Atal Pension Yojana (APY): Invest less than Rs 200 monthly; earn Rs 1000, Rs 2000, Rs 3000, Rs 4000, Rs 5000 pension on retirement

Investing in APY is very cheap, and one can choose to receive pension in the denominations of Rs 1000, Rs 2000, Rs 3000, Rs 4000 and Rs 5000 per monthly.

There are a host of schemes where the Indian government helps a citizen plan their retirment, among which is also the Atal Pension Yojana (APY). This scheme is the best one for lower middle class people, who cannot afford to make hefty investment. APY is be focussed on all citizens in the unorganised sector, who join the National Pension System (NPS) administered by the Pension Fund Regulatory and Development Authority (PFRDA). This scheme roots in providing a sum of money on your retirement every month, but to achieve that you must first begin your investment from now on. Investing in APY is very cheap, and one can choose to receive pension in the denominations of Rs 1000, Rs 2000, Rs 3000, Rs 4000 and Rs 5000 per monthly. In case if you are planning to invest in APY, then this much you should spent every month to achieve the mentioned pension amount. The benefit of fixed minimum pension is be guaranteed by the Government.

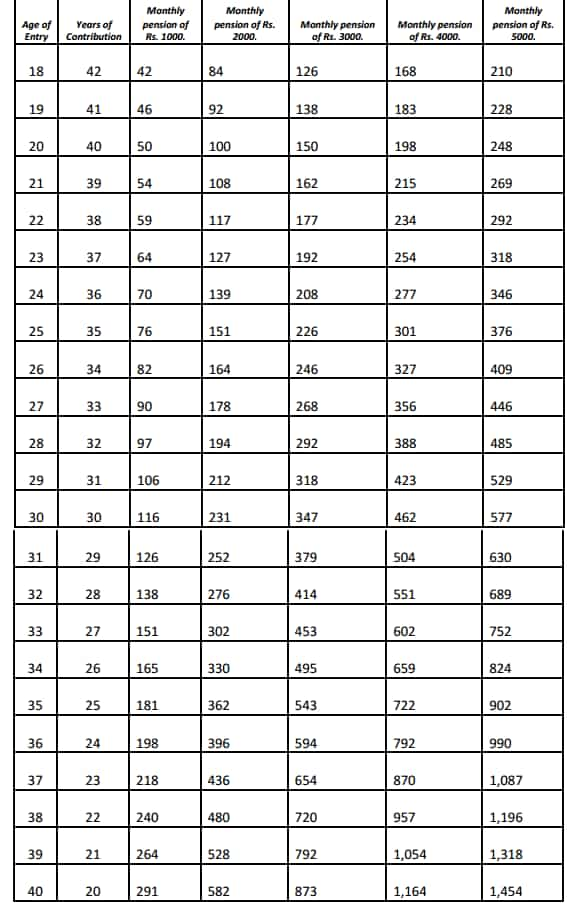

Subscribers would receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month, at the age of 60 years, depending on their contributions, which itself would be based on the age of joining the APY.

Minimum age of joining APY is 18 years and maximum age is 40 years. This means that minimum period of contribution by any subscriber under APY would be 20 years or more.

Eligibility for APY

APY is open to all bank account holders. The Central Government would also co-contribute 50% of the total contribution or Rs 1000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years, i.e., from Financial Year 2015-16 to 2019-20, who join the NPS between the period 1st June, 2015 and 31st December, 2015 and who are not members of any statutory social security scheme and who are not income tax payers.

However the scheme will continue after this date but Government Co-contribution will not be available.

Enrollment and Subscriber Payment

All bank account holders under the eligible category may join APY with auto debit facility to accounts, leading to reduction in contribution collection charges.

Subscribers should keep the required balance in their savings bank accounts on the stipulated due dates to avoid any late payment penalty.

Due dates for monthly contribution payment is arrived based on the deposit of first contribution amount.

In case of repeated defaults for specified period, the account is liable for foreclosure and the GoI co-contributions, if any shall be forfeited.

For enrollment, Aadhaar would be the primary KYC document for identification of beneficiaries, spouse and nominees to avoid pension rights and entitlement related disputes in the long-term.

Here's how much you should invest, to receive any one of the mentioned pension values.

If you are planning to avail the Rs 1000 per month pension, then you should pay amount ranging from Rs 42 to Rs. 291 to your bank account, depending upon the age you begin this account. In case of your death, your nominee will receive up to Rs 1.7 lakhs from the APY Scheme.

In case, you plan to avail Rs 2,000 per month pension, then you will be investing between Rs 84 to Rs 582 on monthly basis with your bank. On demise, your norminee will be eligible to receive up to Rs 3.4 lakhs.

As for Rs 3,000 per month pension, then you must contribute between Rs 126 to Rs 873 in your bank account. However, in case of death before 60 years of age, then your nominee will receive Rs 5.1 lakhs.

Whereas for availing Rs 4,000 monthly pension under APY, then you should invest between Rs 168 to Rs 1,164. An amount of Rs 6.8 lakhs will be given in case of death.

Finally, for opting Rs 5,000 monthly pension under APY, then you must contribute between Rs 210 to Rs 1,454 every month in your scheme bank account. Your nominee will be eligible to receive Rs 8.5 lakh in case of death.

Recently, it was known that, the number of subscribers to APY, targeted at the unorganized sector, has crossed 1.24 crore mark. Among which 27 lakh new subscribers joining in the current financial year.

07:35 PM IST

PFRDA likely to add 10-12 lakh new subscribers by fiscal-end: Chairman

PFRDA likely to add 10-12 lakh new subscribers by fiscal-end: Chairman What is Atal Pension Yojana and who can benefit from it? Are you eligible? Find out

What is Atal Pension Yojana and who can benefit from it? Are you eligible? Find out Atal Pension Yojana: Guaranteed amount! This is the top benefit of joining APY scheme

Atal Pension Yojana: Guaranteed amount! This is the top benefit of joining APY scheme Atal Pension Yojana: 15,418,285! Big growth in numbers of subscribers - Know APY benefits and other important details

Atal Pension Yojana: 15,418,285! Big growth in numbers of subscribers - Know APY benefits and other important details Atal Pension Yojana: Benefits, eligibility, age of joining, contribution period and other important details

Atal Pension Yojana: Benefits, eligibility, age of joining, contribution period and other important details