Income Tax: This is how you can show Rs 2 lakh deposit transaction in ITR copy

This year the department has added a new column where the taxpayer’s will have to report the details of cash deposited in their bank accounts (including loan account) if the aggregate cash deposits for all accounts exceeds Rs 2 lakh during the demonetisation period

It is the last week to file Income Tax Return (ITR) for the financial year 2017. To make sure that all the entries are done properly, do not forget to double check.

While the process has not been changed much, taxpayers should also not forget to show one "important" transaction this time.

On November 9, while Prime Minister Narendra Modi had announced the ban on Rs 500 and Rs 1000 notes, he had mentioned that individuals who are depositing Rs 2 lakh or more during demonetisation period, will have to show it while filing ITR.

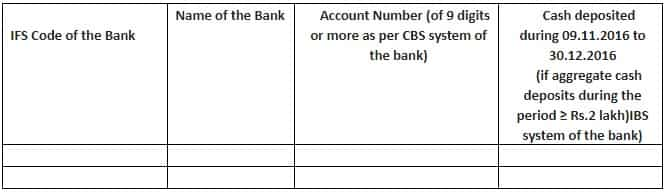

“Tax return forms ask the taxpayer to report details of all their bank accounts (except dormant one). This year the department has added a new column where the taxpayer’s will have to report the details of cash deposited in their bank accounts (including loan account) if the aggregate cash deposits for all accounts exceeds Rs.2 lakh during the demonetisation period (09/11/16 to 30/12/16)," the notification had said.

Chetan Chandak, Head of Tax research, H&R Block India, said that it is not just about reporting the details of cash deposited but taxpayers will also have consider its tax.

In case these deposits represents the income earned for the current year or any of the earlier years (remaining unreported), then taxpayer should ensure that they consider it for the tax computation. If these deposits represent the current year’s income then it should be added to the appropriate head of income and calculate the taxes accordingly. But in case if it is previous unreported income then they can consider reporting it under section u/s 115BBE and pay the taxes @ 60%.

"Its main intention of this move is to identify those taxpayers who have deposited cash in excess of Rs. 2.5 lakh during the demonetization period. Tax department will try to reconcile the treatment of these deposits in the tax return and check whether the taxpayer has offered it under the Pradhan Mantri Garib Kalyan Yojana (paying 50% taxes and depositing 25% in the scheme) or has given some different treatment," Chandak added.

If the taxpayer fails to provide proper justification of a particular treatment he may have to pay tax @60% u/s 115BBE +Surcharge @ 25% of such tax along with edu. Cess @ 3% totaling to 77.25%. In addition to this he may also be subjected to penalty of 10% and prosecution under THE TAXATION LAWS (SECOND AMENDMENT) ACT, 2016.

This is how the form will look like:

According to Abhishek Soni, CEO & Co-Founder at Tax2win.in, the amount of cash deposited during 09.11.2016 to 30.12.2016 in the bank accounts should be filled in the above schedule.

Details of cash deposited are to be reported only if the aggregate amount of cash deposited during 09.11.2016 to 30.12.2016 is Rs.2 lakh or more. In case, if you have received the notice for depositing the cash during the Demonetization from Income Tax Department, then the amount deposited in the bank account should be entered correctly as per the compliance submitted by you to the Income Tax Department, Soni said.

ALSO READ

04:00 PM IST

Income Tax Alert! Filing ITR online? Ensure e-verification before logging out; step by step guide

Income Tax Alert! Filing ITR online? Ensure e-verification before logging out; step by step guide Alert! Three Month Tax Saving Exercise: PPF, loans, insurance to education, top investment options for taxpayers

Alert! Three Month Tax Saving Exercise: PPF, loans, insurance to education, top investment options for taxpayers  Planning to opt for new income tax slabs 2020? You can still claim this NPS account benefit

Planning to opt for new income tax slabs 2020? You can still claim this NPS account benefit Changes required in Income Tax law to benefit homebuyers; check what experts think

Changes required in Income Tax law to benefit homebuyers; check what experts think Yet again, Finance Minister pays heed to Zee Business Managing Editor Anil Singhvi's call, extends ITR filing deadline

Yet again, Finance Minister pays heed to Zee Business Managing Editor Anil Singhvi's call, extends ITR filing deadline