Income tax returns (ITR) filing: Not filed returns for 2 years? Beware! Deadline nearing

Income tax returns (ITR) filing: March 31, 2018 is the last date for taxpayers in filing ITR for the assessment year 2016-17 and 2017-18.

Income tax returns (ITR) filing must always be taken as one of the biggest duties of the citizen, and that it should be followed consistently every year. However, the word income tax itself is a whole new dimension for any individual, sometime as the process can be confusing and cumbersome. While some try to still get cracking and follow proper procedures for filing ITR, either online or taking help of Chartered Accountants (CAs), some simply get frustrated by the fact that it requires them to recall and keep track of what they spent their money on or saved. Thus this may result in laziness and in the process ITR does not get filed - some forget it for years. Other reasons can also be that an individual may simply not have the time to devote to this even as they have to focus on their daily jobs, and not filing ITR for nearly 2 years or more can be a possibility among all.

Income Tax Department on it's portal has been warning taxpayers by saying, “Please avoid last minute rush and file your Income Tax Return for the assessment year 2016-17 and 2017-18 well before March 31, 2018.” The department has also cautioned taxpayers in regards to Phishing mail alerts, saying, “IT department never asks PIN, OTP, Password or similar access information for credit cards, banks or other financial account related information through e-mail or phone calls . Taxpayers are cautioned NOT to respond to such e-mails or phone calls and NOT to share personal or financial information.”

However, history repeats itself, and usually when there is last minute rush on IT department portal, you may end up with incomplete ITR filings, which also turns out to be even more frustrating.

Here's a guidelines from Archit Gupta, Founder & CEO ClearTax, on what happens if ITR is not filed before March 31, 2018. Also, find out how you can file ITR.

So, this is what is happening on the 31st of March 2018:

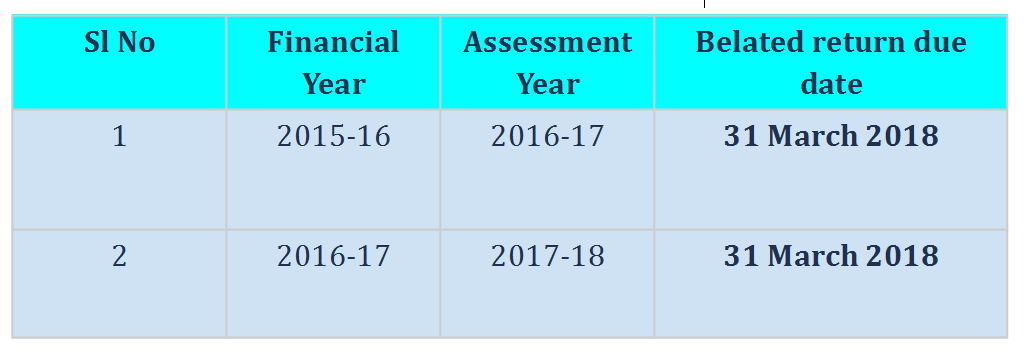

The end of the financial year 2017-2018 is also the last day to file the belated tax returns for the last two assessment years. For those who have failed to file their income tax returns for the past years, it is important to adhere to the deadline as prescribed by the Income Tax Department. In this article, let us understand why it is important to file your tax returns this March.

Belated tax return - what do they mean?

Filing an income tax return after the original due date is called filing a belated return. As the table above shows, the returns for the FY 2015-16 and FY 2016-17 should have been filed in the following year, with the original due dates being 31st July 2016 and 31 July 2017 respectively. However, due to the extensions given to the taxpayers by the provisions of law, a belated return for the same FY can now be filed by 31st March, 2018.

Now, we know that we can file this return. The million dollar question is, why should we?

Being tax-compliant has many benefits. Filing your ITRs can be of great use when you apply for any loans. Banks can easily reject a loan application if the applicant cannot produce the ITR receipts for the last three years from the date of application.

Filing timely returns is an important criteria for VISA processing. Taxpayers whose tax returns are immaculate can also easily register immovable properties in their name. Credit cards may not be issued if your tax returns are not complete. And most importantly, if you wish to have the folks at the Income Tax Department on your side, filing your tax return on time is a good way of going about it.

How can one file their belated tax return?

The process for filing your belated return is the same as when you file the return on or before the due date. One of the best ways to file your ITR online is via the ClearTax portal. Once you log in to their website, you need to select the ITR form applicable to you and fill the form in the same manner as if you were filing the return on time. It is important to choose the assessment year for which you are filing the belated return correctly when filing on ClearTax. And even if you have never filed online before, do not worry! The easy-to-use website will guide you through the steps of filing so that you can complete your return on time easily.

Don’t let your taxes hurt your future…

Not paying your taxes on time can cause many issues; and you may even end up paying penalties for late filing. The easiest way out of this fix is to make your payments on time with online tools like the one provided by ClearTax. So, what are you waiting for?

07:05 PM IST

Income Tax Alert! Filing ITR online? Ensure e-verification before logging out; step by step guide

Income Tax Alert! Filing ITR online? Ensure e-verification before logging out; step by step guide Alert! Three Month Tax Saving Exercise: PPF, loans, insurance to education, top investment options for taxpayers

Alert! Three Month Tax Saving Exercise: PPF, loans, insurance to education, top investment options for taxpayers  Planning to opt for new income tax slabs 2020? You can still claim this NPS account benefit

Planning to opt for new income tax slabs 2020? You can still claim this NPS account benefit Living in a rented house? New income tax slabs can help you save money

Living in a rented house? New income tax slabs can help you save money Income Tax: Four benefits you must know while repaying a home loan

Income Tax: Four benefits you must know while repaying a home loan