Get Yes Bank stock as investment rather than FD account; This lender will make you rich faster

Shocking? Perhaps, but yes, the bank is set to give much higher returns that even your guaranteed FD cannot!

Currently, private lender Yes Bank is going through multiple changes in top management, one of the biggest is finding a new CEO & MD for them by end of January 2019. Apart from that, the bank is also trying to appoint two new senior presidents in the board of directors list. Also, when it comes to trading in Yes Bank, the stock price is very volatile and investors are very cautious as it drops extremely one day and roars like lion on another. It would not be wrong to say that, Yes Bank has become a highly sensitive stock and is likely to stay that way till the time it does not find its founder, MD and CEO Rana Kapoor's successor. Interestingly, Yes Bank stock price reveals a trend, which says 'buy' it when it drops, because it is only a matter of time before it starts to perform to potential again.

Investors should know here that it would be better to have Yes Bank share price in their investment plan rather than opening a fixed deposit (FD) account.

Shocking? Perhaps, but yes, the bank is set to give much higher returns that even your guaranteed FD cannot!

In fact, currently, with Yes Bank at such a low, one should ideally take this opportunity to invest a hefty amount in the stock, and then reap the benefit in the coming months.

Yes Bank share price tumbled heavily during the week when Rana Kapoor’s exit news was announced from third week of September 2018 month. Investors dampened Yes Bank share price so much that, it even touched an all-time low of Rs 166.15 per piece on September 28, 2018, making for an overall drop of 59% in just over a month. Notably, Yes Bank had only touched an all-time high of Rs 404 on August 20, 2018.

One might think, that this was the end of Yes Bank’s glorious days, but did you know in first week of October 2018, the bank managed to gain over Rs 100! Many of those who took advantage and bought the share when it was at its lows in September month, they would now be sitting on a big pile of money.

Reason why investor faith was revived in October, 2018 was because Yes Bank made a serious attempt to expedite the search for Kapoor’s successor, promising that a new CEO will be appointed within the RBI deadline.

A search committee was also formed which included three internal members and two external member.

However, last week, Yes Bank share price once again plunged massively, by as much as 9% when O.P Bhatt, who was a member of external committee decided to resign without any reason being provided for this shocking turn of events.

Be that as it may, this became a great opportunity to buy Yes Bank for value investors.

Thereafter, Yes Bank share price surged by nearly 8% on Sensex, before ending at Rs 205.05 per piece above Rs 13.75 or 7.19% on November 19.

Reason behind such rise was because rating agency ICRA retained AA+ outlook for Yes Bank in long term. The agency takes note that there has been no adverse impact on YES BANK'S deposit base and liquidity profile post recent developments.

Also Yes Bank has showed confidence in finding a new CEO within RBI timeline, even if one external member resigned.

Yes Bank added, “Given the significant progress made by the S&SC with the support of Korn Ferry, over the past three meetings, (most recent being held on November 13, 2018), in its mandate to identify a suitable successor to Rana Kapoor, MD & CEO, YES BANK, the NRC has decided to continue with the existing members to complete the process as per the timeline communicated by RBI.”

Now, this is the current scenario, in which Yes Bank share price is on a roller coaster ride.

Significantly, analysts are very optimistic about the bank. So, if you invest in Yes Bank when it is at its lows, you will be that much more richer and who knows, depending on the amount you invest and the rise in the share price, you may even turn crorepati in coming months.

CLSA in its research report says, “For Yes, the most important aspect to watch out for is the transition at the top level, with CEO Rana Kapoor slated to exit by January 2019. While two longstanding business heads, Rajat Monga and Pralay Mondal, are being promoted to executive directors, the CEO transition will determine the bank’s direction. . It has also seen a relatively higher level of attrition in mid management, which could affect business and quality of execution.”

Further, CLSA explains that, Yes is well placed to deliver healthy loan growth through market share gains (53%) with strengthening of its Casa franchise and capital raising (common tier-1 CAR at 9%). Its stressed loans have been manageable at 2.5%, and a positive outcome from the central bank’s inspection will ease investor concerns.

Analysts at CLSA say, “Our Rs300 target is based on 2.2x Sep 2020 adjusted PB, which in turn is based on a Gordon Growth Model. We prefer to use adjusted BVPS not reported BVPS, as it normalises provisioning by building in 100% coverage on NPLs. Its current valuation is at about a 30% discount to the five-year average. We forecast 16% earnings Cagr over FY18-21 and maintain our BUY call.”

Similarly, SBICap Securities said, “Yes Bank has lost nearly 60% of its market capitalization over the past 8 weeks on the back of a) uncertainty around leadership succession; b) lack of adequate growth capital; and c) potential overhang from asset quality divergences.”

SBICap said, “Our baseline scenario suggests post-money ROEs averaging ~18% over FY19-FY21. We maintain BUY with a target price of Rs315 (2.0x FY20 P/B), implying a 40% upside from current levels.”

If we take today’s share price and SBICap’s target price, then Yes Bank is set to give you a massive 53% return in one year’s time.

Now why you should invest in Yes Bank, rather than opening an FD account. Let’s understand:

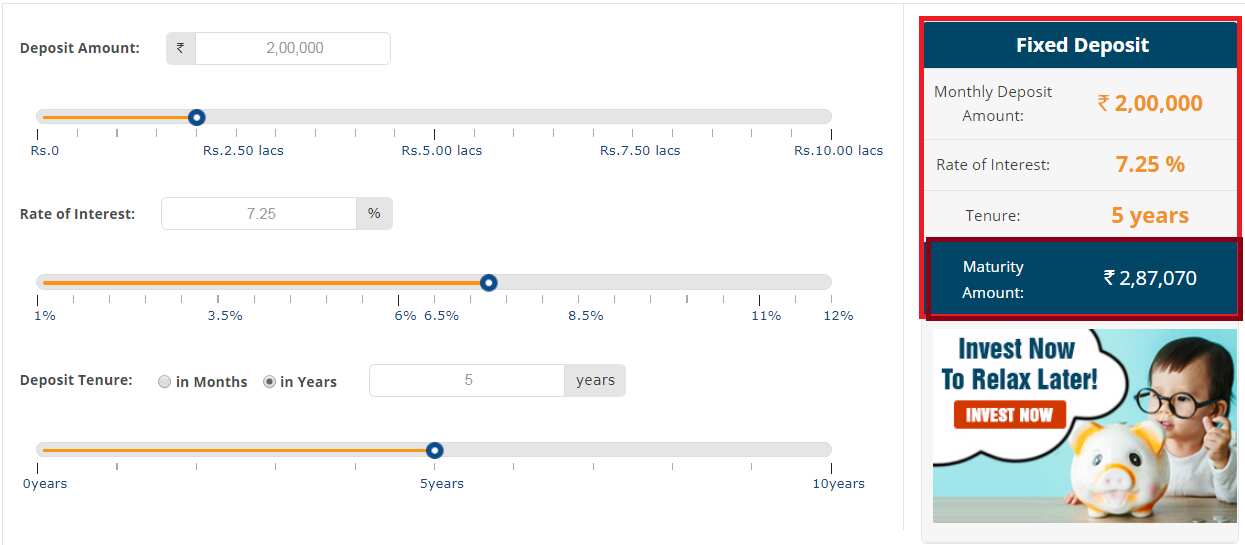

If you open an FD account of Rs 2 lakh for 5 years at, well, Yes Bank itself, then it offers a 7.25% interest rate on FDs for tenure between 1 year to 10 years. Then your amount on maturity would come at Rs 2.87 lakh where you have earned interest of Rs 87,000 in five years.

(Image Source: Policy Bazaar)

(Image Source: Policy Bazaar)

And if the same amount was invested in Yes Bank share price, then you will likely gain over Rs 1 lakh on your investment of Rs 2 lakh, which is in one year’s time. The returns in stock is calculated on the target price of SBI Cap.

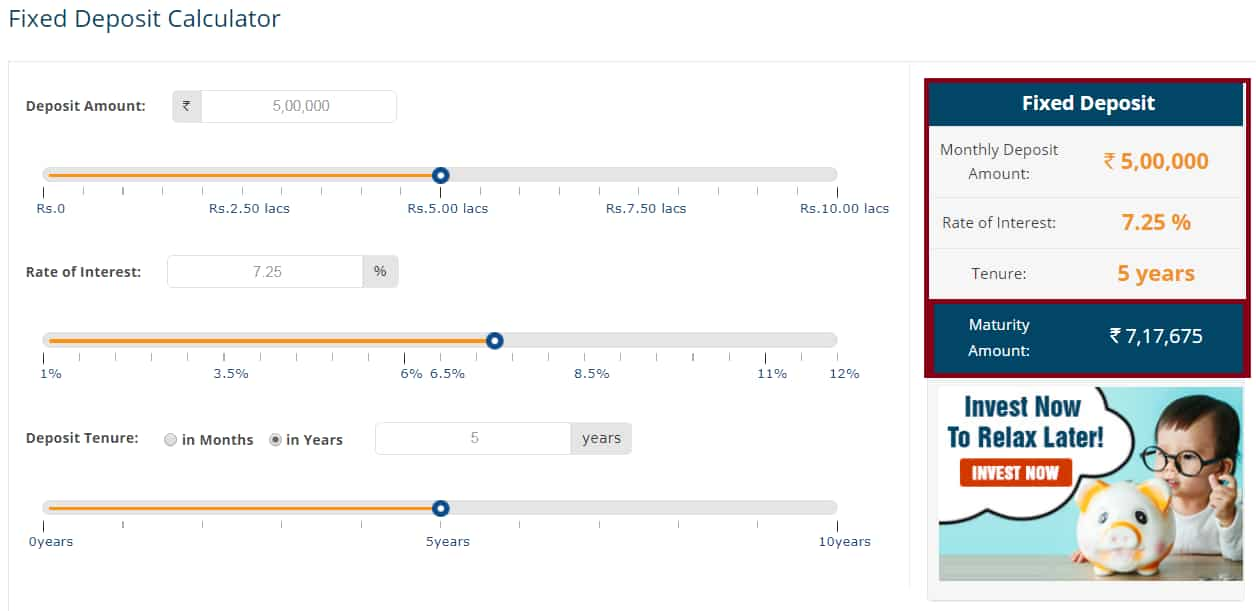

Going ahead, for instance if you have invested Rs 5 lakh in Yes Bank for 5 years tenure at interest rate of 7.25%. Then your maturity amount would be over Rs 7.17 lakh, where your interest earned would be over Rs 2.17 lakh.

(Image Source: Policy Bazaar)

(Image Source: Policy Bazaar)

Meanwhile, if the same Rs 5 lakh was instead invested in Yes Bank share price then, as per the analysts' projections, it may well give you Rs 2.65 lakh returns on your principal investment by FY2020.

Unlike FDs, in five year’s time Yes Bank share price can even make you crorepati as markets are expected to be on booming stage and will touch new heights.

Hence, from the above it is quite clear equities are much better investment option than FDs. And why not begin an investment in Yes Bank and earn massive amounts, rather than what FDs offer.

If you are planning to invest in equities, you must look into to above calculation. Be wise, invest wise, take risk, earn heavy!

07:33 PM IST

Stocks in Focus on March 27: SBI, Dr Reddy’s to Godrej Properties; here are the 5 Newsmakers of the Day

Stocks in Focus on March 27: SBI, Dr Reddy’s to Godrej Properties; here are the 5 Newsmakers of the Day Stocks in Focus on March 26: Yes Bank, India Cements to IndusInd Bank; here are expected 5 Newsmakers of the Day

Stocks in Focus on March 26: Yes Bank, India Cements to IndusInd Bank; here are expected 5 Newsmakers of the Day Stocks in Focus on March 25: Yes Bank, IndiGo to Private Hospitals; here are expected 5 Newsmakers of the Day

Stocks in Focus on March 25: Yes Bank, IndiGo to Private Hospitals; here are expected 5 Newsmakers of the Day RBI extends Rs 60,000-cr credit line to Yes Bank

RBI extends Rs 60,000-cr credit line to Yes Bank Yes Bank branches look deserted after moratorium lifts

Yes Bank branches look deserted after moratorium lifts