How to calculate Advance tax and who should pay it?

If your do not pay Advance tax as per the schedule, you will become liable to pay interest under section 234B and 234C.

Advance tax is your Income tax that you pay in advance rather than waiting for the financial year to end. Since you pay Advance tax in the same year in which the income is earned therefore it is also known as ‘pay as you earn’ scheme. If your Income tax liability exceeds Rs. 10,000 in a financial year then you must pay Advance tax.

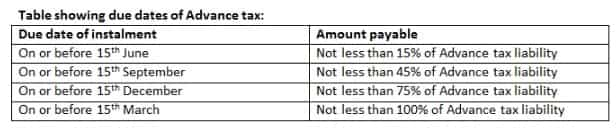

The Income tax department asks you to pay Advance tax in 4 quarterly instalments. So, you may feel that calculating and paying taxes 4 times a year is a big hassle and wastage of time. It appears to be a tedious job at first but with time you will realise how easy it becomes to clear one’s tax liability by paying Advance tax. Government certainly benefits by receiving taxes early from you as it receives a constant supply of income throughout the year, but at the same time there are some advantages for you as well.

Advance tax applies to all taxpayers whether they salaried, freelancers or businessmen. Only senior citizens who do not run a business are exempt from paying it. Small businessmen and professionals have the option of paying their Advance tax liability in one go. Presumptive scheme covered under section 44AD, 44ADA of Income Tax Act, allows businesses with a turnover of Rs. 2 crores or less to pay their total Advance tax in one instalment on or before 15th March. Similarly, professionals like doctors, lawyers, etc. can opt for presumptive scheme if their turnover is Rs. 50 lakhs or less.

If you are a salaried employee, you need not pay Advance tax as your employer deducts tax at source (TDS). Advance tax is applicable when an individual has sources of income other than his salary. For instance, if an assessee earns income via capital gains on shares, interest on fixed deposits, winnings from lottery or races, capital gains on house property besides his regular salaried income then after adjusting for expenses or losses he needs to pay Advance tax. So, Advance tax is payable even by salaried employees on their other income. While employers deduct TDS on salaries, advance tax is paid on income that is not subject to TDS.

As seen in the table above, Advance tax has to be paid in 4 instalments of 15%, 30%, 30% and 25% of total tax liability. To project your likely tax liability for a year and check if you need to pay advance tax, you can take the help of your auditor/tax consultant who normally helps in filing your returns. Even if you are using e-filing intermediary websites to prepare your returns, you can seek their guidance online. Many have year-round advisory services that you can sign up for. If you are a bit tax savvy, you can also use online calculators. Paying Advance tax is fairly easy. There are several banks authorised by the I-T department to accept payment of Advance tax. You also have the option of paying Advance tax online at the department's website www.tin-nsdl.com by filing challan 280.

If your do not pay Advance tax as per the schedule, you will become liable to pay interest under section 234B and 234C. By paying Advance tax on time you can avoid paying interest @1℅ on your outstanding tax amount. If you paid Advance tax in excess to your tax liability then you will receive the difference as refund. I-T department will also pay you interest @ 6℅ if excess tax paid is more than 10℅ of the gross taxes paid for the year.. Remember to also file your tax return on time or you will trigger other interest and penalty provisions.

(The article has been written by Vaibhav Sankla, Director, H&R Block India)

12:31 PM IST

Deadline for third installment of Advance Tax nears; here's how you can pay it

Deadline for third installment of Advance Tax nears; here's how you can pay it  Direct Tax Collections touch nearly 45% of FY18 Budget Estimates

Direct Tax Collections touch nearly 45% of FY18 Budget Estimates Direct Tax collections' reach 39.4% of FY18 Budget Estimates

Direct Tax collections' reach 39.4% of FY18 Budget Estimates Change in fiscal year to Jan-Dec may impact your financial planning

Change in fiscal year to Jan-Dec may impact your financial planning Direct tax collections grow 15% till June 2017, at Rs 1.42 lakh crore

Direct tax collections grow 15% till June 2017, at Rs 1.42 lakh crore