Alert! NPS can make you a crorepati; Turn Rs 5,000 into nearly Rs 1.5 cr! This is how you save big on taxes

Compared to all other government schemes, it would be NPS that not only offers heavy tax benefits, but also gives you massive returns. One should know that to become a crorepati, there is a need for both patience and persistence.

How would you feel, if you were told that you can become a crorepati by just investing Rs 5000 every month? You would be flabbergasted for sure! It would also bring joy as you would just have realised that you can very well take advantage of this massive opportunity to become rich beyond your dreams by investing this amount. But wait! There is more! It's like the government has just given you an early Christmas gift!

Now, what if you were told that not just becoming a crorepati, you could also save big on income tax levied on your crores? That, then, surely would be the icing on the cake meant just for you! So, let us now tell you exactly where you need to invest. All of the above is what the government’s National Pension Scheme (NPS) offers you. Although investment in NPS is compulsory for every central government employee, yet it has also been made available to the general public as well. In a very simple way to describe NPS is that it contains all the answers to your retirement days regarding money, leaving you very well off to enjoy it all.

Compared to all other government schemes, it would be NPS that not only offers heavy tax benefits, but also gives you massive returns. One should know that to become a crorepati, there is a need for both patience and persistence.

Being a hassle free scheme, NPS eliminates the worry of how to become rich from investing in stock markets, or how to bear the burden of highly sentimental driven equities. Surely, equities make you richer than any other investment scheme, but it also demands patience and long term relationship from an investor just like NPS. The only difference between NPS and equities is that, the former gives you security, guaranteed return, equity linked investment and tax benefits. There is no chance that you will lose your money. This threat is ever-present in equity investment, of course. NPS is like a one-stop solution for all those who fear the equity markets ups and downs and are not confident enough in trading.

Notably, equity investments, in the long term, is the best investment opportunity, but not for the faint-hearted and not for those who cannot afford to lose any chunk of their money.

Main objective of NPS is to lower the liabilities of the government with regards to total pension, even as it ensures citizens earn a stable income following their retirement. NPS lends a helping hand to those individuals who do not want to take risk and earn decent returns on their investment.

Anyone can open an NPS account right from starting age of 18 up till 60 years.

With the introduction of eNPS, opening this account has become even more easy - you can do it in just 30 minutes! A Unique Permanent Retirement Account Numbers (PRAN) is sanctioned to each subscriber under this scheme during the time of joining. Not only this, individuals are allocated two accounts, which can be easily accessed at any given time.

One's investment journey in NPS can begin with a minimum amount of Rs 500 at the time of opening the account. It needs to be noted that, the NPS account matures when the subscriber reaches retirement.

To lure citizens, the NDA government just a day ahead of the recently held assembly elections announced a host of tax benefits for investment made in NPS.

Take a note - this is going to make you rich!

How do you get rich in NPS?

Firstly remember, past historical data reveals that NPS has a potential to give a return between 8% to a whopping 14%.

On Monday, the government announced that, now the lump sum withdrawn in NPS - 40% will be tax exempt compared to previous 20%!

What has changed in your gains? Let's check.

One should remember that, as the name suggests, NPS is a retirement scheme and a subscriber will only be eligible to enjoy the gains after s/he reaches 60 year’s of age.

The moment retirement age is reached, a subscriber should know that s/he will have to offer 40% of the gains in NPS for annuity plan, and remaining 60% can be withdrawn.

On that 60%, which you withdraw in NPS, 40% is tax exempted amount. As for the portion you have offered for annuity plan, you will receive pension every month after retirement.

Let’s take an example!

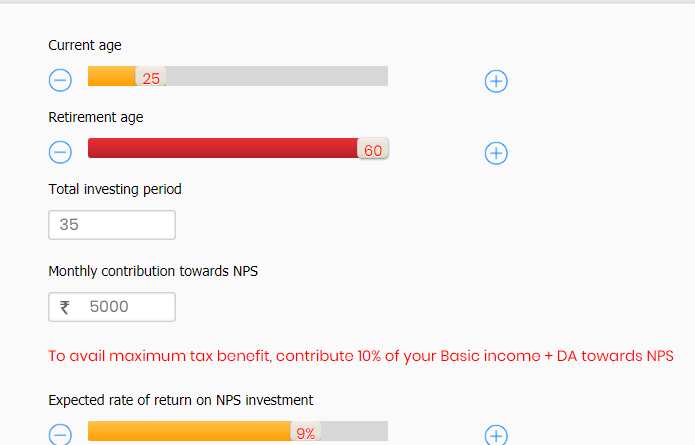

Critically, the sooner you begin your NPS journey, the greater returns you achieve. For instance if you are a 25-year old and decide to invest Rs 5,000 every month in NPS till your retirement age of 60, then you have invested about Rs 21 lakh for 35 years, and on which you have generated Rs 1.24 crore interest taking your overall pension wealth to Rs 1.45 crore!

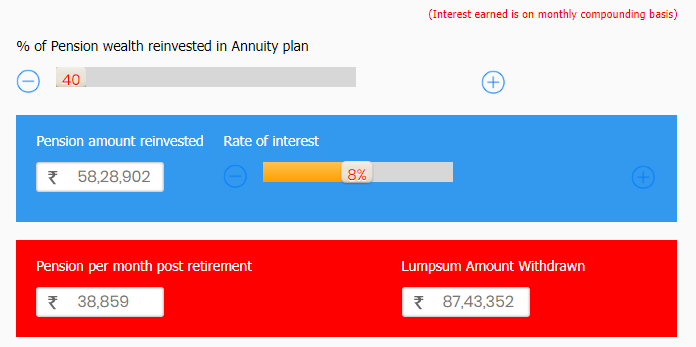

(Image Source: SBI Pension Funds Calculator)

If you invest 40% of your pension wealth in annuity, then from the total pension wealth - about nearly Rs 59 lakh has been removed from which you will receive every month a pension of nearly Rs 39,000 for life time.

Remaining 60% gains, which come over Rs 87.43 lakh can be withdrawn. Now among this withdrawal amount - 40% which would be near Rs 35 lakh will be tax exempt!

Hence, you will now only have to pay taxes on just Rs 52.46 lakh. This lowers the tax burden and increases your wealth withdrawn from NPS.

Also tax benefit does not end over here, as a subscriber can also claim about Rs 1.5 lakh under section 80c of Income Tax Act under NPS.

Surely, this should make you rush to open your own NPS account!

12:02 PM IST

PPF vs NPS: Why you should choose National Pension System ahead of Public Provident Fund

PPF vs NPS: Why you should choose National Pension System ahead of Public Provident Fund How to open National Pension System (NPS) account, step by step guide

How to open National Pension System (NPS) account, step by step guide  Money tips: Smart ways to save Income tax at the last moment; save over Rs 2 lakh

Money tips: Smart ways to save Income tax at the last moment; save over Rs 2 lakh All you need to know about monthly NPS annuity payment

All you need to know about monthly NPS annuity payment National Pension System (NPS): All you need to know about the withdrawal of money

National Pension System (NPS): All you need to know about the withdrawal of money