Two reasons why RBI shouldn't print entire demonetised currency

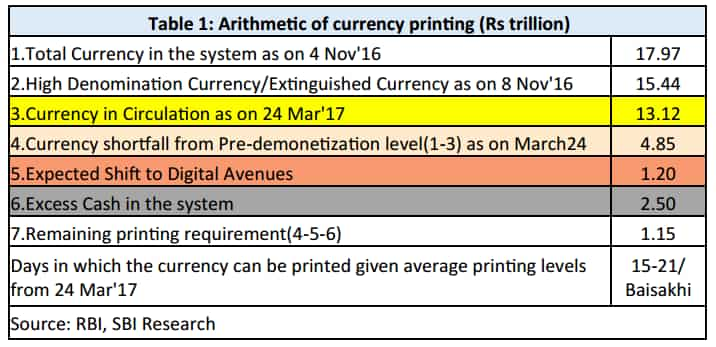

Currency in circulation as on March 24, 2017, was Rs 13.12 lakh crore, Rs 4.85 lakh crore less from total currency of Rs 17.97 lakh crore which stood at pre-demonetisation level.

The Reserve Bank of India (RBI) has been printing new currency in order to replenish the Rs 15 lakh crore, or 86% of the total currency in circulation, that was demonetised by the Government of India on November 8, 2017.

Although long queues at banks and ATMs have vanished, select RBI centres continue to see long lines of people with many being turned back for not meeting required parameters.

Also Read: Demonetisation: RBI turns down Indians, NRIs went for exchange of old notes as deadline ends today

Currency in circulation as on March 24, 2017, was Rs 13.12 lakh crore, Rs 4.85 lakh crore less from total currency of Rs 17.97 lakh crore which stood at pre-demonetisation level.

However, is there a reason why the RBI should print the entire amount of extinguished currency?

State Bank of India (SBI) Research in a note on March 31, 2017 said that there already was excess cash in the Indian economy before demonetisation.

SBI believes there was at least Rs 2.5 lakh crore in excess cash before November.

Secondly, the push for digital transactions has shifted a sizable population towards less-cash usage.

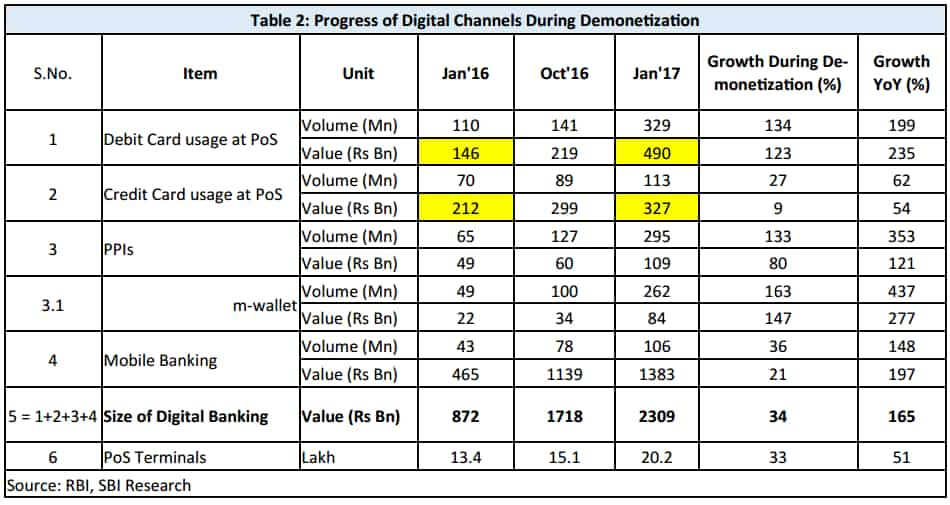

Recent data published by RBI shows sharp growth in digital transactions.

Digital banking has recorded growth of Rs 2.30 lakh crore as on January 2017, a rise of Rs 59,100 crore compared to Rs 1,71,800 crore as on October 2016.

From November 2016 – January 2017, debit card usage at point of sale (PoS) recorded two-folds jump not only in volume but also in value terms.

Debit card usage in value terms stood at 329 million (from 141 million in October 2016) and in value terms was at Rs 49,000 crore (from Rs 21,900 crore of October 2016) in January 2017.

Credit card usage at PoS recorded a whopping 27% rise in volumes (113 million) and 9% in value (Rs 32,700 crore) from November 2016 – January 2017.

Mobile banking saw an increase of 36% in volume (106 million) and 21% in value (Rs 1,38,300) crore.

Moreover, PoS machines across India have seen a massive rise. Three months from Nov’16 to Jan’17, banks set-up 5.04 lakh PoS machines.

SBI said that it believes that the RBI needs to print only Rs 1.15 lakh crore in two weeks time.

SBI said, "We believe RBI should only print Rs 1.15 trillion more. And going by the average pace of printing, the process could be completed in the first fortnight of April."

01:01 PM IST

Is Indian economy better prepared to deal with COVID-19 than it was during 2008 Global Financial Crisis?

Is Indian economy better prepared to deal with COVID-19 than it was during 2008 Global Financial Crisis? Three-month home loan EMI waiver hailed by realty sector; what they said

Three-month home loan EMI waiver hailed by realty sector; what they said Have EMIs to pay? WAIVER relief for home loan, auto loan takers! No need to pay for 3 months

Have EMIs to pay? WAIVER relief for home loan, auto loan takers! No need to pay for 3 months Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps

Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps RBI Repo Rate cut announced; EMI payment delay to loan rates, check top 5 takeaways

RBI Repo Rate cut announced; EMI payment delay to loan rates, check top 5 takeaways