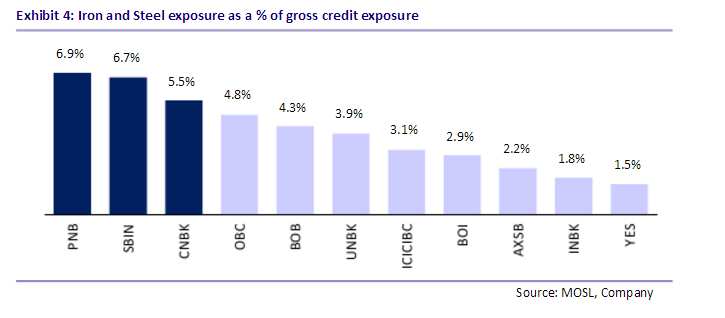

Steel exposure as a percentage of gross credit exposure was highest in public sectors banks compared to private ones.

Total exposure of steel industry is about Rs 3.13 lakh crore out of which gross NPAs is about Rs 1.15 lakh crore – 36.94% of total loan outstanding as on March 2016.

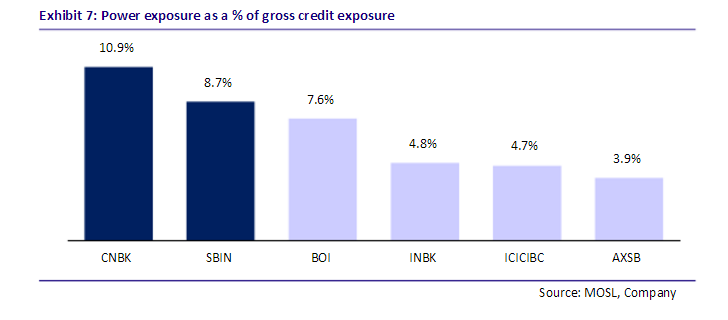

At the same time, power sector exposure is expected to be at Rs 2.3 lakh crore implying a 35% of stress level.

Exposure of power sector as percentage of gross credit is highest in Canara Bank with 10.9%, followed by State Bank of India at 8.7%, Bank of India at 7.6% and Indian Bank at 4.8%.

Private lenders like ICICI Bank and Axis Bank has exposure of 4.7% and 3.9%, respectively.

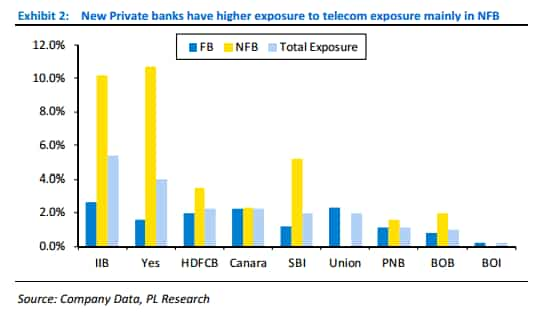

Telecom sector has an outstanding debt of telecom sector is nearly Rs 4 lakh crore.

Debt of total listed telecom companies was at Rs 2,14,477 crore as on September 2016. Looking at their low capacity for refinancing their debt, RBI has maintain a cautious status on this segment for banks.

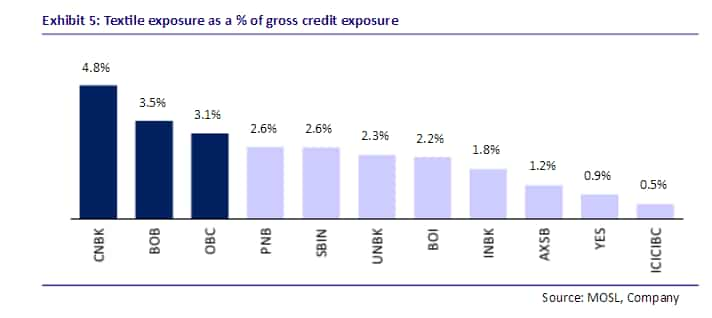

Total advances of textile industries stood at Rs 214,574 crore and had gross NPAs of Rs 37,383 crore as on June 2016, as per RBI.

Textile exposure has been highest in Canara Bank, Bank of Baroda, Oriental Bank of Commerce, Punjab National Bank and State Bank of India in the range of 5% - 2%.

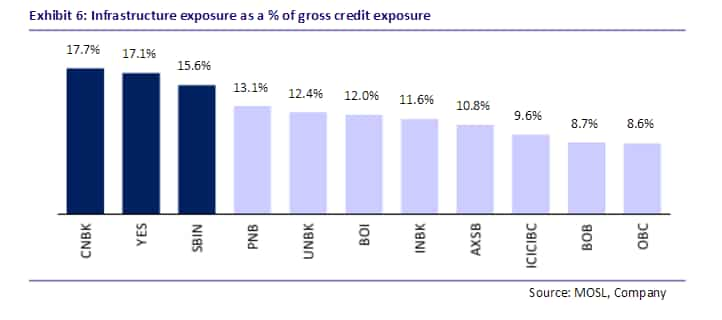

Stressed assets in infrastructure reached already at 17.4% in the year FY13 and now stands at 18.6% by September 2016.

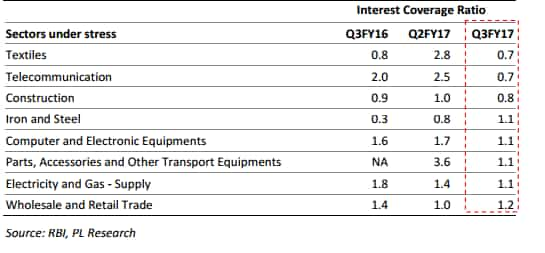

These five sectors have posed major risk even for coming years ahead as their interest coverage ratio is below 1.

04:46 PM IST

Can RBI solve stressed assets problem alone?

Can RBI solve stressed assets problem alone?  Solving NPA problem is a long process, RBI first needs to discipline banks

Solving NPA problem is a long process, RBI first needs to discipline banks  New NPA norms give more power to RBI to settle bad loans but is it that easy?

New NPA norms give more power to RBI to settle bad loans but is it that easy? RBI is at advanced stage of preparing list of debtors: FM Jaitley on rising NPAs

RBI is at advanced stage of preparing list of debtors: FM Jaitley on rising NPAs