Anil Singhvi’s Strategy December 18: Aluminium stocks & Telecom are Positive; FMCG sector is Negative

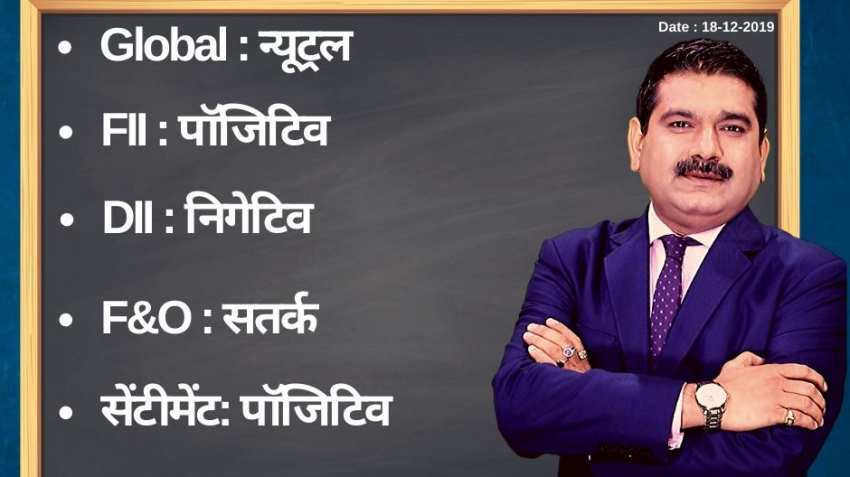

On account of positive FII, neutral global markets, cautious F&O and negative DIIs, the short-term trend of the Indian markets will remain positive, says Zee Business Managing Editor Anil Singhvi.

Amid positive foreign institutional investors (FII) and sentiment, neutral global markets, cautious futures and options (F&O) and negative domestic institutional investors (DIIs) cues, the short-term trend of the Indian markets will remain positive on Tuesday, December 17, 2019.

The markets closed on a strongly positive note on Tuesday, December 17, 2109, with Nifty and Sensex touching their all-time highs at 12,180 and 41,400 respectively. Key benchmarks climbed amid positive Asian equity markets. Sensex at Bombay stock exchange climbed 413.45 points, or 1.01%, to 41,352.17. Nifty at National Stock Exchange also gained 111.05 points, or 0.92%, to close at 12,165, while Bank Nifty rose 166.05 points, or 0.51%, to settle at 32,140.25. Bank Nifty index also hit a record high of 32,213.35 in intraday trade. Tata Steel was the top gainer of the day up by 4.64% while Bharti Airtel and Vedanta were up by 4.54% and 3.36% respectively.

See Zee Business Live TV streaming below:

Zee Business's Managing Editor Anil Singhvi's Market Strategy for December 18:

Strong day support zone on Nifty is 12,050-12,075 and Bank Nifty is 31,900-32,000.

The small day range for trading on Nifty stands at 12,135-12,185, while the medium and bigger ranges lie between 12,100-12,200 and 12,050-12,250 respectively.

The small day range for trading on Bank Nifty stands at 32,000-32,200, while the medium and bigger ranges lie between 31,900-32,300 and 31,750-32,450 respectively.

For Existing Long Positions:

Nifty intraday and closing stop loss 12,050.

Bank Nifty intraday and closing stop loss 31,900.

For Existing Short Positions:

Nifty intraday and closing stop loss 12,200.

Bank Nifty intraday and closing stop loss 32,250.

For New Positions:

Buy Nifty in 12,100-12,135 range with a stop loss of 12,050 and target 12,175, 12,200, 12,250.

Sell Nifty in 12,180-12,250 range with a stop loss of 12,300 and target 12,135, 12,100, 12,050.

Buy Bank Nifty in 31,800-32,000 range with a stop loss of 31,700 and target 32,150, 32,200, 32,250.

Sell Bank Nifty only for aggressive traders with a strict stop loss of 32,250 and target 32,000, 31,900, 31,800.

The put-call ratio (PCR) is 1.62 and the volatility index (VIX) is 12.52.

Still in F&O Ban: Yes Bank

Sectors:

Positive: Aluminium stocks, Telecom

Negative: FMCG

IPO Preview:

Prince Pipes: Avoid, Not Attractive.

Stock of the Day:

Buy Hindalco Futures: Stop loss 210 and target 218, 220. Aluminium stocks looking very strong.

08:59 AM IST

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward

EXPLAINED! Anil Singhvi on his campaign to protect investors and save their hard-earned money; reveals market strategy going forward Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend

Share market today: Abbott India, Aavas Financiers share prices rise, fight off negative Sensex, Nifty trend Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty

Anil Singhvi’s Strategy March 30: 8,300-8,400 is Next Support Zone on Nifty Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day

Stocks in Focus on March 30: MCX, Delta Corp to Lupin; here are the 5 Newsmakers of the Day Stock Market: Sensex, Nifty pare early morning gains; Axis Bank, Coal India, MMTC shares gain

Stock Market: Sensex, Nifty pare early morning gains; Axis Bank, Coal India, MMTC shares gain